Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Fantom blockchain ecosystem is powered by FTM, its native utility coin, which is utilized for staking, governance, and payments. While running a validator node necessitates a minimum stake, staking FTM gives a 4% APY.

However, Avorak is used to stake and reward investors. The gated staking pools and incentives system used by Avorak could result in higher payouts compared to those offered by Fantom.

What is Fantom?

Fantom is an open-source, highly scalable, and decentralized platform for developing dApps. It relies on DAG’s networks of vertices and edges for data modeling and structuring, as opposed to blockchains, which are made up of blocks. Dr Ahn Byung founded the Fantom Foundation in 2018, and since then, the project has developed into one of the most popular blockchains for DeFi transactions.

Fantom Staking, FTM Token, and DeFi Suite

FTM, the native utility coin of Fantom, powers the whole Fantom blockchain ecosystem. The network employs FTM tokens for staking, governance, payments, and fees.

As of March 2021, 2.5 billion FTM coins were circulated out of a total of 3.175 billion. The remaining amount will be given out as prizes for staking Fantom.

FTM is a native mainnet coin that may be purchased, an ERC-20 token on the Ethereum platform and a BEP-2 token on the Binance platform.

By transferring their FTM to a Fantom wallet address, anyone can participate in Fantom staking with a minimum stake of 1 FTM. Additionally, a minimum of 3,125,000 FTM must be staked to run a validator node on Fantom’s permissionless network.

A typical staking strategy allows users to stake their FTM at any time with a validator node for a 4% annual percentage yield (APY) staking payout.

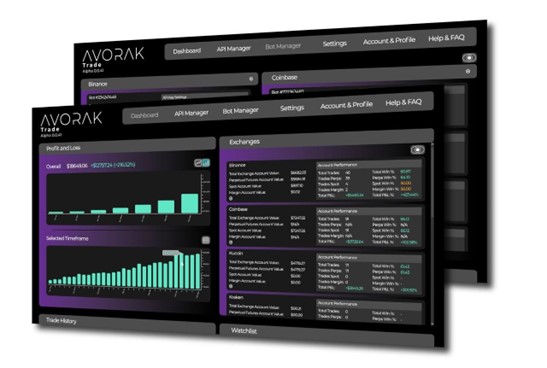

Why Avorak AI Could Make You More Money

Avorak has assigned a portion of the entire supply to primary locked staking pools for people investing long-term in raising their percentage hold of AVRK through three pools.

The pools include Diamond Pool: 1-year lock, 1.56 million token awards, and a maximum stake of 10.5 million tokens. If the staked maximum is reached, the minimum APR is 14.86%.

Platinum Pool: maximum staked token limit of 7.5 million, 6-month lock, and 340 000 token rewards allocation. The minimum APR equivalent is 9.07% if the staked maximum is reached.

Gold Pool: 3-month lock, 100,000 token reward allotment, and a 10,000,000 token staked cap. A minimum APR equivalent of 4.00% will be applied if the staked limit is hit. There won’t be any inflation relative to the overall maximum supply because the pools will be paid 2,000,000 tokens or 5%.

On launch day, deposits will be accepted at the pools, and nobody will be left out because 100% of the ICO supply can be staked.

Conclusion

Avorak’s gated staking pools and rewards mechanism have the potential to produce better yields. Investors can gradually raise their percentage ownership in AVRK by participating in the staking pools, which could result in higher returns.

The tier-based design and alluring annual percentage yield (APY) provided by Avorak’s pools offer stakers a chance to generate large returns on their investment.

For more information on Avorak AI:

Website: https://avorak.ai

Buy AVRK: https://invest.avorak.ai/register

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.