Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

With crypto prices falling, spot trading has lost its momentum, and the futures market has become an area of intense competition among the major exchanges. CoinEx has taken a different approach. By offering easy yet efficient futures services, this long-standing crypto exchange has attracted a large number of emerging crypto investors. In the face of today’s volatile market, here is a report from TokenInsight and CoinEx to explore the trading of perpetual contracts in the future.

- From January to May 2022, the trading volume of perpetual contracts was not significantly affected by the drop in the spot market, and the monthly trading volume remained above $4,000b.

- In May 2022, the 4 leading perpetual contract exchanges (Binance, OKX, FTX, and Bybit) accounted for more than 75% of the perpetual contract trading volume.

- The open interest of Binance, FTX, and OKX have accounted for more than 53% of the total open interest of perpetual contracts from June 2021.

- Perpetual exchanges generally support 100x leveraged trading, while the multi-asset margin mechanism is one of the most important innovations in 2021-2022.

- The perpetual contract liquidity score of the FTX exchange has risen significantly, surpassing OKX and Bybit continuously during the 2021 bull market and second only to Binance. As of May 2022, FTX’s perpetual contract liquidity score still occupies second place.

Market Overview

Although the total market capitalization of the crypto-asset market has fallen by more than 50% from its peak, the trading volume of perpetual contracts has not been significantly affected.

Perpetual Volume, Open Interest & Crypto Market Cap (Source: Coingecko, TokenInsight. Date: 2022.05.31)

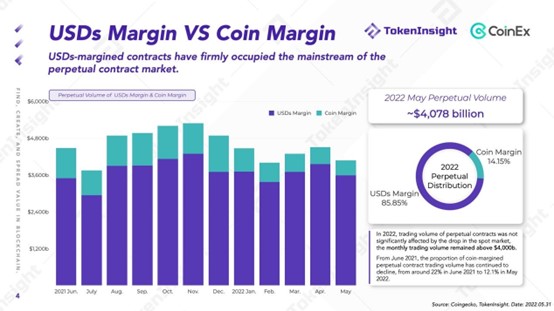

USDs-margined contracts have firmly occupied the mainstream of the perpetual contract market.

Perpetual Volume of USDs Margin & Coin Margin (May 2022)

In 2022, trading volume of perpetual contracts was not significantly affected by the drop in the spot market, the monthly trading volume remained above $4,000b.

From June 2021, the proportion of coin-margined perpetual contract trading volume has continued to decline, from around 22% in June 2021 to 12.1% in May 2022.

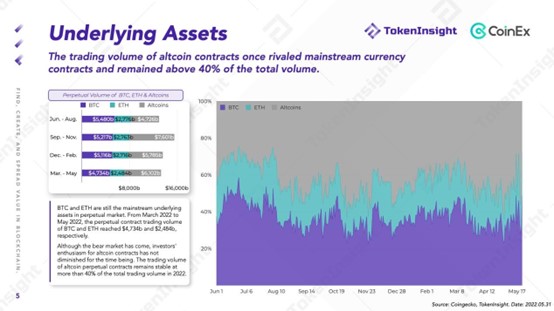

Underlying Assets

The trading volume of altcoin contracts once rivaled mainstream currency contracts and remained above 40% of the total volume.

: Perpetual Volume of BTC, ETH & Altcoins

BTC and ETH are still the mainstream underlying assets in perpetual market. From March 2022 to May 2022, the perpetual contract trading volume of BTC and ETH reached $4,734b and $2,484b, respectively.

Although the bear market has come, investors’ enthusiasm for altcoin contracts has not diminished for the time being. The trading volume of altcoin perpetual contracts remains stable at more than 40% of the total trading volume in 2022.

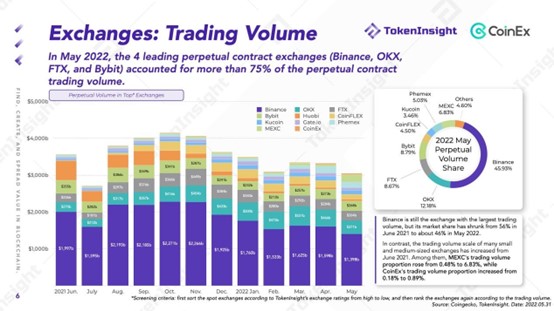

Exchanges: Trading Volume

In May 2022, the 4 leading perpetual contract exchanges (Binance, OKX, FTX, and Bybit) accounted for more than 75% of the perpetual contract trading volume.

Perpetual Volume in Top* Exchanges (2022 May Perpetual Volume Share)

Binance is still the exchange with the largest trading volume, but its market share has shrunk from 56% in June 2021 to about 46% in May 2022.

In contrast, the trading volume scale of many small and medium-sized exchanges has increased from June 2021. Among them, MEXC’s trading volume proportion rose from 0.48% to 6.83%, while CoinEx’s trading volume proportion increased from 0.18% to 0.89%.

*Screening criteria: first sort the spot exchanges according to TokenInsight’s exchange ratings from high to low, and then rank the exchanges again according to the trading volume.

