Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On Bloomberg’s “ETF IQ” on Monday, REX Financial chief executive Greg King made his most forceful public case yet for Solana’s role in real-world finance—especially for stablecoins—and explained why his firm built a 1940 Act, staking-enabled ETF around SOL rather than waiting for a traditional ’33 Act spot product.

Solana Vs. Ethereum

King did not hedge when asked to put the Solana-versus-Ethereum debate into plain language for mainstream investors: “Eth is the second biggest crypto. Solana is basically top five. A lot of people think Solana is the up and comer that will overthrow the area. It is a very controversial debate. I’ve probably made friends and enemies even suggesting that now.”

That framing goes to the heart of today’s market divide. Ethereum remains the default base layer for on-chain finance and developer tooling; Solana’s pitch is raw throughput and low-latency UX for payments, consumer apps, and—crucially in King’s view—stablecoin settlement at scale. It’s also the practical rationale for REX’s product design: if the chain’s economics are driven by volume and staking, package both into a regulated fund wrapper that passes yield through to shareholders.

“Solana is basically faster and more designed for high processing speed. Frankly, when I saw the big debate come out about stablecoins being all built on Eth, I was like, this is a huge oversight. I think Solana is the story of the future as far stablecoins go.”

The vehicle implementing that thesis is SSK—the firm’s Solana-forward ETF that stakes SOL and pays a monthly distribution. King characterized staking for non-crypto natives as an income stream tied to network security rather than energy-intensive mining.

“It boils down to, for investors, basically an interest rate on your crypto,” he said, noting that on Solana it “varies… somewhere between the 6% to 8% annualized range.” In SSK’s design, those rewards are not trapped inside the fund: “SSK is the first fund to deliver that staking reward through to investors in the US,” he said, adding that the current run-rate distribution is “roughly 5% a year right now,” with the standard caveat that payouts fluctuate.

REX Financial CEO Greg King believes Solana is the story of stablecoin’s future over Ethereum. He speaks with @EricBalchunas on “ETF IQ” https://t.co/aVEoiSkzfo pic.twitter.com/iQx9g4oYJg

— Bloomberg TV (@BloombergTV) August 25, 2025

Solana ETF Spotlight

A second pillar of King’s argument is structural. He drew a bright line between ’33 Act spot ETPs—long familiar to crypto investors via grantor-trust structures—and the ’40 Act investment-company wrapper REX chose. The latter, he said, is “the better wrapper… more investor safeguards, more flexible.”

In practice, that means an actively managed portfolio that can hold SOL directly and via listed instruments while delegating to institutional validators and optimizing for staking capture and liquidity. It also means higher all-in costs than a plain-vanilla equity ETF and concentrated exposure to a single crypto-asset’s volatility—trade-offs the firm acknowledges even as it leans into the yield-plus-beta pitch.

The interview also touched on the coming product wave across US exchanges. Bloomberg’s Eric Balchunas flagged the queue of ’33 Act spot applications for tokens with established futures markets, while co-host Katie Greifeld pressed on timing for a “pure spot Solana ETF.” King was cautious on exact dates but not on direction: “I do think we see a bit of an explosion,” he said—then immediately drew boundaries around quality control.

“Crypto gets pretty sketchy below the top 10, certainly below the top 20. I think there is some significant picking and choosing that has to happen by issuers there.” Even among majors, he expects “a lot of funds per coin,” with Solana a “great candidate” given its combination of scale, perceived “underdog” status in the race with Ethereum, and comparatively larger staking reward.

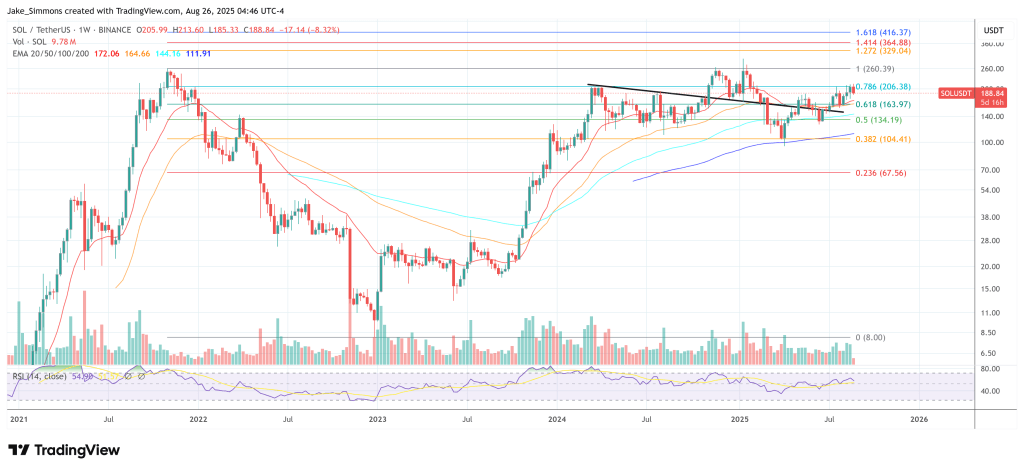

At press time, SOL traded at $188.