After a bit of a standoff late last week, MobileGo resumed its selloff against bitcoin, ethereum, and the dollar to chalk up significant losses.

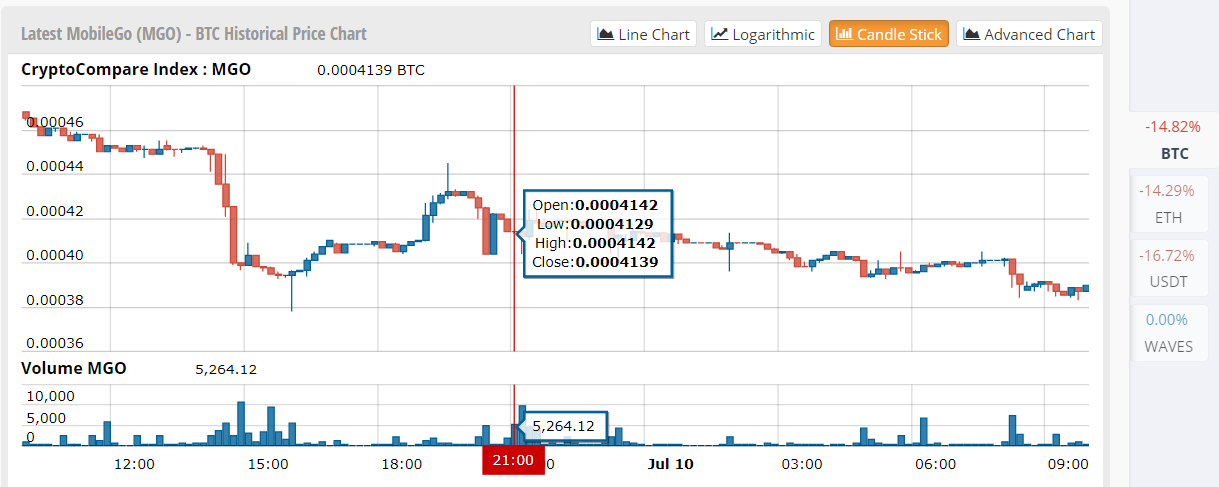

MobileGo vs. Bitcoin

MobileGo is nearly 15% lower against bitcoin after breaking below the key support zone around 0.00040. Price has dipped close to 0.00038 before pulling up to signal a correction to the area of interest.

The recent highs of price action can be connected by a descending trend line, also underscoring the strength of the bearish move. Stronger selling pressure could take it down to new lows closer to 0.00035.

