Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

What is decentralized finance?

Decentralized finance (DeFi) or open finance refers to an open and permissionless financial system. Financial products are powered by blockchains that can execute smart contracts automatically under pre-defined terms. These products can be accessed by anyone instantly without any background checks.

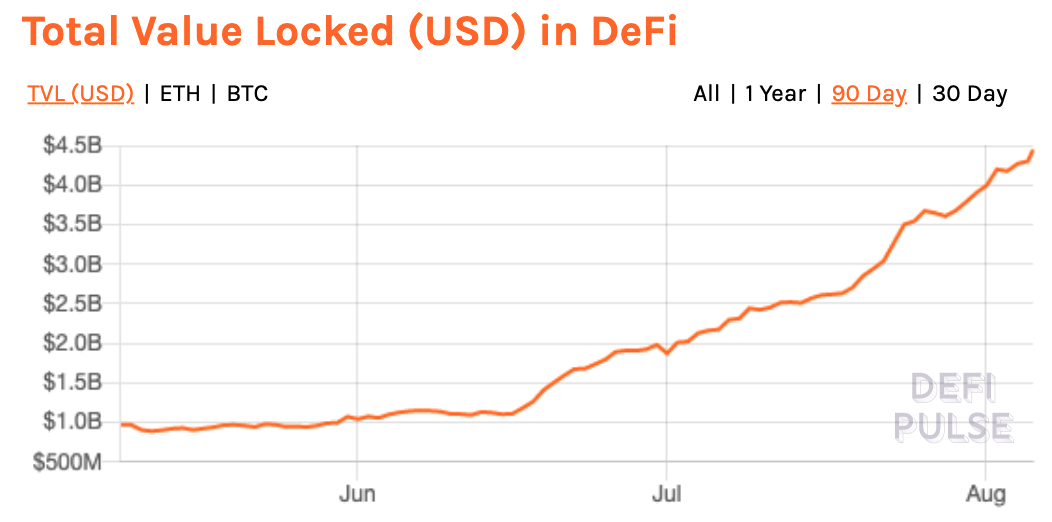

According to DefiPulse, there are currently more than 4 billion dollars locked in DeFi applications. This value has quadrupled in less than two months due to yield farming.

What is yield farming?

What is yield farming?

Yield farming or liquidity mining is the latest trend in the cryptocurrency space. Many new decentralized applications (DApps) are trying to incentivize crypto-asset owners to provide liquidity in their platforms. This is done by distributing their native governance tokens to their liquidity providers as a financial incentive.

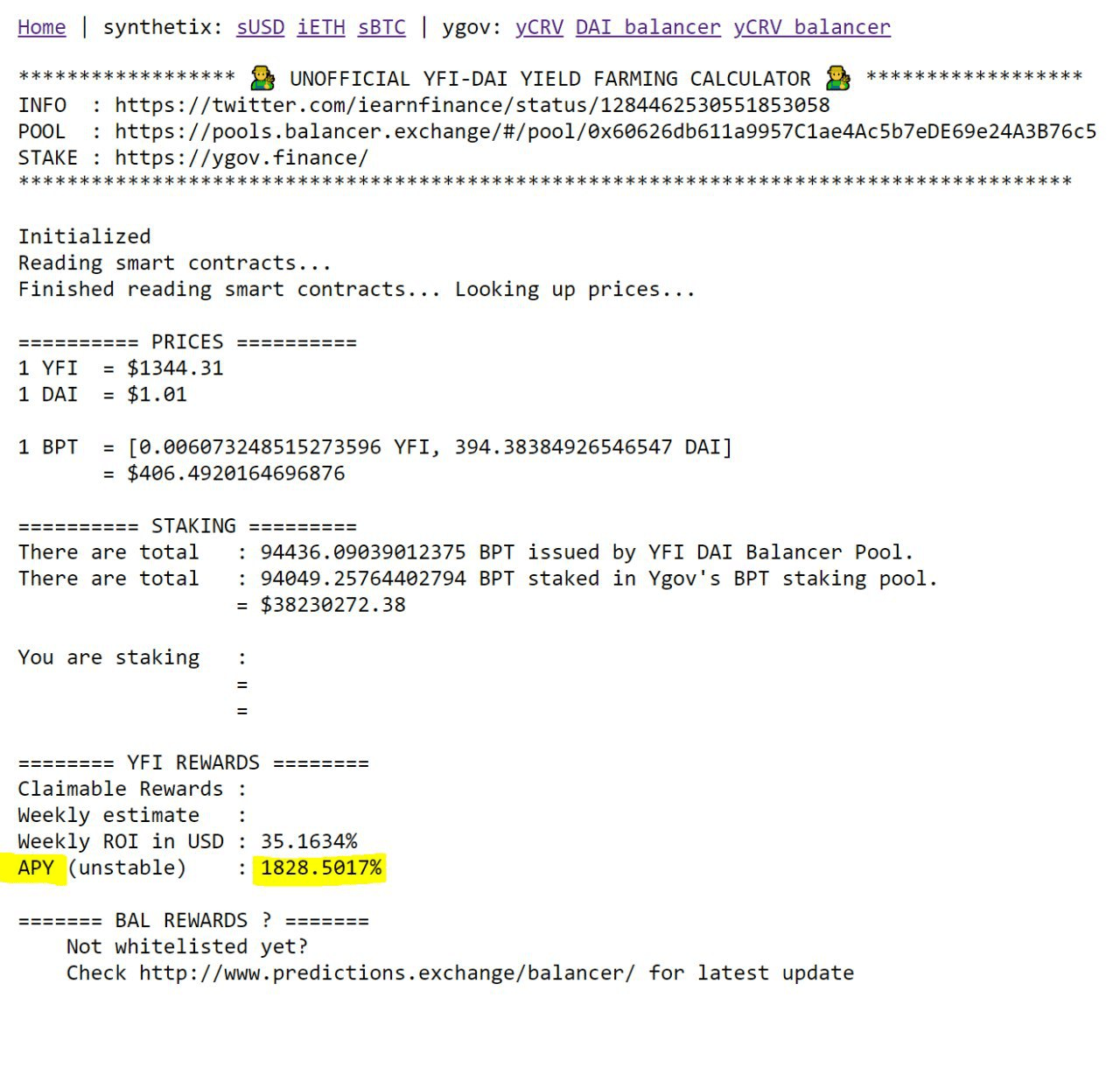

Many crypto owners are now constantly generating passive income by depositing their idle assets into liquidity pools. While the annual percentage yield fluctuates, it is common to see higher than 100% annual percentage yield (APY). This surreal yield significantly outperforms the interest rates of saving accounts offered by traditional banks.

Yield farming is also permissionless and non-custodial, meaning asset owners still have full control over their assets and can withdraw their funds from the liquidity pools anytime they want. There is no lockup period and no KYC required. Deposits and withdrawals are also instant.

Are there any examples of yield farming?

Compound finance is a lending and borrowing dapp (decentralized application) that automatically matches lenders and borrowers, and adjusts interest rates dynamically based on demand and supply. In order to attract liquidity and usage, they ran the first ever yield farming incentive program where lenders and borrowers could receive COMP tokens by utilizing their platforms.

COMP tokens are allocated to users proportional to their utilized USD value in lending and borrowing on the platform. In many cases, borrowers are paid to borrow assets as the COMP token yield exceeds the interest payable.

On the other hand, many liquidity pool providers like Curve and Balancer distribute their governance tokens CRV and BAL to liquidity providers proportional to the amount of liquidity they provide.

There was a one-week YFI mining on yearn.finance in late July. It is a platform that automates yield farming and interest accruing by performing profit switching among multiple dapp providers in the background. YFI is their governance token which can also be staked and earn profits generated from the platform. Its liquidity mining program lasted for one week, and the APY was higher than 1500%.

What is a liquidity pool and Anyswap?

What is a liquidity pool and Anyswap?

Traditionally, each trade involves a maker and a taker. When traders want to execute a large trade order, they will suffer a huge slippage if there is low liquidity.

Many decentralized automated market makers (AMMs) are trying to mitigate this issue by bootstrapping liquidity in the same pool using smart contracts. Users with idle assets can deposit funds into liquidity pools and earn trading fees from trades against market takers.

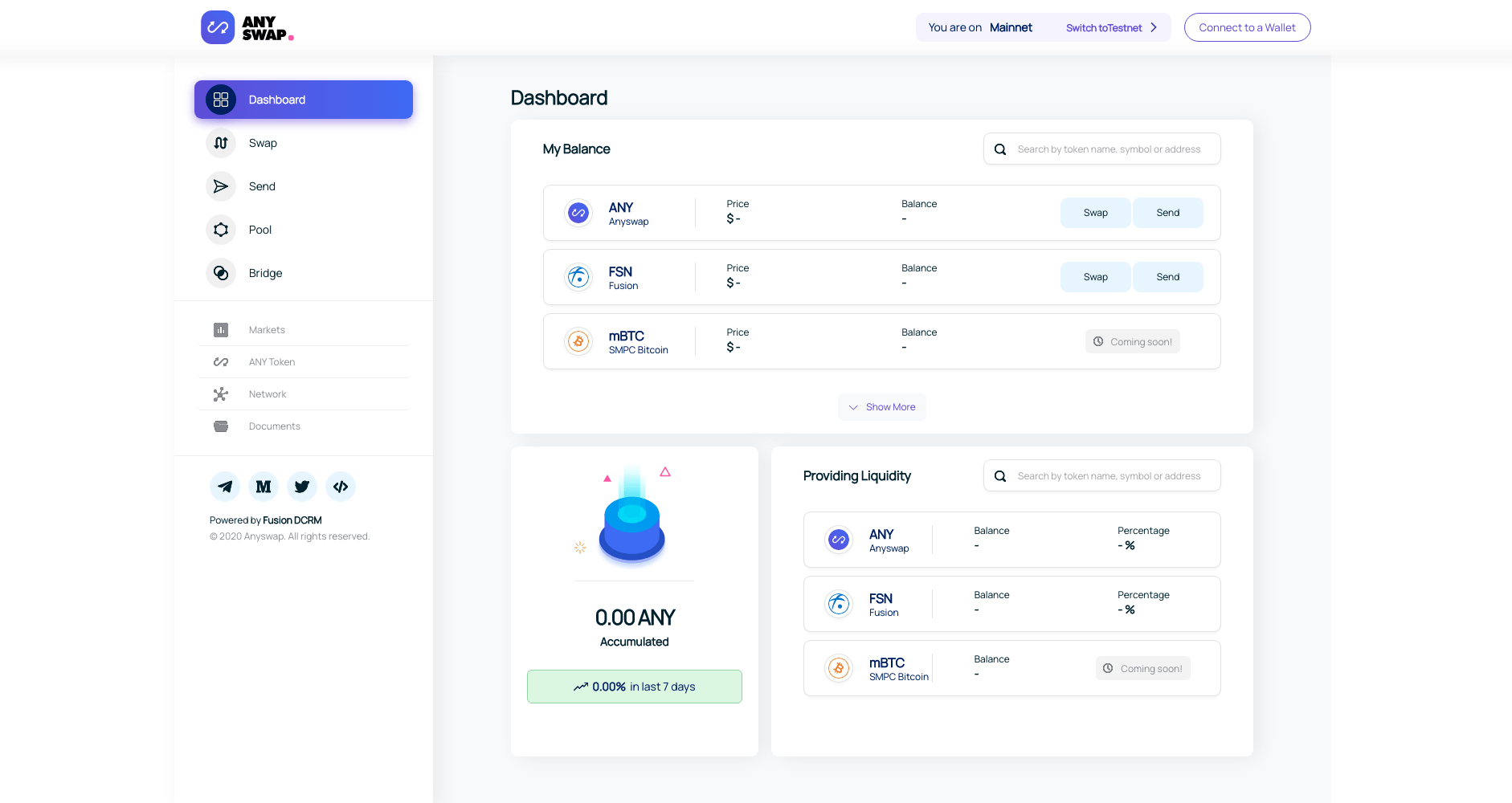

Anyswap is a fully decentralized AMM that supports cross-chain token swaps using DCRM technology on the Fusion network. Liquidity providers earn 0.3% from every swap transaction that utilizes the liquidity pools. Anyswap’s cross-chain support can attract liquidity from countless blockchains such as Bitcoin and Ethereum. Therefore, it has a larger potential than existing single-chain AMMs.

Anyswap was launched on 20 July and has already registered over 6.6 million USD in trading volume in the last 24 hours! This makes Anyswap one of the top 10 decentralized exchanges (DEXes) in terms of the 24-hour trading volume.

What is governance token and ANY token?

Governance tokens give token holders the power to influence decisions that affect the protocols of community-driven decentralized platforms. All protocols need to be updated, and token holders can act as “shareholders” and collectively decide on what to change, when to change, and how to change the protocols, usually by voting.

ANY token is the governance token of Anyswap. The token can be used to vote for adding supported chains, elect Anyswap working node, and vote for changing governance rules.

Can I yield-farm with Anyswap?

Anyswap is currently running two incentive schemes – liquidity mining and trade mining.

For liquidity mining, 9900 ANY is rewarded to liquidity providers every 6600 blocks (around 24 hours) on a pro-rata basis. For trade mining, 250 ANY is rewarded to traders every 100 blocks proportional to their trading volumes.

Having both incentive programs running simultaneously ensures that both market makers and takers are adequately rewarded, and hence construct a healthy ecosystem where liquidity pools are highly utilized.

Since a fixed amount of reward is distributed among liquidity providers, the APY will drop when more liquidity is added into the protocol. The APY for liquidity mining is currently at 430%. The earlier you participate in farming ANY token, the more yield you can generate!

How to passively earn ANY token?

You can go to anyswap.exchange and interact with Anyswap on the Fusion network using Metamask or Ledger wallet. Support for other wallets is coming soon. You can click the “Swap” tab for swap trading and the “Pool” tab for adding liquidity.

Take liquidity mining in ANY/FSN pool as an example, you need to deposit the equivalent values of both ANY and FSN tokens from the “Pool” tab. You will start earning passive rewards immediately after deposit. Those passive yields come in two forms, swap fees accrued within the pool, and ANY tokens from the mining incentive scheme.

If you do not have any ANY token to start with, you can buy them from the “Swap” tab using FSN. Happy farming!