Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After 3 months of what can only be described as a DeFi mania in the $7.61 billion worth sector, the market finally came to a halt in September and is now recovering. The situation however is not grim at all as further market growth requires exactly what already happened, a healthy correction. Farmers can now prepare for the next cycle of yield farming and in this article, we will show you how to maximise your profits.

Yield farming is no easy task. It requires constant research, liquidity pool search, and even a bit of luck. Maximising your LP rewards requires you to dedicate even more of your time. Time is money and to help you save it we gathered all tips that an expert farmer should know.

For some, even grasping the basic concepts of yield farming and how it works can be difficult. However, we assure you that once you have mastered the fundamentals, nothing is stopping you from turning from an amateur into a pro. During the DeFi craze, the euphoric market movement lasted long enough for some investors to turn yield farming into a full-time income. All it takes to achieve that is knowledge, experience, and motivation to succeed.

In September 2020, developers keep launching new projects in hopes of becoming the next Uniswap, Aave, or Maker. With the inflow of developers, there is likewise similar demand from farmers who rush to be the first ones to farm on a project and earn more money than latecomers. With that in mind, let us start by familiarizing ourselves with reducing the ever-growing ETH gas fees.

Minimize ETH gas fees

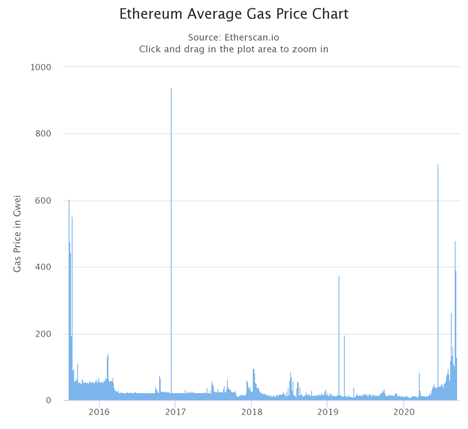

Gas fees have the highest impact on your yield farming profit compared to any other feature. Exorbitant ETH fees prevent farmers with smaller portfolios from participating while at the same time rewarding whales. Most times, fees only cost a fraction of your transaction at $10 on average. However, the situation radically changes when network activity reaches sky-high records. That time is exactly the moment when farmers make the most money.

Two weeks into September, gas prices range at 77 gwei according to EthStats. Only one week earlier when the DeFi market reached a new record, those same fees averaged at around 450 gwei. Dollar-wise, the average liquidity provider spent $40 for swapping tokens and even more for providing liquidity. Therefore, you must minimize the gas you spend on transactions.

Essentially, most yield farming protocols provide fixed gas fees that do not change depending on the value of your transactions. As we mentioned, this mechanism rewards whales and prevents smaller farmers from participating.

Data from EtherScan

On that account, it is important to look for projects that do exactly the opposite. DEX protocols such as AnySwap ensure true decentralization by making sure that everyone can be a liquidity provider. The significantly lower fee is made possible by using the Fusion blockchain network. The feature makes it the platform with the lowest gas fees.

Features for controlling Gas Fees

Some protocols aim to challenge high gas fees by setting a maximum fee amount. However, that is only helpful to a limited degree. While it may be useful to not pay more than $100 in fees alone, traders rightfully consider even $30 fees to be high.

Another plan developers currently undertake is to charge gas fees only two times. That is, when a farmer gets into an LP position and when he exits it. For now, this is a concept that requires a lot of development to come into realization due to its complexity. At the moment, farmers are forced to rely on themselves and avoid gas fees by choosing better protocols. Only 4 months into the DeFi boom, farmers have no special tools to lower fees on their own.

Be on the lookout for new projects

In yield farming, there are both micro and macro aspects. From a micro point of view searching for the most rewarding liquidity pools (LP) within a platform is your daily commitment if you want to receive the highest rewards possible.

If you are secluding yourself to one single project you must always follow updates. However, that is not generally recommended unless it is highly profitable at the moment. Updates from the team may come in the form of news feeds, Telegram or Discord groups, project websites, etc.

The number one method for staying updated with a project and knowing exactly how many people are interested or what features might increase yield rates is joining Discords or Telegrams. Traditionally, developer teams post updates more frequently and reveal more information compared to more official sources such as blogs. Therefore, if you are an active part of a yield farming project’s Discord you might be the first person to hear that the team plans to introduce a feature that could increase rewards by 20% or more.

Macro Aspect

On the other hand, a macro point of view is when you look for the most profitable yield farming project within the entire $7.6 billion DeFi ecosystem. Therefore, it is recommended that you surround yourself with DeFi information and stay on the lookout on various cryptocurrency platforms. If you have not already, the easiest way to stay up-to-date with crypto is to join Crypto Twitter, Telegram groups, and read from related news platforms.