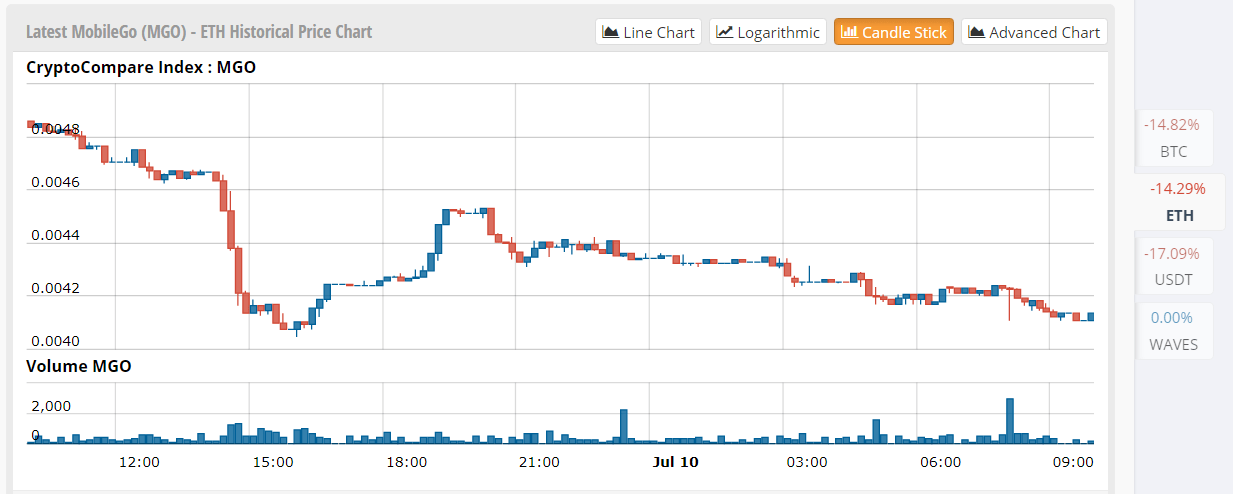

MobileGo vs. Ethereum

MobileGo continued to edge lower against ethereum and is currently approaching the longer-term lows at 0.0038. A break below this level could put it on a steeper decline while a bounce could spur a pullback to nearby inflection points.

Volume kicked higher earlier today but this was hardly sustained. Watch out for potential profit taking at the recent lows, though.

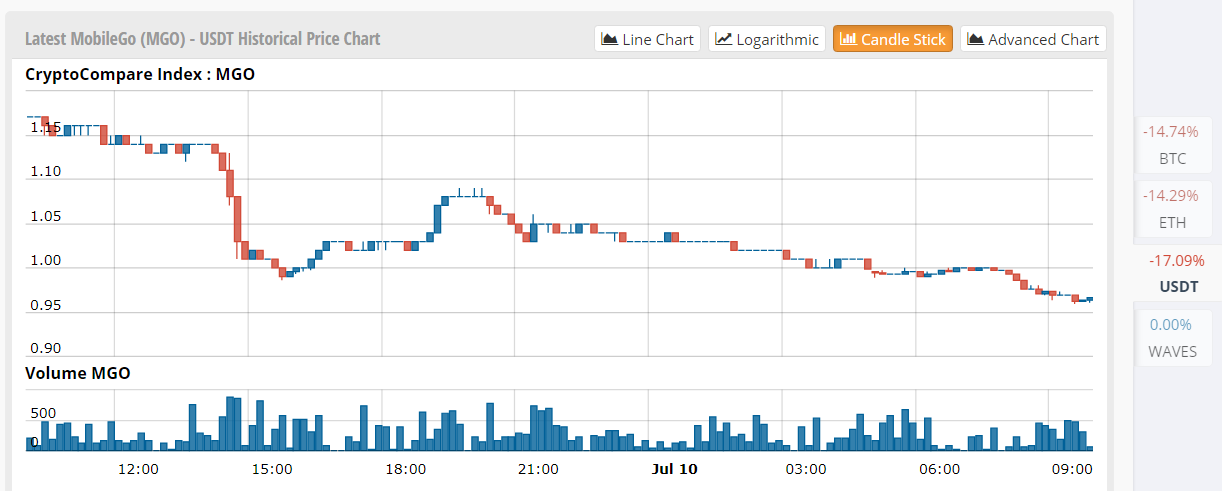

MobileGo vs. USD

After forming a head and shoulders reversal pattern on the longer-term time frames as pointed out previously, MobileGo made a new drop to the dollar upon seeing stronger than expected US NFP figures.

The headline figure indicated a 222K increase in hiring for June versus the 175K forecast. Apart from that, the May reading was positively revised from 138K to 152K. This was enough to revive Fed rate hike expectations for September even as the central bank is also widely expected to start balance sheet reinvestment operations by then.

However, it’s worth noting that the unemployment rate ticked up from 4.3% to 4.4% while the average hourly earnings index fell short with a 0.2% gain versus the estimated 0.3% rise. The previous reading was revised down to 0.1% as well, signaling weak wage growth and downside inflationary pressures.

Looking ahead, there are some Fed officials set to testify, along with Fed Chairperson Yellen herself. Another round of cautious remarks could force USD to retreat against MobileGo but the lack of positive news from the industry has made it difficult for cryptocurrencies to hold on to gains.