Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As global financial markets turn more and more uncertain, a search for stable and value accretive assets is underway again. Precious stones look like the most suitable candidate due to many reasons: they are rare, hard to process and, most importantly, see counter-cycle demand and get even more investors’ attention during economic downturns. We in D1 Coin possess a deep knowledge of the market and equally deep expertise in investment field; we are glad to have this opportunity to share our knowledge with you.

While many investors turn their head to gold and silver, they tend to forget precious metals’ best friend, precious stones.

Diamonds are the first stone that comes to mind when thinking of what to give that special someone and no engagement ring or tennis bracelet would be complete without these beautiful stones. Rare, vibrant, and seemingly catching fire: diamonds are the world’s most precious stone.

However, when it comes to investing in diamonds, many investors simply don’t know where or how to start. Today, we want to give you insight about what the diamond markets are doing, how diamonds are perceived as a stable store of value, and why you should consider owning diamonds in your investment portfolio.

First, let’s clear the air on one concern that many investors face when considering buying diamonds. Just how rare are they? Diamonds as a material, in its rough natural form, is surprisingly more common than people think. Diamond drill bits, files, saws, and grinders can all be purchased from the hardware store down the road. This drives the imprecise belief that diamond gemstones are common and we just grind up extras for industrial use, but that couldn’t be further from the truth…

What many don’t realize is that up to 80% of the rare diamond deposits pulled from the ground are only suitable for industrial use. They are simply unfit to make the scintillating gems you see adorning decorations and jewelry, no matter the skill of the expert craftsman cutting them.

Only 20% of diamonds can be considered high enough quality to produce a gem and drastically less are graded high enough to qualify as investments.

With the high cost of entry for decently sized, investment grade purchases reaching the tens of thousands of dollars, the diamond markets themselves can be difficult to break into as well. This bars many retail investors, who may already be nervous about market conditions, from even considering an investment. These investors with less experience in the diamond market won’t want to risk such a high amount of capital on a single purchase that they aren’t completely confident in.

Part of the issue hampering the diamond market’s ability to flourish is the lack of liquidity. One of the biggest benefits of a stable or safe harbor investment is the ability to liquidate it for cash and this is what makes precious metals so appealing. Diamonds, however, are more difficult to sell and move quickly.

Pricing varies widely between buyers and sellers, and it’s difficult to nail down the value of any natural diamond; each is a unique treasure and has to be graded accordingly. This creates lower liquidity in diamond markets and, without a proper index, it becomes difficult to accurately nail down how the market for diamonds is behaving.

Enter IDEX, the International Diamond Exchange:

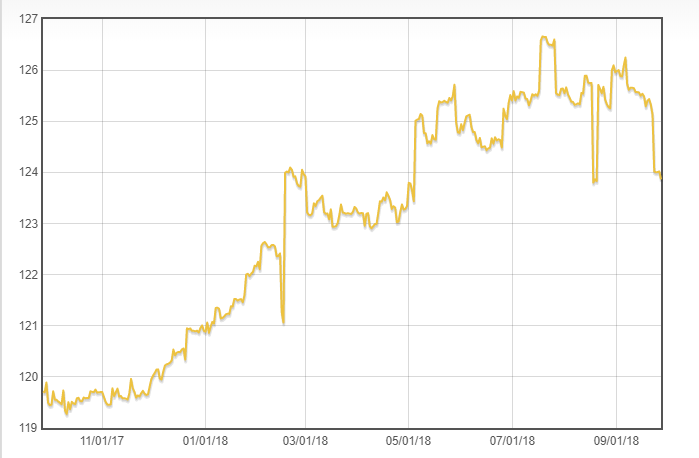

IDEX is one of the few companies tracking and charting diamond trades, with a graph going back up to five years.

IDEX has also created a calculator that establishes the average price for a diamond based on a few factors: the size, color, clarity, and whether the diamond in question has a round or a fancy cut. These tools help establish some basis for prices within the diamond market even though much of the price negotiation still lies in a grey area.

IDEX also features news and reporting on market trends, such as a recent article, >how retail sales are slowly increasing by a whopping 8.5%<, that was published in July. While that seems like a small number to many, this shows there is still a strong demand in a multibillion-dollar retail sector. High-grade polished diamonds are a scarcity and demand may increase as sales rise further.

