Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

O3 Interchange, the first ever cross-chain DEX, was officially released. As a continuous innovator of cross-chain swaps, O3 Labs has upgraded their cross-chain mechanism by aggregating multiple DEXs on the source chain and destination chain and introducing the NPAPs liquidity pool mechanism, enhancing the interoperability of protocols between Web3 networks.

O3 Interchange has created an optimal user experience with its aggregated liquidity.

Not just a bridge!

Currently, most of the Cross-Chain swaps are designed for the same assets. Although the V1 version of O3 Swap already enabled exchange between different assets, the choices of assets on the destination chain were relatively limited. As a result, O3 Interchange aggregates multiple DEXs on the source chains and the destination chains, which breaks the barriers between various networks and brings true interoperability to our cross-chain DEX.

Under the new mechanism, O3 Interchange can achieve both on-chain and cross-chain swaps quickly. Users can exchange tokens from any supported chain to another token freely. The one-click exchange of assets between multiple chains eliminates the need to reserve a gas fee for each chain.

O3 Interchange acts as the connection point among different networks. Its biggest function is to avoid and solve traffic jams, enabling DeFi users to visit the Web 3.0 world quickly, efficiently and economically from one entry point. When users initiate a cross-chain swap, O3 aggregates the liquidity from different DEXs to find the most optimal route. O3 Interchange provides users a DEX-like experience.

Trustless and Based on AMMs

O3 Swap is the first-ever cross-chain DEX protocol in the industry. We allow for exchanges of native tokens across chains thanks to our cross-chain liquidity pools.

O3 Interchange has introduced two-way capital pools through an NPAP liquidity pool mechanism (nativeToken & peggedToken AMM Pools). The NPAPs are similar to Curve’s AMM pools. In short, it is an outside liquidity pool where users provide liquidity as LP. The process is transparent and rewards are given in $O3.

For example, users can deposit token A, pA or A+pA to earn profits in O3. In this case, peggedTokens can be used to provide liquidity and act as an important intermediary cross-chain asset within the O3 Interchange cross-chain system.

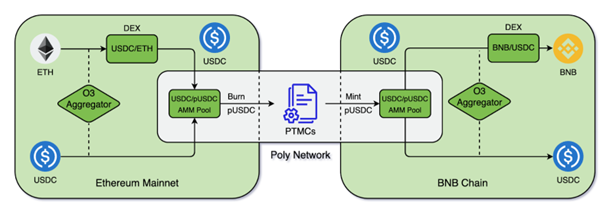

Swap ETH on Ethereum Chain to BNB on BNB Chain

First, O3 Interchange aggregator will aggregate DEX liquidity pools on Ethereum and BNB Chain and swap ETH into USDC automatically.

Then, USDC is swapped into pUSDC on ETH through NPAPs and pUSDC will be burned on ETH after the PTMC (Pegged Token Management Contract) is approved. Consequently, the same amount of pUSDC on BNB chain will be created after PTMC is approved on the target chain.

Then, pUSD is swapped into USDC through NPAPs on BNB.

BNB is transferred to the address on the target Chain after USDC is swapped into BNB through the DEX liquidity pool on the target Chain. Thus, a swift and cost-efficient cross-chain swap is completed.

It can be concluded from the above example that pUSDC is only acting as an cross-chain medium. It allows users to experience a one-click asset-swap between different chains because the trustless process is automated, and no assets-related transfer, top-up and withdrawal of any form are needed.

O3 Interchange puts the minted pToken, in this case pUSDC, in the liquidity pools (Hub), which is the only place that users need to interact with pegged token. A liquidity entry chain is provided to each native token, meaning all initial pegged Tokens minted from the native token are deposited through its respective liquidity entry chain. Thus, the total amount of pegged tokens among all chains on O3 Interchange is decided by the native token that users deposited with its corresponding liquidity entry chain. The quantity of pegged token mints is firmly controlled by the users.

The NPAPs Liquidity pool not only increases the asset utilization rate but also provides attractive arbitrage opportunities. Market makers and profit-driven liquidity will balance liquidity pools and enhance trade volume. This incentivization fully reflects the value capture capability of O3 Interchange. Day-to-day users don’t need to worry about liquidity and will be more confident when staking into liquidity pools.

Execution of Interoperability

Admittedly, there are still lots of bottlenecks and the technology is constantly evolving. Despite the classic triangle dilemma of decentralization, security and accessibility, O3 Interchange introduces the 4th dimension to cross-chain swaps, liquidity.

Asset utilization efficiency is greatly improved by AMMs which aggregate fragmented liquidity. With O3 Interchange, users can swap native tokens on one chain to native tokens on any other chain. Interchange is interoperable and allows users to experience a fast and low-cost cross-chain swap.

Additionally, the O3 team will package the core code into an SDK and open source to all builders in the ecosystem. Builders can integrate the cross-chain protocol of O3 Interchange into their own DAPPs, allowing the whole crypto ecosystem to interact with our product and to gradually capture more value.

Community Governance and Economic Model Innovation

Transaction fees will be 0 until June 19th, which means users only need to pay gas for cross-chain swaps. More importantly, O3 Labs will buy back the circulating O3 in the market periodically with the earned transaction fees. O3 Labs will use 80% of the fees we earn to buy-back and burn O3, which means that O3 is entering a deflation era. The next round of airdrops is being discussed and we encourage all users to take full advantage of O3 Interchange during the promotional period.

O3 tokens can be earned by staking LPs. Users can obtain LP by providing liquidity on different chains as LP providers. O3 Interchange is now supporting cross-chain swaps for mainstream assets on Ethereum, BNB Chain, Polygon, Arbitrum, Fantom, Gnosis and Optimism.

O3 Labs is building an O3 DAO for governance. O3 owners can obtain Community Governance tokens by staking after O3 DAO is live. Users can make proposals for the Community and the DAO will vote on them.

The only way to propose and vote is to become an O3 holder, which allows you to earn the governance token $O3 DAO (DAO3) by staking O3.

Conclusion

O3 Labs believes that accessible, interoperable and innovative technology always triumphs. O3 Interchange is innovating with the interoperability between different Internet protocols, especially in the DeFi 2.0 era.

This cross-chain field has seen explosive growth and the upgrades from O3 Labs will work as a catalyst to accelerate the development of the whole market.