Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

OMS is integrating several Chainlink decentralised services to support the OMS ecosystem. The first integrations will involve the use of Chainlink Price Feeds to access reference rates on various fiat currencies against USD and Chainlink Keepers to automatically update their reference rates stored on-chain when they deviate from the latest reference rate.

Being the industry leader in decentralised oracle solutions, Chainlink provides OMS with a way to securely and reliably get accurate external data feeds on-chain, as well as to automate key smart contract functions in a verifiable and timely manner, leading to truly decentralised and trusted OMS products. Chainlink has demonstrated historical reliability during heavy market volatility and network congestion over extensive periods of time, making it the top and only choice for servicing these off-chain needs.

OMS Supply Adjustment using Chainlink Price Feeds

OMS seeks to introduce a suite of products to the DeFi ecosystem that virtualise real-world assets and allow users to predict their rise or fall in price. OMS is an Ethereum-based elastic supply token designed to rebase (inflate/deflate) its supply by automatically distributing it to users in a manner that’s proportional to the percentage of supply they hold. The rebase mechanism is designed to adjust the supply based on specific USD-based price thresholds.

The OMS token is pegged to USD, however, the purchasing power strength of USD changes over time based on prevailing economic conditions. Subsequently, OMS needs to consistently assess the relative strength of the USD at given points in time and then adjust the on-chain reference rate used to calculate the OMS price adjustment thresholds.

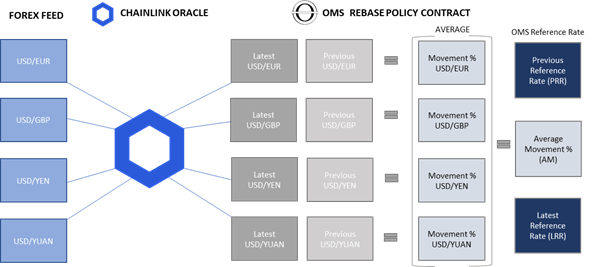

OMS determines the purchasing power strength of USD by comparing its value against leading currencies. The OMS Reference Rate (RR) is adjusted based on the relative strength of the USD against other global currencies, namely the EURO, GBP, YEN, and YUAN. Relative strength is measured as a moving average of monthly exchange rate movements for the USD against these currencies.

This is where the Chainlink Price Feeds integration is required. OMS queries the USD-denominated Chainlink Price Feeds for the EURO, GBP, YEN, and YUAN, and then records the values in the OMS policy contract. The average movement in each pair is then calculated, with the aggregated value used to update the OMS Reference Rate stored on-chain.

OMS selected Chainlink Price Feeds because they reflect extensive volume-adjusted market coverage across all trading environments. The Price Feeds are operated by a decentralised network of secure node operators, that aggregate data from numerous premium data sources to ensure accuracy, availability, and tamper-proofness.

Automation using Chainlink Keepers

Chainlink Keepers offer a step-change in the automation of on-chain contract modifications, replacing the off-chain adjustments currently used by the OMS protocol.

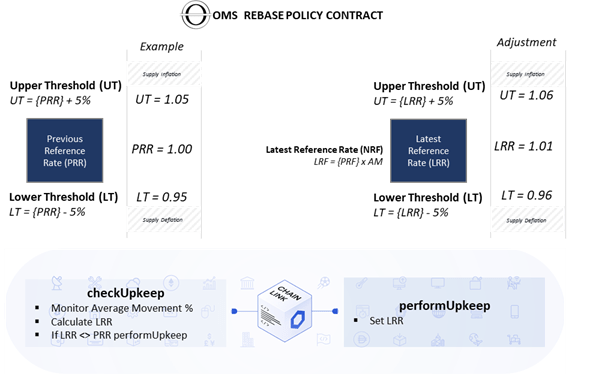

- OMS leverages the Chainlink Keepers checkUpkeep function to check for deviations in the latest reference rate (LRR) compared to the previous reference rate (PRR).

- If an adjustment is required to the OMS policy (LRR and PRR deviate), the performUpkeep function is automatically triggered to adjust the OMS Reference Rate dynamically.

The reliability of external data sources is a key element of the OMS protocol design and Chainlink offers a suite of products that offer OMS the opportunity to leverage a trusted, secure source of price data. In addition, the Chainlink Keepers integration allows OMS to automate the reference rate adjustment processes on-chain, adding further security to the OMS elastic supply mechanism and removing human intervention. This ensures rebases are always relying on accurate data when performing rebases. Chainlink Keepers was our top choice because it’s decentralised, consists of highly reliable node operators, allows for trustless on-chain verification, and is optimised for low-costs.

The reliability of external data sources is a key element of the OMS protocol design and Chainlink offers a suite of products that offer OMS the opportunity to leverage a trusted, secure source of price data. In addition, the Chainlink Keepers integration allows OMS to automate the reference rate adjustment processes on-chain, adding further security to the OMS elastic supply mechanism and removing human intervention. This ensures rebases are always relying on accurate data when performing rebases. Chainlink Keepers was our top choice because it’s decentralised, consists of highly reliable node operators, allows for trustless on-chain verification, and is optimised for low-costs.

The emergence of Elastic Supply mechanisms in decentralised finance has provided a unique opportunity to create new monetary systems that improve upon fixed supply currencies such as Bitcoin. However, since they are typically pegged to a specific asset, such as USD, fluctuations in the value of the underlying assets must be factored into protocol design. The OMS Chainlink integration provides a reusable mechanism to adjust supply thresholds dynamically without off-chain intervention.

Future Integrations

Future Chainlink integrations will centre around other OMS products and services including the OMS Asset Index (AI) platform, which includes:

- Multi-asset price feeds—integrate additional Chainlink Price Feeds to access markets in Commodities and Forex.

- On-chain management of leveraged trading positions—make use of Chainlink Keepers to monitor changes in margins and automate actions based on market conditions.

- Automated reserve allocation to maximise yields—utilise Chainlink Keepers to monitor and aggregate yields based on a risk/return calculation.

Quote

“We were looking for an oracle solution that would work across multiple elements of the OMS ecosystem and working with Chainlink for our oracle and transactional requirements made perfect sense due to their long-standing reputation for reliability and security. The integration process so far has been smooth and engaging and we will continue advancing our integration efforts across all aspects of our protocols. As a relatively new project, we appreciate the fact that the Chainlink Labs team have gone out of their way to guide us through the integration process.” — Pravin Bechar, Co-Founder of OMS

About OMS

Decentralized Finance (DeFi) has rapidly emerged as a means to allow anyone global access to markets that would not be typically available in traditional finance systems. Built on immutable blockchain technology, DeFi has enabled a global audience to access a range of financial instruments including lending, borrowing, and decentralized trading that have previously been restricted by jurisdiction or locality. OMS seeks to add to the DeFi ecosystem by introducing an Ethereum based suite of products that allow for the virtualisation of real-world assets into crypto derivatives.

The first part of the OMS ecosystem – the fully audited elastic supply OMS token was released on 6th June and listed on the Uniswap exchange.

OMS has already reached several milestones, including a new staking program called the Cascade which has one of the highest yield returns in the DeFi ecosystem. But there is so much more in progress in the coming months…

To learn more about Open Monetary System (OMS) and stay up to date with the project’s development, follow us on our official communication channels.

Website: https://oms.finance

Telegram: https://t.me/omsfinance

Twitter: https://twitter.com/financeoms

Medium: https://medium.com/oms-finance

Facebook: https://www.facebook.com/oms.finance.team