Also, more recently, a terrible event has been in the news affecting the markets. Typhoon Mangkut raged through the area near the Hong Kong Jewelry and Gem Fair causing the premature closure of the event.

The Hong Kong festival plays a major role in the diamond ecosystem as it is one of the primary shows that Chinese buyers are able to access. With its early closure, the next available event is the Bharat Diamond Week.

While the organizers of Bharat Diamond Week are enthusiastically expecting attendance at the event to exceed that of previous years due to the storm, the real excitement lies in the coming holiday season. The United States of America’s economy is showing strength with the stock markets at all-time highs, unemployment low, and still remains one of the world’s largest consumers of diamonds. With greater spending power, comes increased demand and everyone is going to be looking for the perfect gift for their loved ones as the holiday season sets in.

Even as demand for diamonds rise, one thing remains clear: supply and production of diamonds continue to remain flat, with predictions of supply decreasing by 1–2% by 2030. Coupled with the rising demand from the end of 2017 and on, the lower supply will see many searching for the best deal possible as surplus starts to dry up.

Thanks to the rules of economics, higher demand and lower supply tend to increase prices. However, there may be more factors at play here.

Solving the Liquidity Problem

On the other side of the coin, it remains to be seen what the end of the holiday season will bring to diamond sales. Liquidity typically stabilizes to normal models after the gift rush ends, but this returns us to the long-standing issue of the diamond markets.

Solutions to the liquidity problem, however, are hard to come by due to the natural barrier of entry that is the high price of investment diamonds. Sellers of loose diamonds are concerned only with price, but purchasers must consider being able to not only buy the diamond for the right price but also determine how profitable it could be and who would be able to buy it.

This means that the most common buyers of diamonds will be jewelers who will use the precious stones to create their works of art. They then make jewelry using the diamonds and sell the resulting products to their clients.

The issue lies in the fact that jewelers generally only buy diamonds when they need them to restock on supply. There is very little secondary market involved in the asset class asides from used jewelry sales and lack of opportunities to sell a particular diamond without being in the know about interested parties in your area.

So the question is: how do we get the more investors involved?

Natural polished diamonds represent a rare asset that combines stability, scarcity, and acts as a means of transferring value. However, many would be frightened off by the ever-present low liquidity.

These three main issues make overcoming the liquidity problem difficult:

- Diamonds, even with an appraisal, are highly subjective to pricing by both parties. If both don’t agree to the cost of the diamond, a sale can’t be made.

- Diamonds have a high cost of entry and common investors typically build physical investments over time, rather than actively trading them.

- Diamonds, like all physical assets, are difficult to move around the world with. Security and local laws must be taken into account and may cause a hassle for investors.

Luckily, we’ve come up with a solution.

D1 Brings A Solution To The Table

Enter D1 Coin, the asset-backed crypto token representing 1/1000th of a diamond carat.

With the D1 Coin, investors are able to not only place their funds within a fungible, stable currency, but they are also able to tackle one of the biggest hurdles of diamond investing. With D1 Coins being equivalent to a diamond’s weight rather than subjective value, we fast-track the ability to price out the diamond and eliminate the need for both parties to review the diamond in person.

By utilizing the liquidity inherent within the crypto economy, D1 Coins become a digital representation of a diamond, where users are able to easily utilize it to store their wealth, pay others, and exchange for physical diamonds from the D1 Reserve.

So, what’s the best part?

While gold and silver can be traded on the commodities markets, diamonds are absent due to the requirement of reviewing each and every diamond to go through. However, with D1 Coin, investors and traders alike can now utilize the crypto markets in the same manner as one would with precious metals trading, knowing that each token is backed by the weight of a GIA certified diamond.

It’s like returning to the gold standard on steroids.

Imagine being able to pay someone in diamonds in the span of a few seconds, or earning and saving up for a diamond that you could hold in your hands, or putting a ring on the finger of someone you love. Imagine having a safe and secure store of value that you can transfer anywhere in the world.

This is why the D1 project is so revolutionary.

About D1

D1 aims to be one of the top asset-backed crypto tokens accessible by everyone, backed by the valuable and rare investment-grade natural polished diamonds.

Investors from the ultra-rich to the retirement-minded can purchase and trade these coins with the peace of mind knowing that each holds the value of 1/1000th of a carat of hand selected quality diamonds.

Image: Pixabay