Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

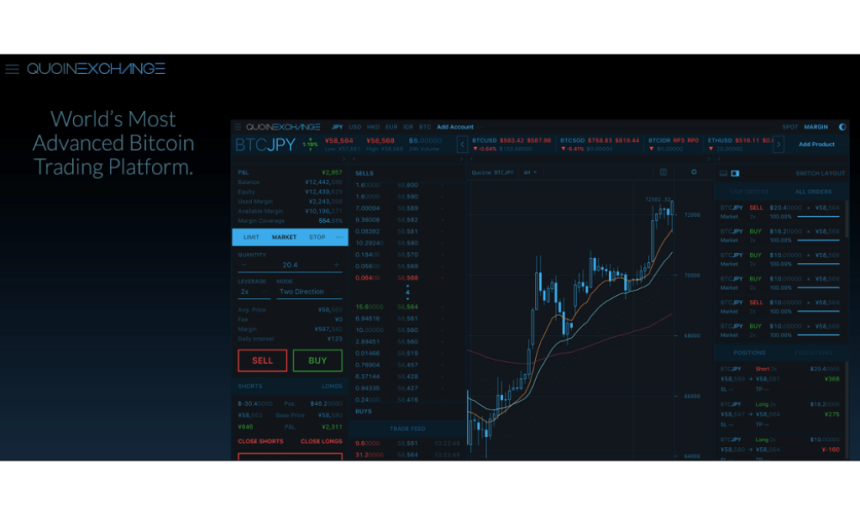

September 29, 2016 Tokyo, Japan – QUOINE, the cryptocurrency spot, margin and futures exchange has announced several key updates to its platform following the successful $20 million funding round. These new updates are part of the company’s continuous efforts to create the most advanced digital currency exchange platform on the market.

The two-year-old platform, QUOINE has registered an explosive growth since its launch in 2014. It is now one of the top cryptocurrency exchanges in the world. Its world-class matching engine is capable of processing a million transactions per second. It is also among the very few exchanges on the internet that support up to 25X leverage and asset lending. In addition to the recently introduced futures trading, the platform’s offering includes market, limit, stop, trailing stop and TWAP (Time-Weighted Average Price) orders.

The latest additions on QUOINE platform includes;

New Dashboard: A result of constant customer interaction and feedback process, QUOINE has completely overhauled its trading platform to offer a new look and feel. In the process, the platform has retained all advanced features, charting tools and trade options while making it much easier to use with a clearer format. The feature rich trading platform is sure to be appreciated by sophisticated traders.

Mobile Apps: The long awaited mobile application for iOS and Android platforms are now available on Apple App Store and Google Play Store respectively. The mobile apps follow the same design cues as the refreshed website dashboard. These fully featured, easy-to-use applications make it easier for users to trade on-the-go from their mobile devices.

“Our team has been working tirelessly to bring these exciting updates to our continually growing customer base, and it shows in these new releases. I can’t wait for our users to experience them first hand, and I’m sure our users will use our platform more as a direct result,”

Said Mike Kayamori, CEO of QUOINE. He added,

“Releasing our app allows a whole new audience to enjoy our zero trading fees since smartphones are becoming the primary device for so many people nowadays,”

About QUOINE

Established in 2014, QUOINE customers have taken advantage of the exchange’s powerful graphing tools and trading options on its feature-rich interface to benefit from price movements in both a rising and a falling market. QUOINE’s team consists of banking professionals with extensive experience in financial products, including fixed income, currencies, commodities, equity, and derivatives, as well as specific verticals such as Trading Systems, Forex Platforms, Quant Development, Operational Risk & Controls, Financial Risk Management, IT Security, Web/Mobile development & design, Quality Assurance, Regulatory, and others.

About The Founders

Mike Kayamori

Mike is QUOINE’s Co-Founder & CEO, following a career spanning 20 years where he held senior roles at Mitsubishi Corporation, Globespan Capital Partners, and Softbank Group. Having graduated with a Bachelor of Arts in Law from University of Tokyo before going on to complete an MBA at Harvard, Mike brings extensive experience encompassing Business, Management, and Investment within the technology and telecommunication sectors.

Mario Gomez Lozada

As QUOINE’s Co-Founder, CTO and President of Product, Mario has helped shape the trading engine and platform functionality from day one. Following a Bachelor and a Master of Science degree in Computer Science from University of Kansas, Mario has had a career in Investment Banking IT spanning 15 years culminated in senior positions, including CTO of Pacific Rim Fixed Income Currencies & Commodities for Merrill Lynch Japan, as well as CTO of Fixed Income, Currencies & Commodities Asia, and CIO Japan for Credit Suisse.

Learn more about QUOINE at – https://www.quoine.com

Media Contact

Contact Name: Eddie Chng

Contact Phone: +6593881892

Contact Email: eddie@quoine.com

Location: Tokyo, Japan

QUOINE is the source of this content. Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest.