Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Where to invest in 2020? TOP 5 directions. Where to invest money online or offline this year, how to “buy time” and receive interest even when you are not working? Where to invest in 2020 in order to receive monthly income, how best to do it, as well as several important recommendations from professionals in this regard.

- Securities

Securities have long been a common source for investments. Many people dream of being co-owners of Apple, