Fintech companies have long been considered the most innovative part of the financial industry, with their fluid applications and easy-to-use user interfaces posing a significant challenge to the traditional banking experience.

However, in the blockchain industry, these innovative companies and their applications have struggled to keep up, and with DeFi ‘s rise to prominence, they are catching up.

What fintechs have yet to realize is that their new competitors are not traditional banks, but DeFi ‘s bankless experience, which gives users the control and opportunity they think they have when using the app.

DeFi subscribers can maintain absolute control over their assets while receiving superior returns with lower risk and higher returns than their traditional counterparties.

What is DeFi? What is the difference between centralized and decentralized? MiSon How to capture DeFi value and create excess profit? Read on

DeFi Development: The Next Generation Era in Finance

DeFi, or decentralized finance, is a futuristic approach to financial services. DeFi development refers to financial services built and run on blockchain technology, a technology that transforms financial services into decentralized services. Decentralized services are financial services that can be accessed by anyone with an Internet connection without relying on traditional financial services such as intermediaries, banks, and agents.

In other words, DeFi is evolving to create open source, transparent, license-free financial services that You can control all financial transactions and services through a decentralized application.

DeFi has the benefits of accessibility, security, efficiency and more. With DeFi, anyone can access financial services and products without an intermediary, making it more inclusive and transparent.

The difference between centralized and decentralized finance

Decentralized finance is a complete departure from the centralized and traditional approach to financial services and banking.

Centralized Finance ( CeFi )

CeFi refers to the traditional financial system in which financial institutions such as banks act as intermediaries and control the movement of money between people. This type of finance is controlled and managed by intermediaries such as banks, financial agents, companies, and government authorities. Every transaction and every process includes third-party permission. Without the permission of the intermediary, the transaction is not possible. And you must pay fees, transaction fees and brokerage fees for each transaction.

Decentralized Finance

DeFi development is a financial service built on blockchain technology that enables direct transactions without intermediaries and licenses. DeFi consists of smart contracts that automate the flow of financial activities and processes such as lending, trading, and investing.

Decentralized finance is an ecosystem that provides decentralized banking and financial services to send, receive, borrow, deposit or exchange financial assets without the help of intermediaries such as banks, brokers or trading agents. DeFi was developed with a focus on transparency and ease of access, as well as security.

The growth of DeFi is an exciting and positive trend for the financial industry. With the World Bank estimating that 1.7 billion people are unbanked as of 2017, it will be much easier for these people to access financial services under the DeFi model, which represents a campaign to introduce borderless, uncensored and accessible financial products.

As trust issues in traditional finance continue to emerge and yields stagnate, the trend of massive capital flows to DeFi will only continue.

MiSon captures the value of DeFi

The rise of DEX abounds in the decentralized investment space. From the beginning of Uniswap and SushiSwap to BSC, the DeFi world ecosystem is flourishing day by day.

Liquidity has become the primary distinctive feature of DEX, and MiSon is undoubtedly the most promising protocol regarding the liquidity aggregation profit track.

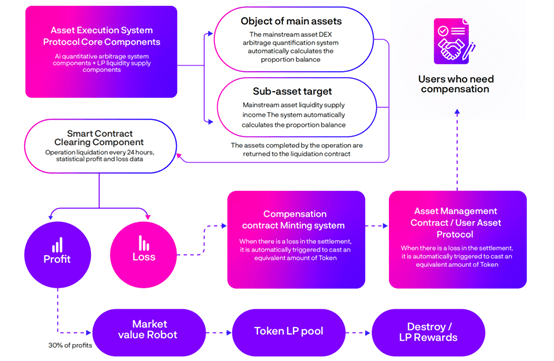

The MiSon protocol’s radar component makes it easy to capture DeFi quality projects, and its DEX+AI order flow arbitrage module easily addresses the lack of liquidity and high slippage in DeFi lending protocols.

And DeFi is the only project on the EVM component with multi-protocol aggregated returns, supporting the top 15 major global stablecoin lending, and automatically capturing arbitrage opportunities for lossless returns through decentralized lending protocols such as Aave and Compound.

For liquidity arbitrage alone, or for DeFi, the expectation of excess returns is not met. The MiSon protocol is like a central nervous system that can be switched freely to improve the utilization rate of capital turnover is the core, which improves the efficiency and greatly increases the yield.

The agreed profit generation is divided into two parts.

1) Lending protocol Liquidity arbitrage

2) DEX + Ai order flow arbitrage

3) 30%+ combined return

MiSon’s core value proposition has five points.

1)Improve capital efficiency

2)Protocol retention ratio

3) Protocol profit support

4) Insurance minting protocol

5) Token Ecological Empowerment

Summary

In any case, the decentralized financial DeFi is Definitely worth watching. will MiSon surprise us? We’ll see.

To learn more about MiSon, Visit:

MiSon Official Website: http://mison.finance/#/

Twitter: https://twitter.com/MisonProtocol

Instagram: https://www.instagram.com/MiSonProtocol/

Telegram chat: https://t.me/MiSonProtocolio

Telegram channel: https://t.me/MiSonProtocol

Linktree: https://linktr.ee/misonprotocol

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.