Although crypto trading can be enjoyable and rewarding, it can also be rather strenuous and time-consuming. That’s why many are turning to automation, which has officially weaved itself into the fabrics of the crypto world. That’s where Bitgsap comes in with its new automated futures bot called the “Combo Bot.”

Bitsgap is an online crypto exchange offering trading, bots, arbitrage, signals, and more. Futures trading with Bitsgap allows you to use derivative instruments to place bets on (buy or sell) a digital token at a specific price/day in the future.

The Combo Bot can utilize several pre-developed strategies to execute long or short positions on digital tokens. Additionally, you can take an “isolated” or “cross” margin position with up to 10x leverage. With multiple automated strategies and compatibility on 25+ exchanges, this bot is flexible and built to maximize returns effortlessly.

The Various Combo Bot Strategies

The Combo bot uses both GRID and DCA algorithms to trade, and they are built in to adjust to the best and worst-case scenarios to make as much (or lose as little) money as possible.

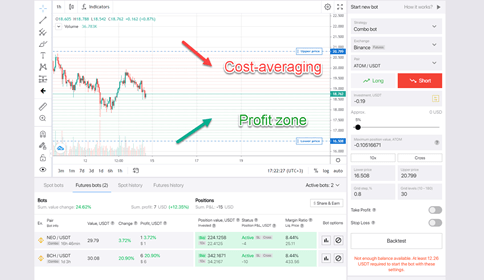

Shorting

When the bot shorts, it executes “buy” GRID orders to take profits when the token’s price decreases (in the profit zone). On the flip side, the bot will execute DCA short-sell orders when the price increases, thereby dollar-cost-averaging and exiting the position in pieces:

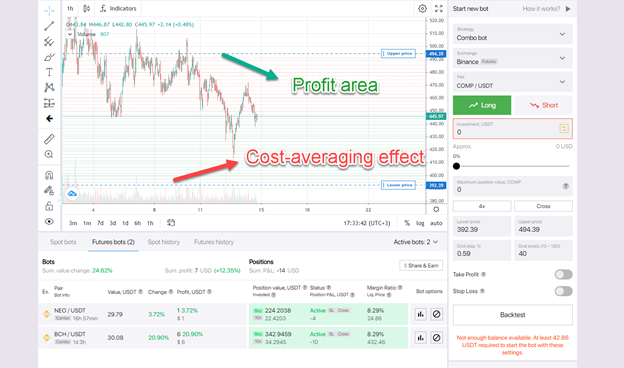

Longing

Going long is considered less risky than shorting and is ideal in a bull market to maximize returns. As the price continues to rise over time, the bot executes calculated GRID sell orders to take profits to hedge if the price drops sharply. When the price decreases, the Combo Bot executes DCA “buy” orders to dollar-cost-average and accumulate more tokens:

Combo Bot Metrics and Statistics

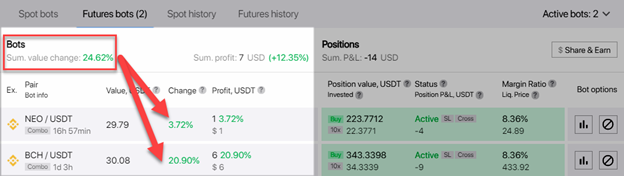

Percent Change and Profit

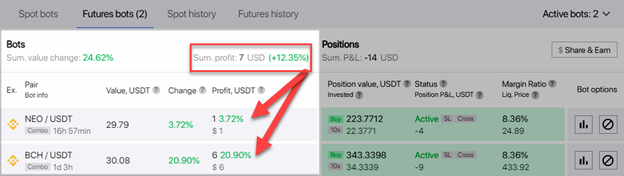

You can view each bot’s profit % change and overall gains, with the trading pair and value denoted on the left. If you are operating more than one bot, the “sum.value change” will display the cumulative % change across all active bots.

The “Sum.profit” information displays your total actualized return in USD, as well as the equivalent gain in %

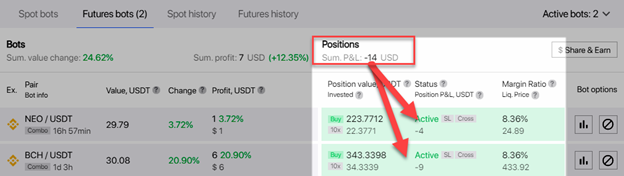

Futures Contract Information

You can navigate to the “Positions” section to view open futures contacts. The total value, status, and margin ratio of each position is displayed. Additionally, the “Sum.P&L” metric shows your total profit or loss across all of your open contract positions to give you a comprehensive view.

Leveraged trading can be dangerous, so educate yourself!

While futures trading offers investors a whole new world of opportunities to make money, the investor can find risk on the other side of the story. Utilizing leverage can be dangerous for those who do not fully understand the risks, so make sure to educate yourself and do your research before diving in.

Bitsgap provides you with a demo mode to trade “virtual” money and practice trading on the real markets to lower risks and facilitate education. The demo mode lets you “test before you invest” and see how your settings would respond to real profit and loss in a risk-free scenario.