Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bumper Finance’s liquidity program is now live. Investors keen to power up the “God-mode for crypto” now have the opportunity to join others in providing liquidity to this innovative DeFi protection protocol. Participants depositing their USDC reserves into the program early can expect to yield up to 300% APR by locking their funds away for three months. The community is ablaze with fearful whispers of the looming bear that Bumper Finance aims to cancel.

The Limits of Stop-Loss

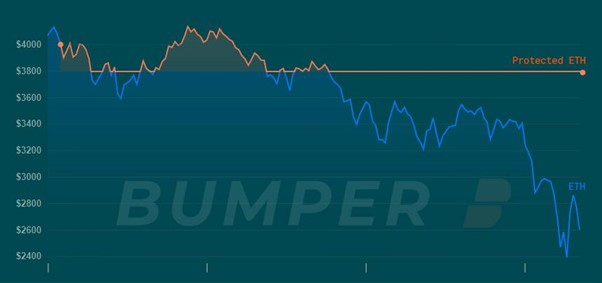

Crypto is a bipolar beast. Even reliable assets like Ethereum suffer swings that would make the average Wall Street day trader blanche in fear. For the experienced, it’s another day riding the charts. Yet as the crypto space matures, even veterans are looking for ways to safeguard their assets and ensure a price floor that is palatable.

Often, the only way to have security is with inefficient and cumbersome Stop-Loss methods, which require funds to be in the hands of exchanges and for the user to input a roll-call of price-action commands that, even for the benefits they offer, open the door to missing out on asset rebounds that occurred while they were sleeping. Flash crashes can also trigger Stop-Losses, leading to unwitting holders waking up to find their prized crypto collections exchanged for stablecoin amounts that are far below the asset’s value the next day.

Setting the Floor

Bumper Finance, from the team that was behind INDX and developed by the Sydney-based Block8, offers a solution to these problems. It allows users to take policies that mitigate the effect of volatile swings on their assets. By paying a small premium, averaging around 3%, users can lock in prices for their crypto and can be rest assured that, should another violent downswing occur, they can cash out for their set price.

So, if Ethereum drops 20% one week, a savvy user can cash out the policy and pocket the difference in USDC – and be ready to reinvest as they see fit. Most importantly, if the asset price goes the other way, then policyholders are free to enjoy the fruits of that asset rising as the price of the premium dwindles into insignificance. Policies are not long-term commitments either. After 2 weeks, a user is free to remove it at any time.

Those premiums will be used to pay out to those providing USDC to the protocol. The chance to put stablecoin reserves to work is an enticing one for people who are holding stablecoins but are unsatisfied by the normal interest rates paid by various centralized entities.

Incentivising the Liquidity Program

To incentivise liquidity providers in kickstarting the protocol, Bumper’s generous liquidity program is key. A day 1 investor can expect 100% APR for depositing USDC, paid in the protocol’s native $BUMP token, as standard.

The public sale price being pegged at $2.40 means that those who contributed early will have a chance to sell their tokens for profit on the open market come IDO, or have an outsized role in ongoing governance of the protocol as it develops. An early investor stands to farm a lot more of the $22 million $BUMP made available. However, liquidity providers can enter at any time during the 12-week period of the program through the Bumper Finance interface.

Don’t Fear the Bear

As the wider crypto market enters unprecedented uncertainty, with the shrill klaxon of the media blaring FUD and regulatory wolves circling, $BUMP looks well-positioned to offer a defense against such fears. It offers a chance for investors to keep their crypto assets as crypto, but safe in the knowledge that a guaranteed dollar price is assured and their crypto is protected from price drops. By doing so, it may well empower the entire market, as investors can put their assets to productive use with impunity – free from the stain of impermanent loss and the claws of the bear. Now, the new liquidity program will further incentivise users to take action, either by protecting their assets or earning APR on their liquidity.