Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto industry was thrilled to learn that legendary macro investor Paul Tudor Jones gave Bitcoin and honorable mention within one of this latest market outlook reports.

In this report, he explained to investors that he believes Bitcoin will likely be the big winner of the mass inflation resulting from the loose monetary policies being undertaken globally to help curb the economic impacts of the Coronavirus pandemic.

He is one of the first big names within the traditional investing world to offer brazen support of Bitcoin – even going so far as to say that it reminds him of gold in the 1970s.

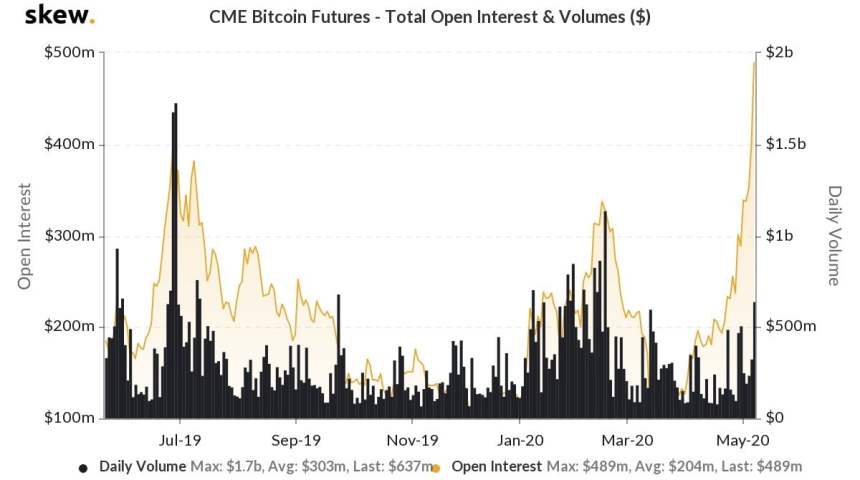

One volume trend seen while looking towards the crypto’s CME futures suggests that there may be other major players besides Jones who are moving to gain exposure to the benchmark cryptocurrency.

Bitcoin Finds Itself Caught Within Intense Uptrend as Major Investor Offers Endorsement

Prior to news breaking regarding Jones’ endorsement of Bitcoin, the cryptocurrency had been caught within the throes of an intense rally that had led it from March lows of $3,800 to the lower-$9,000 region.

His venerable reference to BTC fanned the flames of the crypto’s uptrend and helped push it past $10,000.

The topic of Bitcoin arose in relation to discussions about the massive inflation the world will soon see due to the immense money printing from central banks across the globe.

“The best profit-maximizing strategy is to own the fastest horse… If I am forced to forecast, my bet is it will be Bitcoin,” he explained within the market outlook note titled “The Great Monetary Inflation.”

He also explained that Bitcoin and the macro economic situation surrounding it reminds him of gold in the 1970s.

As reported by NewsBTC, if BTC follows the price action gold has seen in the time since the 1970s, this could mean that the crypto will soon be trading at $40,000 or more.

CME Volume Data Suggests Other Big Players are Involved in BTC

Avi Felman – the head of trading at BlockTower Capital – explained in a recent tweet that BTC open interest (OI) climbing on the CME in tandem with a decline in trading volume suggests that institutions, funds, and professional traders are moving to gain futures exposure to the crypto.

“Notice how OI on the CME is skyrocketing, but volumes aren’t up. What to make of it? Well, people like PTJ using futures as exposure. Less people trading, more people getting long term exposure,” he explained in reference to the chart seen below.

If this volume trend on the CME is emblematic of more large traders like Jones moving to gain long-term exposure to the benchmark cryptocurrency, this could point to underlying strength behind the crypto’s recent uptrend.

Featured image from Unplash.