Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

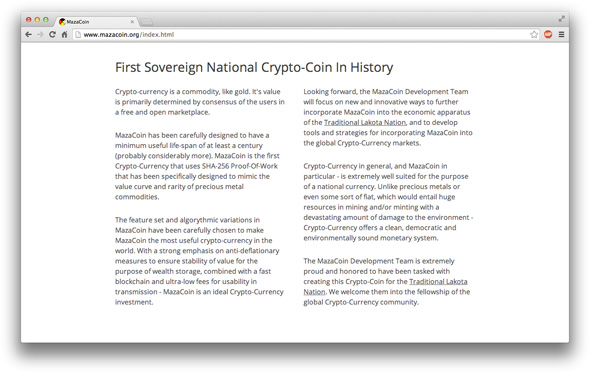

A Native American tribe is turning to the power of digital currency to meet their monetary needs. The Oglala Lakota Nation of North and South Dakota has reportedly adopted a bitcoin clone as their official currency, according to Forbes.

Dubbed MazaCoin, the tribe is relying on their limited sovereignty in order to make this work — distancing themselves from the United States dollar.

“I think cryptocurrencies could be the new buffalo,” said Payu Harris, developer and Native American activist. “Once, it was everything for our survival. We used it for food, for clothes, for everything. It was our economy. I think MazaCoin could serve the same purpose.”

The idea first started when Harris raised about 4 bitcoins to show the tribe how to mine and use bitcoin. But when his digital wallet was stolen, he begun working on the clone.

Harris signed a joint venture agreement with the Oglala Sioux Tribe Office of Economic Development earlier this year, and subsequently began mining the digital currency — which will hit 2.4 billion units over 5 years (compared to bitcoin’s 21 million). Thereafter, 1 million coins will be mined annually.

To serve as a “reserve”, millions of coins have already been pre-mined (in what has been described as a two-phase pre-mine). Last week, the MazaCoin genesis block was hashed, marking the beginning of what could possibily be a turning point in currency for the tribe’s people.

In effort to get the tribe hands-on with the currency, Harris has handed some out to both businesses and individuals who have expressed interest.

“I want to get my people educated and show them this is the next level of finance,” he said. “Let’s make the rest of the world play catch up. Let’s be leaders and rebuild the economy on our terms. We’re not going to ask the federal government if we can do this. I refuse to ask them to do anything within my own borders. When you have children going hungry, it’s time to focus.”

On whether or not the cryptocurrency will catch on in the tribe, Harris said: “Just like debit cards, it will take a while for people to get it.”

Read the full report at Forbes. Great piece.