Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Derivatives trading dominates the cryptocurrency market with a 70% share, as per CoinMarketCap. Its significance is increasing as the volume of cryptocurrency trading, including derivatives, grew by 76.1% in January 2023 compared to the previous month. The derivatives market’s share also rose from 68% in December to 70.3% in January. BitMake is well-positioned to become a major player in this competitive market, given the positive market outlook for 2023.

The derivatives market landscape is undergoing a new change

Since 2017, Bitcoin futures products launched by the Chicago Mercantile Exchange (CME) have made derivatives the dominant force in the cryptocurrency market.

BitMEX used to be the market leader for derivatives, but other platforms like OKX, Bybit, Binance, and FTX have launched their own perpetual contracts, resulting in a decline in BitMEX’s market share.

On-chain derivatives protocols like GMX and dYdX have gained prominence after FTX’s derivatives market failed. However, leading derivatives platforms like Binance, OKX, and Bybit lack differentiation and innovation, while the on-chain derivatives market lacks liquidity and user experience.

In this market, BitMake is an emerging force that competes with its comprehensive and innovative product design, technical strength, and differentiated service experience.

BitMake: A Derivatives Trading Platform Designed for Professional Traders

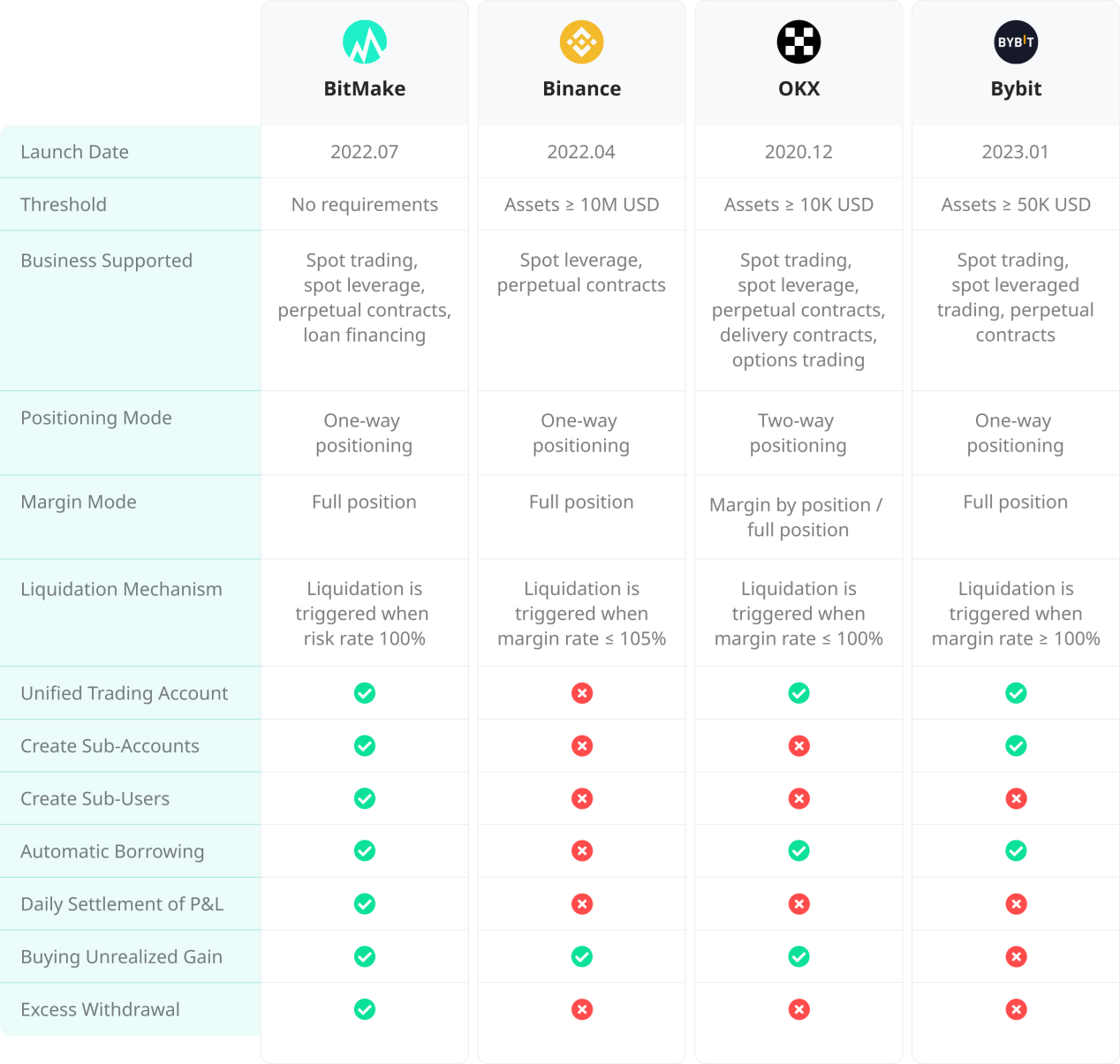

BitMake is a platform for professional traders that launched in July 2022. It provides various cryptocurrency trading services such as spot trading, spot margin trading, Perpetual Futures Contracts trading, and wealth management lending.

Its unique feature is a unified trading account that allows traders to collateralize multiple currencies and use them as collateral for trading, maximizing their capital utilization.

- BitMake: Setting a New Standard for Derivative Products with Unified Trading Account

BitMake is gaining attention in cryptocurrency derivatives trading for its unified trading account. This allows users to trade various currency types, including spot trading, Perpetual Futures Contracts trading, and lending/financing all in one account. This feature eliminates the need for fund transfers, improves capital utilization, and reduces the risk of liquidation.

Compared to other traditional trading platforms, BitMake’s unified trading account model is more comprehensive, flexible, and secure. It allows for features like automatic borrowing and over-withdrawal, making trading more convenient.

- Automatic Position Settlement Boosts Risk Management

BitMake is committed to providing users with high-quality Perpetual Futures Contracts trading services. Its trading system is based on a unified account, providing users with perpetual contract products with USDT as the settlement standard, and supporting leverage up to 125 times. The unified account system allows all available assets to be used as margin for positions, maximizing fund utilization and reducing derivative trading risk by sharing the same margin.

To better protect users’ trading security, BitMake also adopts a more inclusive liquidation mechanism and settlement mechanism. In BitMake, forced liquidation is only triggered when a user’s risk rate reaches 100%.

In addition, BitMake conducts daily automatic position settlement at UTC 0:00, converting unrealized profits and losses of current positions into realized profits and losses. Therefore, users may see their unrealized profits and losses become zero after each settlement.

- Focusing on institutional users, providing professional services

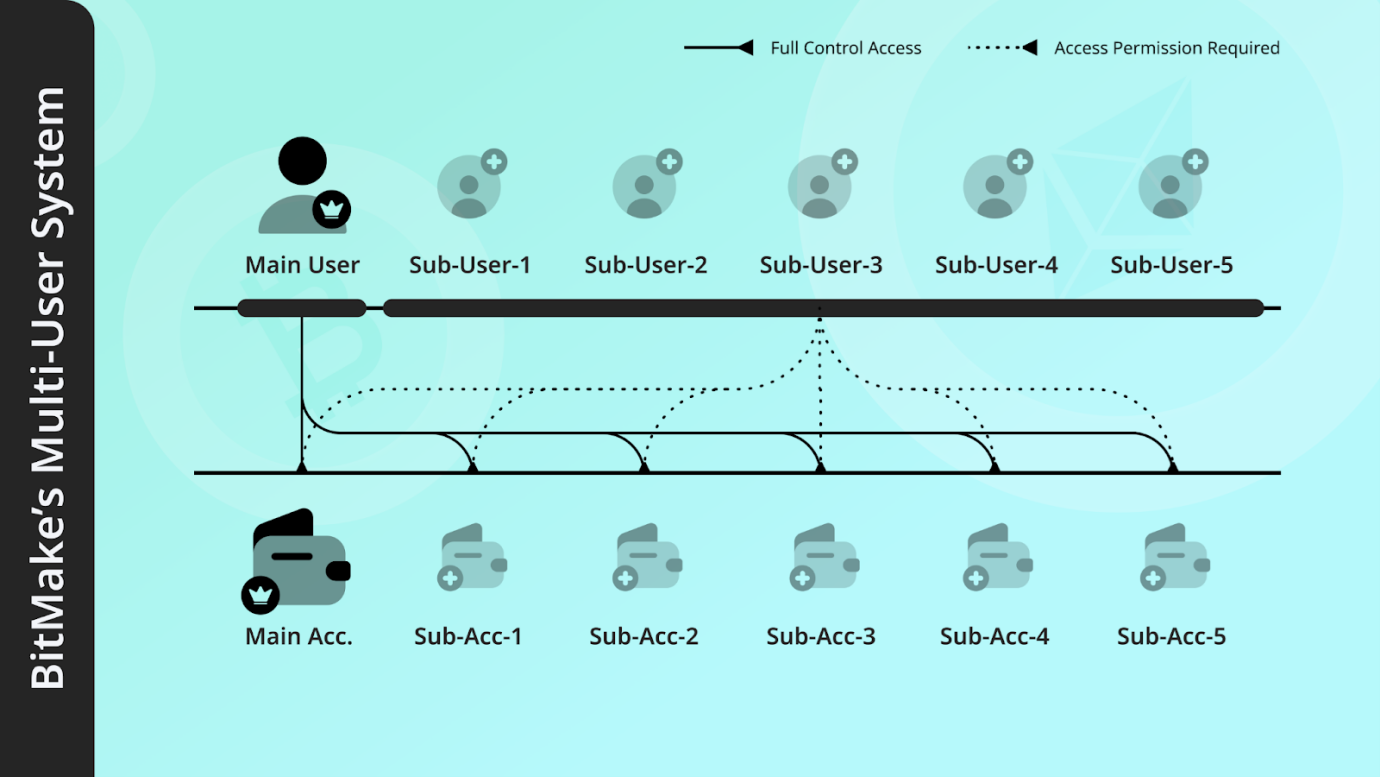

BitMake designs a flexible account system to meet the specific needs of institutional users, including the ability to create up to five sub-accounts for risk isolation and up to five sub-users for greater control over fund management.

BitMake also offers a powerful API function that supports trades in under 10ms, improving trading accuracy and fund security. Institutional users can apply for certification on the official website to lower fees and reduce trading costs.

- Excess Withdrawal Enables Flexible Asset Utilization

BitMake platform supports the function of excess withdrawal, which allows users to withdraw more than their available balance by collateralizing their assets.

This innovative feature greatly improves the utilization of user assets, provides greater convenience for asset management, and significantly reduces the transaction cost of currency exchange. This function allows easy withdrawal of popular digital assets without requiring users to hold multiple assets, thereby increasing their flexibility

The excess withdrawal function is crucial for users who handle numerous withdrawal requests. The conventional process involves lengthy review and confirmation, causing delays, especially with large numbers of requests.

- Newcomer in the Derivatives Field, with the Potential to Breakthrough

BitMake, as a new force in the derivatives market, its core team members are all veterans in the cryptocurrency industry with many years of experience. With sophisticated product design and strong technical capabilities, BitMake has maintained smooth operation since its launch.

The derivatives market has room for growth and is not yet saturated. While leading platforms have taken some market share, innovative derivative companies like BitMake can still make a breakthrough in the competitive market and bring new energy to the industry’s development.

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.