Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

2020 has come. It’s the year of the next Bitcoin halving, which is going to happen in May. How will it affect the price of cryptocurrencies?

The general consensus is that it should drive the value of the whole market up. Some analysts predict that Bitcoin could jump to $50,000, others that it could go up to $100,000. These scenarios may not happen, but one thing is for sure – the world will go crazy about trading cryptocurrencies again. People will take long and short positions on Bitcoin, and the volatility should be high.

That’s why trading cryptocurrency contracts in 2020 is a great idea. Apart from Bitcoin, the hottest altcoins of the year are going to be Ethereum and Litecoin, according to various analysts.

Trading BTC, ETH, and LTC with leverage

Blockchain and cryptocurrency opened the door to limitless innovation. One of the most recent achievements is PrimeBit, a P2P platform for margin trading contracts for cryptocurrency. Let me show you how it works.

First of all, you get access to a number of Bitcoin accounts. You can fund them with any sum (no minimums), and set different leverage. PrimeBit offers the highest maximum leverage on the market. You can set leverage up to 200x. It means you can buy a contract worth 200 Bitcoins with just one Bitcoin deposit or to put it in a different way, you can open a position worth one Bitcoin at a price of $8,103 with just a $40.52 deposit. That’s nice! Especially if you get easy and fast Bitcoin transfers from anywhere in the world.

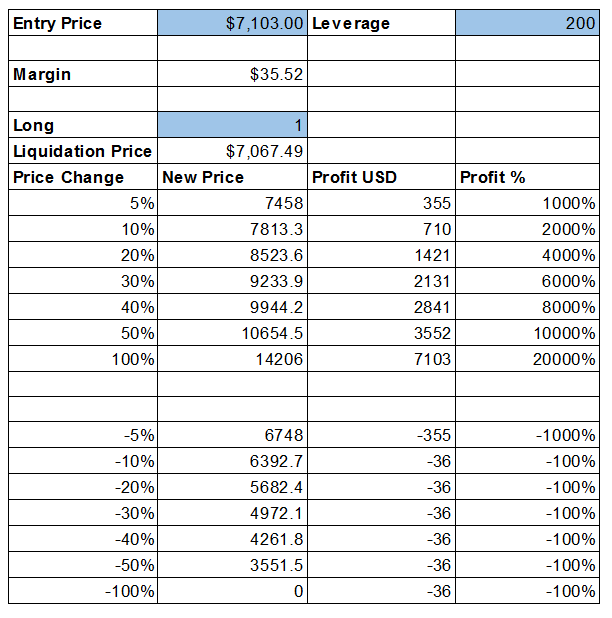

Trading with margin means accelerated profit, but also accelerated potential loss. Here’s how it works for the highest leverage available on PrimeBit.

The Profit / Loss asymmetry on PrimeBit

You open a long position (a buy order) on BTCUSD worth exactly $7,103. As I mentioned above, you need just a $35.52 margin to do it. Let’s go through possible scenarios.

Now, let’s take a look at what happens if the market goes against you. For this highly leveraged position, the liquidation price is very close to the entry price. It’s enough for Bitcoin to drop to $7,067.49 for you to be knocked out of your position.

However, what you lose is just the $35 you invested – that’s the only thing you risk, while you can easily earn 10, 20, or even 100 times more.

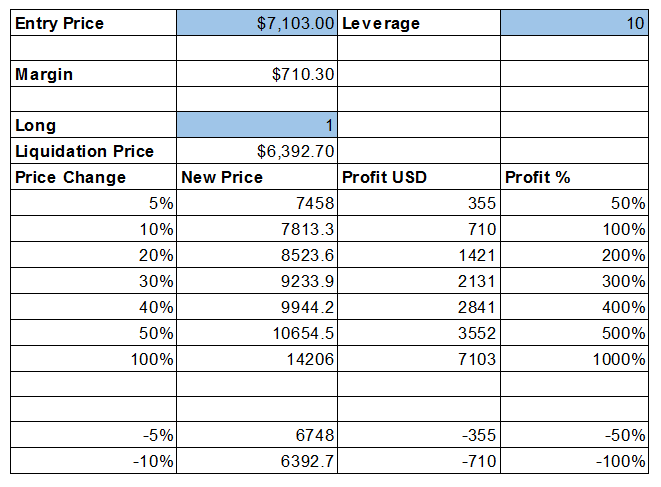

Reducing the leverage

If you want to play it safer, you should use lower leverage. Let’s take a look at a similar trade made with just 10x leverage. In this case, you’ll need a much larger deposit. To open a position worth one Bitcoin you need to have 1/10th of its entry price, which in our simulation is $710.30.

What you get in exchange however is a much looser margin of error, as the liquidation price is $6,292.70. Bitcoin price would have to go as low for your position to get automatically deleveraged.

You are still able to profit substantially. If Bitcoin reaches $7458 you get $355 profit. If it goes up just by 10% to $7813.3 you double your deposit!

If you’d like to make money on trading cryptocurrency, you definitely have to try PrimeBit. It’s the only major cryptocurrency contracts platform that works with MetaTrader 5 – the world’s leading trading tools.

Give PrimeBit a try using MT5 desktop, mobile apps, or PrimeBit’s MT5 WebTrader, where you can start trading without having to install anything. You can test PrimeBit with a fully functional Demo account or a Live account with no minimum Bitcoin deposits.