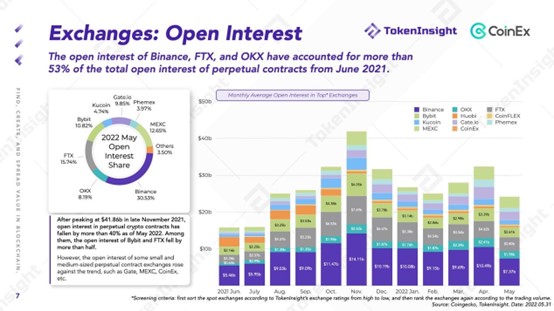

Exchanges: Open Interest

The open interest of Binance, FTX, and OKX have accounted for more than 53% of the total open interest of perpetual contracts from June 2021.

Monthly Average Open Interest in Top* Exchanges

After peaking at $41.86b in late November 2021, open interest in perpetual crypto contracts has fallen by more than 40% as of May 2022. Among them, the open interest of Bybit and FTX fell by more than half.

However, the open interest of some small and medium-sized perpetual contract exchanges rose against the trend, such as Gate, MEXC, CoinEx, etc.

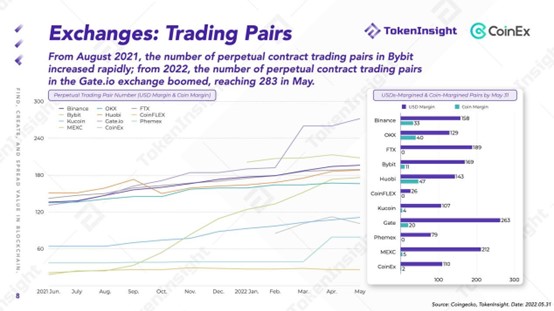

Exchanges: Trading Pairs

From August 2021, the number of perpetual contract trading pairs in Bybit increased rapidly; from 2022, the number of perpetual contract trading pairs in the Gate.io exchange boomed, reaching 283 in May.

Perpetual Trading Pair Number/USDs-Margined & Coin-Margined Pairs by May 31

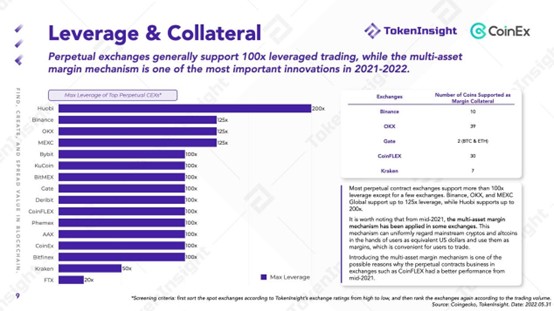

Leverage & Collateral

Perpetual exchanges generally support 100x leveraged trading, while the multi-asset margin mechanism is one of the most important innovations in 2021-2022.

Max Leverage of Top Perpetual CEXs*

Most perpetual contract exchanges support more than 100x leverage except for a few exchanges. Binance, OKX, and MEXC Global support up to 125x leverage, while Huobi supports up to 200x.

It is worth noting that from mid-2021, the multi-asset margin mechanism has been applied in some exchanges. This mechanism can uniformly regard mainstream cryptos and altcoins in the hands of users as equivalent US dollars and use them as margins, which is convenient for users to trade.

Introducing the multi-asset margin mechanism is one of the possible reasons why the perpetual contracts business in exchanges such as CoinFLEX had a better performance from mid-2021.

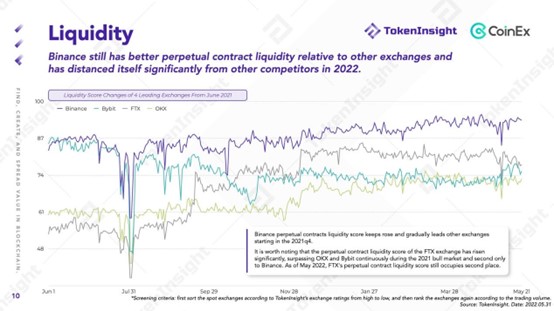

Liquidity

Binance still has better perpetual contract liquidity relative to other exchanges and has distanced itself significantly from other competitors in 2022.

Liquidity Score Changes of 4 Leading Exchanges From June 2021

Binance perpetual contracts liquidity score keeps rose and gradually leads other exchanges starting in the 2021q4.

It is worth noting that the perpetual contract liquidity score of the FTX exchange has risen significantly, surpassing OKX and Bybit continuously during the 2021 bull market and second only to Binance. As of May 2022, FTX’s perpetual contract liquidity score still occupies second place.

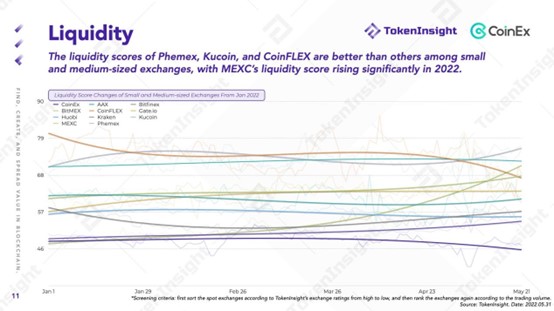

The liquidity scores of Phemex, Kucoin, and CoinFLEX are better than others among small and medium-sized exchanges, with MEXC’s liquidity score rising significantly in 2022.

Liquidity Score Changes of Small and Medium-sized Exchanges From Jan 2022