- Ripple (XRP) consolidates but bulls in control

- CoinBase support very bullish—price and regulatory wise

- Transaction levels dip as prices drop

Until after Ripple (XRP) prices rally above 34 cents, we shall maintain a neutral but bullish outlook. Confidence is because of recent CoinBase addition, increasing adoption levels and a possible recovery of Bitcoin.

Ripple Price Analysis

Fundamentals

Crypto is all about relevancy and of the many, XRP is a standout. The coin is the third most liquid, high supply digital asset of the XRP Ledger. While there is contention whether the currency is entirely decentralized and therefore a utility, the addition at CoinBase did calm some nerves. It did because CoinBase, even if it is trudging in a storm right now, is reliable and asserts for compliance.

Add that to their preference of proof of work networks and the shift to XRP consensus type—proof of correctness is a show of confidence in a ledger designed explicitly for big banks. Although the debate will rage as long as Ripple Inc holds the majority of the XRP tokens—and outrageous comments that Ripple Inc is running a well-orchestrated Pump and Dump scheme, their progress must be lauded.

SWIFT dominates but Ripple is less than ten years old and as the benefits of blockchain permeate, there is no reason why banks will shift to this new, efficient and cost-effective global payment system.

Candlestick Arrangements

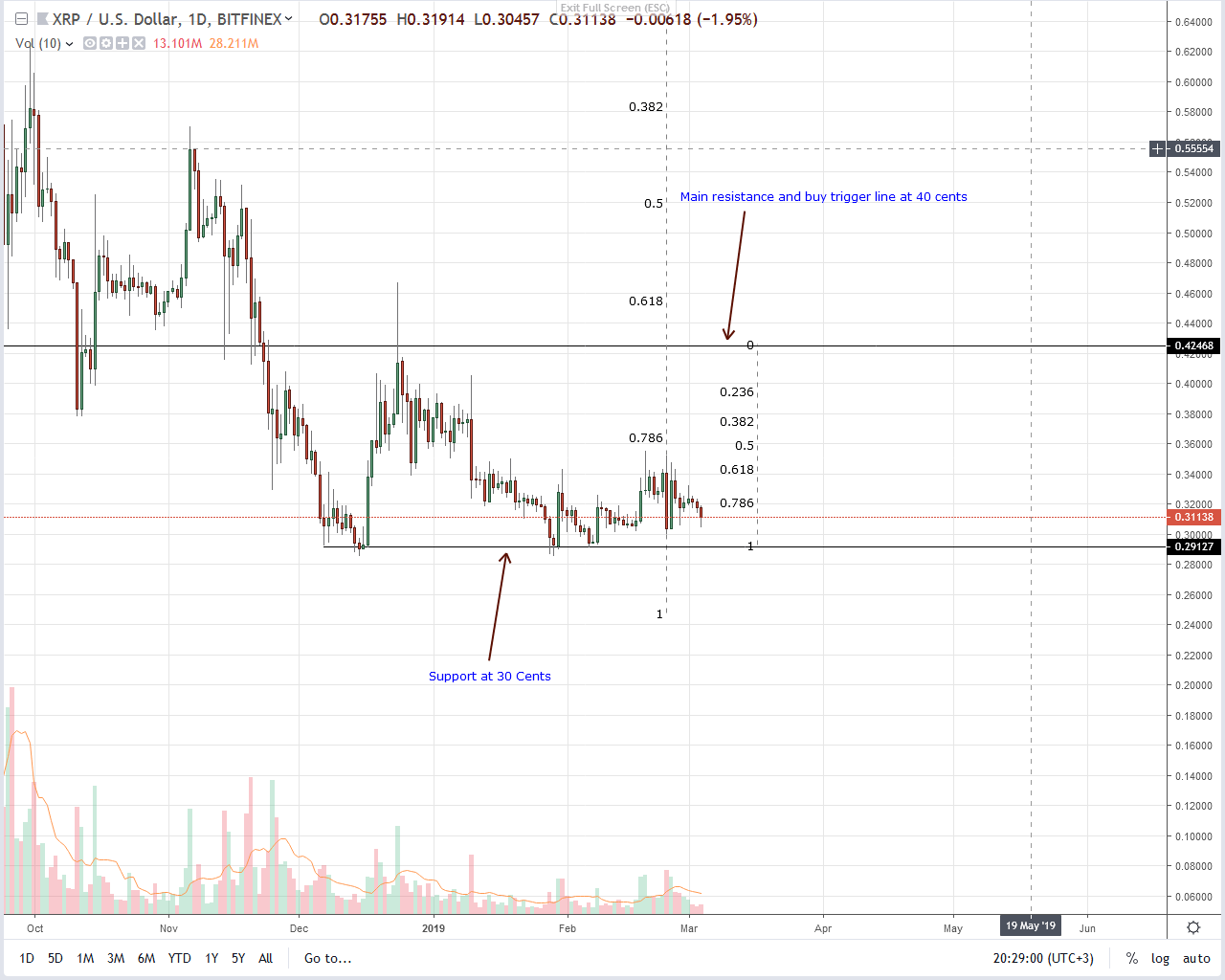

One week after CoinBase announcement, bears have reversed all the gains made on Feb 25. Even so, prices are trading above the solid 30 cents floors. At this pace, we expect prices to edge higher in line with Feb 25 trends. That means prices may rally above 34 cents as risk-off traders buy breakouts with first targets at 40 cents.

Today’s bar may close with a long lower wick as bulls reject lower prices which is overly bullish. Once again shows the strength of 30 cents as reliable support, a probable base for higher highs. All the same, as long as prices are trading within these tight trade ranges and bulls have the upper hand, we shall maintain a neutral but bullish outlook on Ripple (XRP) as we expect a break and close above 34 cents.

Technical Indicators

Dropping prices is causing participation levels to fall. Recent averages are at 30 million and in comparison with Feb 24—61 million, the only way XRP bulls will be in control is if volumes swell above 30 million and 61 million.