Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

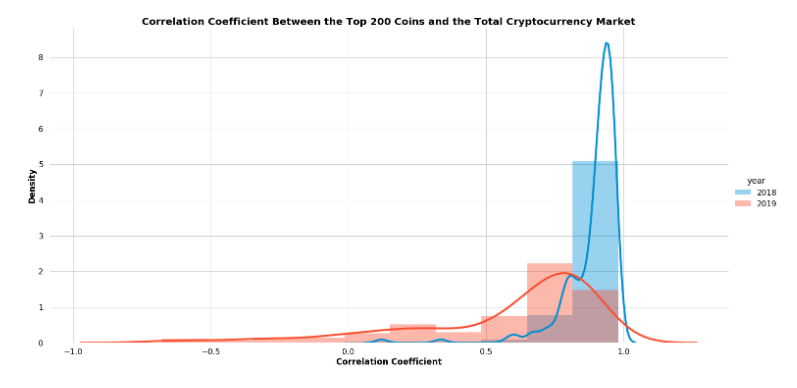

According to a study conducted by cryptocurrency market researchers at Hodlbot.io, individual digital currencies are less correlated with the wider market so far in 2019 than they were in 2018. This, according to the study’s authors, is good news for those investing in a wide selection of crypto assets.

If it continues, the trend observed should be music to the ears of the likes of Vinny Lingham too, who has called for a decoupling of Bitcoin from the rest of the market before any serious bull run can start up again.

Correlation Between Crypto Assets and Wider Market Falling

One of the interesting phenomenons of recent years in the crypto space is the correlation between digital assets. When one coin moves up, the rest almost universally follow. Obviously, there are some exceptions to this. Low market capitalisation coins can be subject to pump and dump schemes and news events, such as partnership announcements or security breaches, can make a specific crypto rise or fall out of tandem with the wider market.

In an effort to assess whether the correlation between digital assets and the wider crypto market is increasing or decreasing, researchers from Binance-focused trading bot software developers Hodlbot.io have devised a study based on the Peason correlation coefficient of the the market capitalisation of a given project and that of the wider market over time.

In 2019, correlations between individual coins and the market dropped when compared to the previous year.

A one-tailed Welch's t-test, confirms that in 2019 #cryptocurrencies have a lower mean correlation.

You can find the full @hodl_bot blog here:https://t.co/qVvWlkKQYj pic.twitter.com/uyeEqGO8oi

— anthony xie (@XieToni) April 6, 2019

Anthony Xie, the founder of Hodlbot.io, writes that a correlation of +1 indicates that the market cap of the asset in question will always move in the same direction as the wider market. Meanwhile, a correlation of -1 will mean that an asset will always move in the opposite direction. Finally, a correlation coefficient of 0 indicates that there is no relationship between the variables.

The study found that the correlation between the top 200 crypto assets and the wider market has dropped since 2018. The research is the second of its kind this year already. Crypto exchange giant Binance also published a similar study last month. It drew the same broad conclusion evidenced in the graph below:

According to the study’s authors, the lowering correlation between crypto assets is a positive for the entire market. Although many investors think they are incredibly diversified because they hold 5, 10, or even 50 different digital currencies, if they always move up or down in price together then the overall portfolio is not really diversified at all.

Reduced Correlation May Also Delight Some Long-Term Bitcoin Bulls

As reported earlier this week, some of the biggest proponents of Bitcoin believe that the number one digital asset will not break out of the bear cycle it has been in since December 2017 until its price moves out of sync with the rest of the market.

South African crypto entrepreneur and Civic (CVC) founder, Vinny Lingham, stated that the correlation between Bitcoin and the wider market signalled that investors were not able to judge a project on its own merits and instead were largely speculating mindlessly on the space as a whole. He even went as far as to joke that another spectacular crash might be in order to make market participants wise up.

He summarised his own position as follows:

“How can we have a situation where the market price of one asset dictates the value ascribed to other unrelated assets, irrespective of whether or not anything changes in their own separate networks.”

Related Reading: Will A Future Decoupling See Alternative Crypto Dominate Bitcoin?

Featured Images from Shutterstock and Hodlbot.io