Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Changpeng Zhao, founder and CEO of Binance, the world’s leading crypto exchange, believes that authorities should provide clear rules for crypto and recognize that the industry is different from traditional finance.

On April 12, Zhao spoke at the Web3 Festival in Hong Kong where he said that the lack of regulation is detrimental. “Having bad restrictive regulations is better than that,” he said.

He added that regulatory authorities should understand the specifics of crypto. “There’s also a very natural tendency to borrow traditional financial [regulations] to just apply to crypto. Crypto is different from banks,” he commented.

Compliance is not everything

Binance has followed the KYC/AML rules in their entirety, but this has not protected the exchange from a regulatory crackdown. The Commodities Futures Trading Commission (CFTC) has lodged a suit against Binance and its CEO and accused Binance of violating derivatives rules by offering U.S. persons to trade financial instruments involving digital assets without holding a license.

Last week, the Australian Securities and Investments Commission (ASIC) canceled Binance Australia’s derivatives license. A day earlier, it received a cancellation request from Binance.

Binance is not the only exchange that has suffered from a regulatory crackdown. Ripple has been in litigation with the U.S. Securities and Exchange Commission (SEC) since the end of 2020. Many major market participants find themselves being targeted by regulators in one way or another. For example, in March 2023, the SEC filed a lawsuit against Justin Sun, the founder of TRON. He was charged with the unregistered offer and sale of crypto asset securities as well as fraud and market manipulation.

In this environment, exchanges and other platforms will focus on surviving, often at the expense of small investors. In order not to attract even more attention from regulators, they will shut down the accounts of their customers for even the slightest mistake.

Protect your assets with Mixer.Money

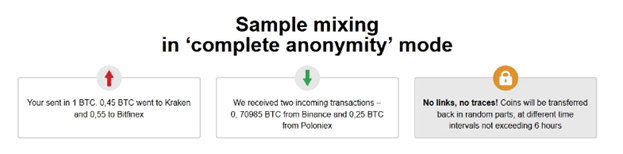

The ‘Complete anonymity’ mode was designed to ensure thorough mixing of bitcoins. After coins are deposited into the pre-mixer, they are sent to our investors at an exchange. The transactions are organized randomly and are almost impossible to trace.

We provide coins from verified exchange users. In fact, the ‘Complete Anonymity’ mode provides you with bitcoins which have already been validated by exchanges. The investors who receive your coins and the ones who provide coins to customers are not the same people. The algorithms continuously split, mix, and send bitcoins to different addresses. The delay is adapted to protect assets from quantitative analysis. The transit wallets are selected in such a way as to send the same amount back without change, which also protects transactions from being tracked.

We do not have authentication or registration, and do not store user data. Our customers do not even have an identification code assigned to them. All issues are handled by means of a PGP signature. You can use a TOR mirror for bitcoin mixing. It disables the calculator and transaction detector since they can’t be implemented without Javascript, and this does not reduce anonymity.