Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Given that some pundits had predicted that the spot Bitcoin exchange traded fund (ETF) approval would be a sell-the-news event, it has come to be because the leading cryptocurrency has dropped to the $42,000 zone.

Nevertheless, Borroe Finance ($ROE) is showcasing itself as an AI crypto that is a force to be reckoned with because it has set its eyes on outdoing Render’s performance because it intends to catapult the Web3 sector to the next level.

Borroe Finance is Materializing as a Web3 Powerhouse

Given that Web3 seeks to usher in the next internet era where participants will be fairly compensated for their efforts, Borroe Finance is in high gear to ride on this wave thanks to its revolutionary marketplace.

With liquidity pools making waves in the crypto sector, Borroe Finance is borrowing a leaf from this trend since it links revenue buyers and sellers in the Web3 sector so that short-term capital is no longer an issue.

Therefore, Borroe Finance lowers the barrier to Web3 entry by enabling businesses and content creators to raise instant funds by using their future incomes as collateral, which have already been generated as non-fungible tokens.

This outstanding approach is geared toward spurring innovation in Web3 by onboarding more participants, and this is why fear of missing out is engulfing the Borroe Finance network based on its long-term outlook.

As a result, investors and early adopters are giving Borroe Finance a keen eye, as evidenced by the high HODL trend being witnessed on its governance token called $ROE.

For instance, at least 220 million $ROE tokens have been bought at presale, which is currently at the fourth stage where each coin is selling at $0.019.

With $ROE serving as Borroe Finance’s gateway, this token is destined for greater heights on the foundation of the network’s real-life Web3 utility.

Bitcoin Falls to the $42,000 Zone

With the spot Bitcoin ETF approval already behind the crypto community’s back, the top cryptocurrency’s price continues to take center stage on the crypto news streets.

This is because Bitcoin has dropped from $45,000 to the $42,000 level, with some experts previously predicting that this was bound to happen since the ETF approval would take the sell-the-news route.

This short-term pain does not mean that the spot Bitcoin ETF approval does not have a bullish long-term outlook because some predictions have indicated a notable BTC surge.

For instance, financial giant Standard Chartered pointed out that Bitcoin would hit the $200,000 level by the end of 2025 in the post-ETF era.

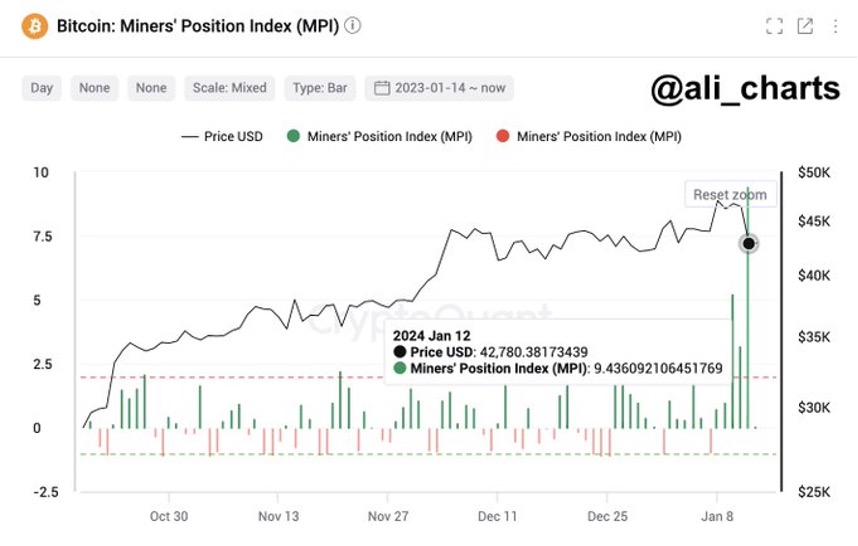

Meanwhile, leading market analyst Ali Martinez highlighted that the current pullback might be ignited by miners offloading part of their BTC holdings.

The analyst noted, “On January 12, the Bitcoin Miners’ Position Index (MPI) hit a high of 9.43! This indicates miners moved more BTC than usual, hinting at potential sales. Despite a recent BTC price correction, stay vigilant – further miner selling could drive prices further down.”

Source: CryptoQuant

Bitcoin was down by 8.3% in the past week to hit $42,897 at the time of writing, according to CoinGecko data.

Learn more about Borroe Finance ($ROE) here:

Visit Borroe Finance Presale | Join The Telegram Group | Follow Borroe Finance on Twitter

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.