Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The asset that legendary investor Warren Buffett once called a “rat poison” is looking like nectar in 2019.

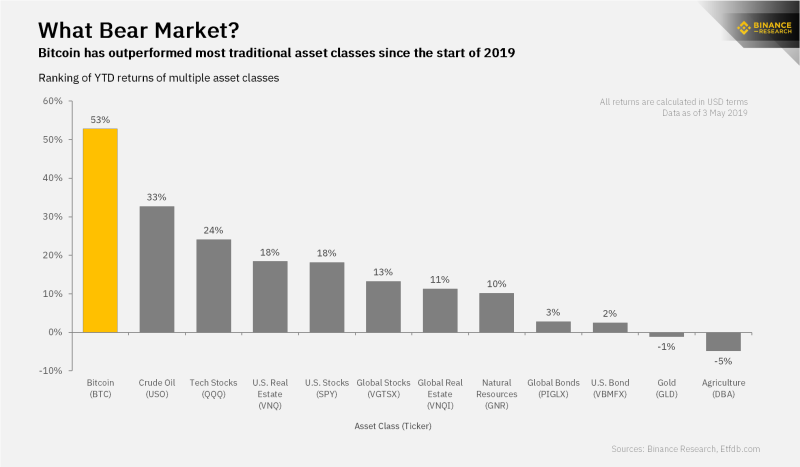

Bitcoin, the world’s largest cryptocurrency by market capitalization, surged up to 53 percent in a much-needed bullish recovery session. In comparison, Crude Oil recovered by 33 percent, while the technology stocks rallied by 24 percent. Recession-stuck US real estate market and S&P 500 also stopped behind bitcoin with an 18 percent rebound, each. Meanwhile, global stocks, real estate, and natural resources gained between the range of 10-13 percent.

Gold, an asset which resembles bitcoin’s underlying properties the most, had a moderately depressive 2019 so far as it dropped 1 percent. The Agriculture sector, too, remained a lousy investment after posting 5 percent in YTD losses.

More Room to Recover

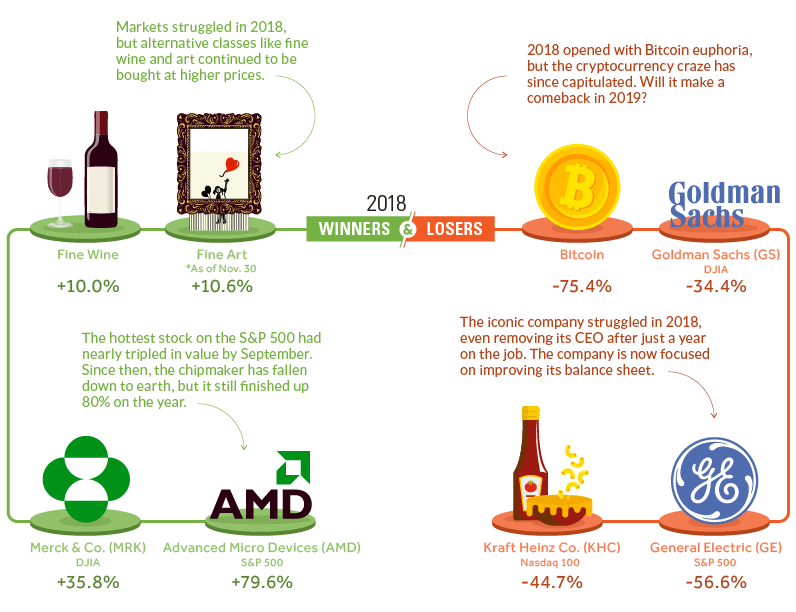

Bitcoin’s recovery followed a bearish 2018 in which the cryptocurrency dropped more than 70 percent in market valuation. The story was the same but minimalized for other markets. Crude Oil, for instance, closed 2018 on a 24.8 percent loss. The S&P 500, at the same time, plunged 6.2 percent, while Gold erased 2.6 percent before the closing the year.

The recent rebound across all the essential markets find its drive in the Federal Reserves’ interest rate policy. The US President Donald Trump is putting incredible pressure on the central bank to lower the interest rates, which will make borrowing cheaper. The move is bullish for the market in the short-term since more affordable financing would lead to an increase in spending – which includes investments.

But the fact that bitcoin is attracting more fiat money than its peers in the traditional market signifies its emerging “safe haven” status. Financial stability issues have not left the US market despite assurances from the White House. On the contrary, the Federal Reserve has shown concerns about the rise in business debts and leveraged corporate lendings, which does not make retail investors too enthusiastic about purchasing/speculating on their equities.

Then, there are trade and tariff tensions between the US and China, “Brexit,” and skepticism around Fed policy that could push investors towards more promising assets. The ongoing broader recovery serves as a reminder that bitcoin could balloon faster than traditional asset classes. There is, indeed, more room to recover for this politically-independent financial instrument.

Bitcoin Long Data

The US Commodity Futures Trading Commission (CFTC) stated in its April 2019 report that institutional investors increased their long positions by 88 percent in the bitcoin futures contracts. At the same time, short positions saw a drop of 63 percent.

According to Mike Novogratz, the chief executive officer of the US-based Galaxy Digital, institutional investors’ long sentiment on the bitcoin was a signal that the asset was heading into a bullish 2019. And so it happened.

“I don’t see us breaking $10,000 by the end of the year but I think [in] Q1/Q2 if the institutions start coming in, we’ll put in new highs,” Novogratz said.

Not precisely a rat poison, one would say.