Many investors and analysts have been pointing to Bitcoin’s upcoming mining rewards halving event as a reason for why the benchmark cryptocurrency is fundamentally bullish, and it certainly is a positive event from a long-term perspective.

There are other key data metrics that support the theory that BTC is fundamentally strong – and maybe even undervalued – besides the halving that investors should take note of.

Some of these data points include the actual circulating Bitcoin supply – which may be significantly lower than previously thought – as well as the vast amount of BTC that hasn’t been touched in years.

These two factors both signal that the crypto may be highly undervalued, and that its mid-to-long term outlook may be more bullish than previously thought.

Bitcoin Circulating Supply Likely Significantly Lower Than Previously Thought

Bitcoin’s fixed supply is an integral part of what makes it a form of “hard money” – as not even traditional physical assets like gold can boast having absolute scarcity.

This is more than a simple talking point, however, as it also plays a role in the cryptocurrency’s deflationary nature.

Because there are only 21 million BTC that will ever exist, the regular mining rewards halvings – like the one that will be seen in roughly 13 days – ensure that the crypto will continue deflating on a regular basis.

This regularly reduces the cryptocurrency’s inflation rate, thus reducing the supply of freshly minted BTC that hits the market from miners.

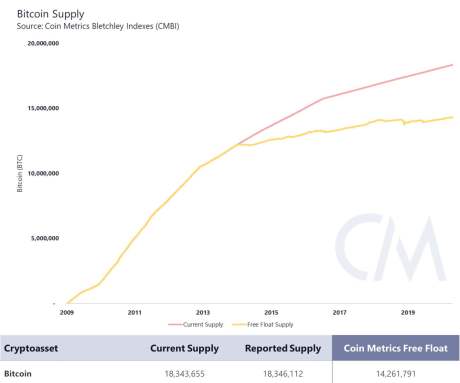

It also appears that the crypto may be scarcer than previously thought, as data from research and analytics firm Coinmetrics suggests that there are actually only 14.3 million Bitcoin in circulation.

“After strengthening our methodology to overcome potential manipulatable behavior, Coin Metrics Free Float Supply of Bitcoin has been adjusted to 14.3M, implying that 4.1M BTC are not in circulation,” they noted in a recent tweet.

BTC’s Scarcity Signals it May Be Highly Undervalued

In addition to the circulating supply being significantly lower than it initially seems, a massive amount of Bitcoin has remained untouched in wallets for years, suggesting that the owners of these wallets are long-term investors.

Data from IntoTheBlock reveals this:

“Currently 43.06% of all circulating $BTC has not been moved for at least two years. This has increased by 10.6% in the last year. From those: 4.04m BTC or 22.02% hasn’t been moved in >5 years.”

The confluence of greater scarcity than previously thought coupled with the massive amount of Bitcoin that has been sidelined within wallets for years seems to suggest that the crypto is highly undervalued at the present moment.

Featured image from Unsplash.