Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Today Solana is the 5th largest cryptocurrency on planet Earth and the 4th largest non-stablecoin token by market capitalization. It’s worth some $77 billion in May 2024– going by the average SOL price on crypto exchanges.So it’s catching up to Ethereum fast.

Is Solana the Ethereum killer that crypto investors have been searching for?

A year ago Solana was the 10th largest crypto by market cap, worth $7.7 billion for a 10x in price in just one year. Around this time in the last Bitcoin supercycle, after the BTC halving in May 2020, Solana had just launched in March and was not even among the top 1,000 cryptocurrencies.

Meanwhile, Ethereum grew from a market cap in May 2023 of $217 billion to $371 billion at market prices today for a 71% increase in price over the 12-month period. DeFi (decentralized finance) altcoin investors want to know:

Will Solana eventually flip Ethereum like it is about to do with BNB Coin (Binance token) for the second time this year?

It’s entirely possible, but Ethereum still has a $300 billion head start on Solana and seriously epic amounts of untapped potential just waiting to be unlocked when corporate giants in the finance, legal, and insurance industries begin to take it seriously and use its smart contract tech to carry out decentralized finance operations on the blockchain.

But as far as the competition between Ethereum and Solana goes, there’s still the question of Solana’s higher throughput, faster transaction speed, and lower fees.

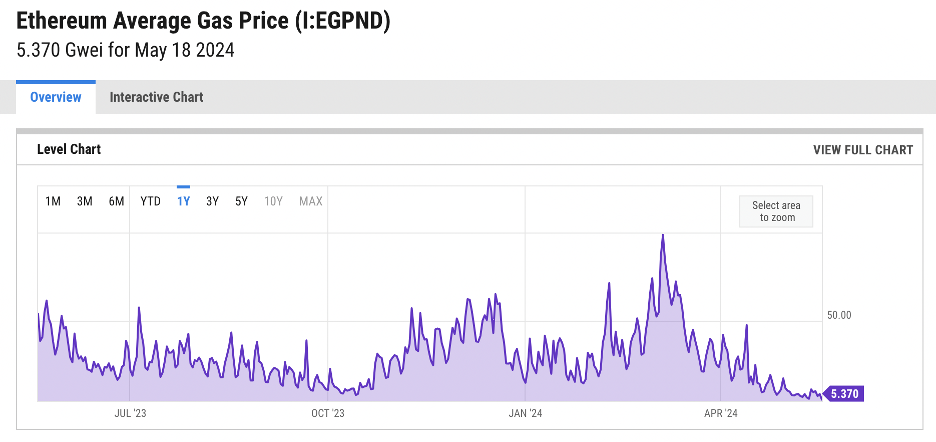

Gas on Ethereum sure isn’t cheap. Crypto investors who like new projects have been piling up presale tokens like Kai Cat Coin ($KAI) before ETH fees claw back up from historic lows.

Is Solana Better Than Ethereum?

In a recent speed test conducted by CoinGecko, Solana ranked the fastest among cryptocurrency blockchains, handling over 1,000x transactions per second (tps). Ethereum was faster than Bitcoin (10 tps), but much slower than Solana, with 22 (tps).

For comparison, Visa says it can handle 65,000 transactions per second.

According to CoinGecko, Solana has a theoretical maximum to match Visa’s of 65,000 per second: “Despite ranking as the fastest blockchain, Solana has still only achieved 1.6% of its theoretical maximum speed of 65,000 TPS.”

So is Solana better than Ethereum?

Ethereum’s fees are no joke. That’s why gem hunters do their research on which memes are trending (like PopCat in Q1) to justify paying the Ether network’s higher gas fees and make sure their next altcoin gem is a winner like Kai Cat.

Solana vs. Ethereum Long Term

“Ethereum has some of the strongest persistent demand drivers in crypto, and retains unique advantages to its scaling roadmap.” (Coinbase, May 14)

At the speeds clocked by CoinGecko, Solana can handle 91 million transactions in a day and Ethereum can handle 1.9 million in a day. But it’s not necessarily the fastest network with the most throughput that will deliver the most value in the Web3 industry.

Bitcoin is among the slowest and no altcoin has caught up to it or even come close in the history of the blockchain sector. The wait time and fees to move money on the BTC network is a massive part of its appeal and serves the brutally deflationary ethos and design of the currency.

Participants don’t lock money into that chain without expecting to leave it there and HODL (hold on for dear life) instead of spending it. In the online realm of infinitely improving abundance and speed, it’s the coin’s digital scarcity and illiquidity that make it such a valuable Internet asset.

Ethereum is much the same in its economic design, but the one pretty important bonus feature: Its tokens can be customized and anyone can use the network to issue tokens with any features and benefits they can dream up for a blockchain engineer to program.

The higher ante to participate is a feature that attracts big, moneyed players in decentralized finance and every industry Web3 can serve, like decentralized law and insurance. They like that it’s more expensive to use Ethereum because they understand that it makes the network more secure. Whale-sized cyber exploits might pay on a cheap blockchain, but not on a pricey one.

Meanwhile, token presale buyers get to reap the benefits of Ethereum’s first in class security. Investors can also stake tokens to fish KAI Coin’s Staking Pond– so the KAI economy will hold its value on the market when it goes to exchange.

Stay Connected With KAI On Socials: X | Telegram

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.