There are various hurdles to widespread merchant adoption of bitcoin; some of them are tangible, while others are often contrived growing pains. One of the minor issues in the former category that keeps reappearing in community discussion and problem-solving is the wait time required for transaction completions, known as “confirmations” in the bitcoin GUI.

Transactions with bitcoin are not fully guaranteed until they are mined in the blockchain, with an average lapse of 10 minutes to find a block. This complex process does take time, but it helps to prevent problems like double spending, fraud, or insufficient fees. Of course, this time lapse is still remarkably an improvement over the reversibility of credit cards, which can confer a chargeback up to 3 months after the original transaction—a serious liability cost for businesses.

This supposed lag, be it a legitimate or artificial issue, is an ideological drag for on-the-fly commerce and somewhat betrays the maxim that bitcoin will herald in the new economic singularity as a frictionless, instant payment.

Modern society has developed a drive-thru mentality for most goods and services. We want everything here and now. Sending and receiving our money is now absorbing and grappling with this expectation.

Bitpay’s Impulse Control:

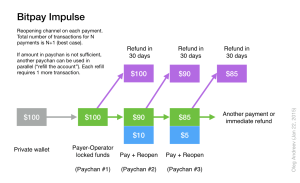

Bitpay’s new proposed solution to this is inter-channel payments, which it calls the “Impulse” protocol, a technical backend that may enable trustless acceptance of 0 confirmations. To do so, it arranges a triad 3-party scheme of Payer, Operator, and Recipient. The trusted operator would co-sign transactions to enhance trust, and would therefore not sign double spends. The specifications for this can be viewed on their newly published whitepaper.

The first pressing question that arises from this dilemma is what scenarios would require the acceptance of confirmation transactions? While the immediacy of this economic necessity as of yet remains unseen, the main concern is to further minimize any potential attacks on the network.

Oleg Andreev, a software engineer from Paris, submitted on January 22 a thoughtful review on Github that summarizes the Impulse protocol, extending a detailed list that reviews the various pros and cons of Impulse.

Andreev modeled an intuitive graphical overview of the protocol:

Bitcoin Core Developer, Jeff Garzik, in his presentation at the 2015 North American Bitcoin Conference, called Impulse “the Holy Grail of instant, secure transactions.” Garzik weighed in favorably on the Impulse Protocol, noting:

“From a holistic perspective, it upgrades everyone’s payment processing security today, and creates a protocol that can be used in an even more trustless fashion tomorrow.”

Another Bitcoin Core Developer, Peter Todd, also chimed in, though with less favorable criticism on the discussion—noting that the bitcoin platform Green Address currently addresses the same issue.

Like the lightning fast transaction speed itself, perhaps one of the most interesting features of the bitcoin economy is the blinding rapidity at which the network evolves. As soon as one entity emerges with a proposed transformation or edit to the bitcoin currency, a new one materializes near simultaneously in beautiful synchronism.

Interestingly, we could be hearing more from Andreev, who is also working on the problem:

“I really like how Impulse combines several good ideas in a one quite elegant scheme, but it’s still not optimal in terms of scalability and security. I’m working on my own idea of a decentralized clearing network and taking into account all pros/cons of Impulse. Will share when it’s more-or-less complete.” – Oleg Andreev

NewsBTC is excited to continue following these developments closely.

Eric Martindale, from BitPay, clarified their current stance in a recent Reddit post:

“We’re still trying to solve the trust problem. We’ve seen some proposals, but no clear solution has emerged. Before we move to adopt such a protocol, we’d like to see more community feedback and ideas on how we can reduce or even eliminate the need for trust…”

0 Confirmations Bitcoin Payments via NoRiskWallet:

News and developments are traveling fast. The speed at which even the transaction technology itself is evolving. A new wallet was just developed last Saturday from the Amsterdam hackathon, Block trail, called NoRiskWallet that synthesized elements of the ongoing discussion. The developers noted:

“This project is based on previous ideas of GreenAddress.it, vague descriptions from Peter Todd about payment hubs, the Impulse.is proposal from BitPay and comments from Reddit user oakpacific.”

To accept 0 confirmations NoRiskWallet again uses the triad of payer, operator, and recipient. The operator here assumes the responsibility of trust and uses its own funds as collateral (releasing them preemptively to the merchant).

Most importantly here, both Eric Martindale himself and the NoRiskWallet team observe the indispensable advisory of the bitcoin community at large, giving further credence to the interdependent quality of group-minded innovation, and the decentralized nature of this emerging technology.

Images courtesy of BitPay.

The trust problem has been solved by the darkcoin developer. there is a white paper on it.. search darkcoin instantX

there is also a you tube video of the POC.

Bitpay is just trying to turn BitCoin into PayPal so they can sit on transactions at their discretion. That is what this new feature is. They are destroying BitCoin, never use BitPay to conduct a BitCoin transaction.

BitPay is PayPal just google it. They are owned by PayPal. The jewery will never end with PayPal or BitPay as they design the systems to do the exact opposite of what it was originally designed to do. Jimbit is right, use DarkCoin if you want to get rid of these bastards.