But even that might not be enough, especially if the market is at a phase where things are moving fast. News and announcements come and go and on places like Twitter, they reach everyone after only 30 minutes.

Well, what other sources are there you might ask. For the extra vigilant farmers, we recommend that you start spending a bit more time on Medium. Medium is an online publishing platform where internet users can share their ideas. These ideas also include developer updates and even project announcements. You can keep track of new projects under crypto-related tags. These tags include crypto, cryptocurrency, blockchain, DeFi, yield farming, etc. On that account, you would be the first person to analyze a newly created yield farming protocol.

One easy trick that can help you easily keep track of important news with high social engagement is using news aggregators. However, for the sake of being the first one to catch the launch of a new platform, we recommend Twitter and Medium as the best sources due to better news recency.

Manage risk and secure high rewards

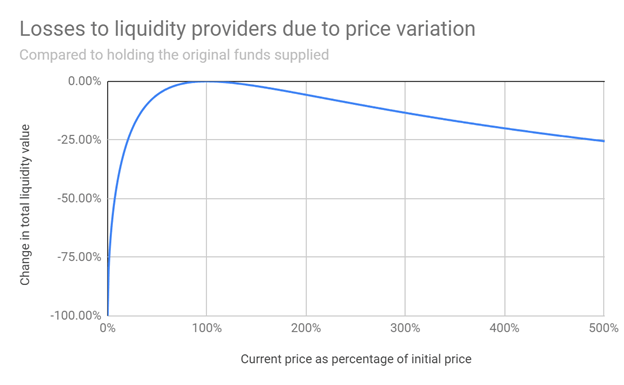

Last if not least, the traditional risk-reward ratio is important not only in trading but in yield farming as well. If you ask any professional farmer what his top priority is, he will mention impermanent losses. The concept is slightly difficult to explain as it is tied to multiple factors within the market but if you think outside the box it will come naturally.

In the plainest terms possible, impermanent loss is what happens when the asset you are farming loses or gains too much value. Yes, you can make less money even if the asset you once held increased in value.

A great example used to explain permanent loss is a stablecoin LP. If you were to contribute liquidity to an ETH/USDT LP at a set date where ETH costs $400 and ETH increases $50 in price, you will probably make less money than you would if you held the assets. The only situation in which this is not true is if not only the value of an asset rises but trading volume as well. This way, you make the same amount of money or even more as all the fees generated by an exchange go to your LP earnings.

It becomes even clearer if you use for example a situation where ETH loses its value. If one day Ether costs $100 or $200 less, you will lose money instead of earning it. Therefore it is highly important to manage your risk and keep track of market movements.

Securing better rewards

Some yield farming protocols and DEXs attempt to solve this issue by offering better reward distribution systems. On Uniswap all liquidity providers earn 0.3% on exchange fees. Other protocols may provide higher or even lower rewards. However, DEX protocols like AnySwap award their users with not only rewards on fees but earn passive income with the native ANY governance token as well. Therefore in high-risk situations, farmers would benefit from earning an additional token apart from their usual LP token and essentially negate impermanent loss.

While it would be perfect for a farmer to only participate in LPs when markets are stable, the risk-ratio is not high enough to warrant farming. When assets are skyrocketing, yield farmers are in the perfect position to benefit from high return rates. To maximize their profit during these times, we recommend that they keep in mind our tips and prevent losses.

Conclusion

Mastering the fundamentals is the first step towards being a successful yield farmer. Becoming a master in yield farming, however, requires you to know more than the average investor to stay ahead in the race. With our guide of yield farming tips, we explained the necessity to stay up to date, minimize gas fees, and control risk-reward ratios.

Technological limitations currently prevent farmers from having full control in maximizing profits and controlling factors such as ETH gas fees. However, an optimistic and motivated mind will always seek ways to better their position. As we learned, when liquidity pools are not rewarding enough farmers should ‘zoom out’ and search for other projects that provide better returns. In the same way, liquidity providers should constantly look for services that provide solutions to issues such as gas fees.

LP rewards can also be improved in more than one way. By searching for governance-focused yield farming protocols, farmers stand the chance to earn two kinds of passive income. One stream of money can come from the usual way, liquidity pools. However, protocols that truly reward their users will provide governance tokens as well. In that case, farmers maximize their profits by earning fees from LPs and selling their newly earned governance tokens. Better yet, long-term farmers can keep the tokens and have them appreciate in value. For those keen on governance, they can use the tokens to vote on major issues.

To conclude, the only real way to earn more profit is to constantly seek knowledge. To truly prepare for the next wave of DeFi craze and yield farming, the adept yield farmer will seek projects that truly aim to reward their users in a secure and decentralized manner.