Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Why is it so difficult for new tokens to attract liquidity? Attracting liquidity requires earning the trust of investors. But, the crypto market has had its fair share of rug pulls, with developers removing all coins from the liquidity pool or early investors selling off their entire holdings to book profits. In either case, retail investors suffer. From 2021 to July 2024, over $2 billion was lost to crypto hacks and rug pulls. Reputed names like Mt. Gox contributed to this figure.

While this number has the lion’s share of scam tokens, a lot of genuine projects with solid fundamentals also go down the same route due to poor launch strategy or flawed TGE roadmap.

The Flaws In Launch and Fundraising: What makes new projects prone to rug pulls and pump and dumps?

Launchpads are the go-to route for new projects to enter DeFi (decentralized finance). These launchpads give new projects the required push by connecting them with early investors. However, these early investors have an unfair advantage that they can exploit during TGEs (token generation events).

Early investors tend to mass-sell during TGEs because:

- PoS-based chains rely on locked volume to generate liquidity. This requires early investors to lock in their assets for a certain time period, with the asset growing. This prompts the investors to sell their bags as soon as the token hits the market, removing the liquidity on day 1

- Once a token is launched on a launchpad, users must find a suitable platform to list the token for trading. This process can be inefficient, consuming both time and capital. Listing on a platform with limited users could lead to insufficient liquidity, making it difficult for early investors to cash out. This prompts them to mass sell at the first available opportunity. And who is the exit liquidity? Retail investors.

Liquidity Is The Casualty

With complex UX, increased entry barriers, and hundreds of non-interoperable chains already leading to underutilized capital, rug pulls and mass sell-offs create another hurdle for creators of new token economies. What follows a rug pull event is distrust, panic, and skepticism.

Here’s how a rug pull event affects the market in general and a project seeking liquidity in particular:

- Erosion of Trust

Investor Skepticism: After a rug pull, investors become wary of new projects, fearing they might also be scams. This skepticism extends beyond the projects directly involved, creating a general mistrust in the entire market.

Reputation Damage: The crypto market as a whole can suffer reputational damage, as new and existing investors may associate it with high-risk and fraudulent activities.

- Restricted Liquidity

Hesitant Investors: As trust diminishes, investors become more cautious about committing their funds to new projects. This hesitation results in lower liquidity, as fewer people are willing to buy and sell tokens.

Concentration of Capital: Investors may prefer to keep their funds in well-established tokens with lower perceived risk, rather than diversifying into newer projects. This concentration further restricts liquidity for new tokens.

- Barriers to Market Growth

Reduced Participation: The fear of rug pulls can deter potential new users from entering the market. People who might otherwise explore crypto investments may choose to stay away, perceiving the market as too risky.

Lower Fresh Volume: With fewer new users and reduced capital flow, the market sees less fresh volume. This stagnation limits the overall growth and dynamism of the market, as fewer trades and transactions occur.

What DeFi needs is a more effective liquidity generation model, with a level playing field at TGE and incentivization of early support to new projects.

Enter Honeypot Finance

Honeypot Finance is a community-driven DeFi Hub on Berachain that brings together a unique AMM model with a community-led launchpad and DEX. For the first time, Honeypot is developing a launchpad specifically focused on DEXs. This innovative approach integrates Automated Market Maker (AMM) functionality with the token launch process, directly addressing the liquidity challenge by ensuring that new tokens have immediate access to deep liquidity pools upon launch.

It flips the launchpad-driven locked volume method with the supplied volume method. Honeypot creates a level playing field by eliminating pre-sales for liquidity gathering. At the forefront of the fight against rug pulls are Honeypot’s Dreampad and the FTO (fair token offering) model.

FTO: The Anti-Rugpull Economics

FTO (fair token offering) is a mechanism designed by Honeypot Finance to help new projects issue their tokens. Here’s how it promotes long-term holding, i.e. supplier volume:

- FTO involves the creation of a 100% deep liquidity pool for instant trading. While this enables trading from day 1, there are no pre-minted tokens in the market. It rules out pump or dump by early investors since there’s nothing like early access to the token.

- While the team behind the project can sell the LP tokens for further development, this does not lead to a shark slump in the token’s price. This is because removing liquidity is only allowed in balanced proportions according to constant k. Meaning even if the team decides to sell some tokens, it won’t lead to a decline in the token’s price.

- Liquidity providers are eligible for a share of transaction fees in accordance with their contribution. Besides, they also earn $BGT emissions from PoL, unlocking access to further monetization opportunities through the Flywheel Model.

The Flywheel Model

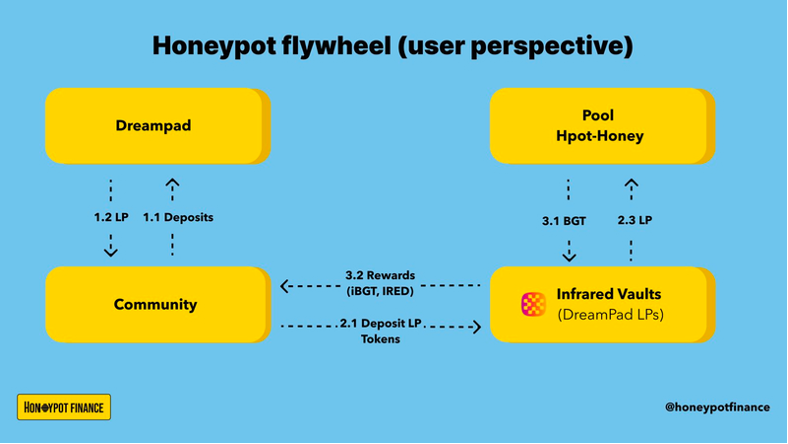

FTO unlocks additional usage for $BGT by integrating it into Honeypot’s Flywheel model. Here’s how:

- $BGT miners and delegators to the BeeHive node (Honeypot Finance’s node) will receive $HPOT (the governance token of Honeypot) as bribes.

- The bribe mechanism is directly linked to voting rights, boosting incentives for $HPOT and $Honey token pools.

- In return, $HPOT holders can collect $BGT profits by participating in PoL mining.

With ever-increasing incentives for providing liquidity, early investors are unlikely to dump their holdings at the first available opportunity.

Final Word

As long as a token sale through traditional launchpads remains the go-to mechanism for liquidity gathering, the risk of mass dump by early investors will persist. Honeypot Finance’s FTO creates a 100% deep liquidity pool while ruling out the traditional practice of pushing pre-minted tokens in the market. It also incentivizes contributions by early investors in the form of $BGT. Finally, it has an anti-dumping burn mechanism to tackle volatility and create trust in the market. Simply put, FTO maximizes early investment benefits for new and old users alike, making mass sell-offs a less attractive option.

About Honeypot

Honeypot Finance is creating a DeFi Hub on Berachain that’s run by its community. At its core, Honeypot Finance is building a suite of apps like a launchpad and a decentralized exchange (DEX) using a special kind of automated market maker (AMM) model to initiate a new narrative of Fair Token Offering acting as a accelerator for Berachain’s Proof-of-Liquidity.

By putting the community in the driver’s seat, Honeypot is aiming to build something that can keep growing and benefiting its users for the long haul.

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.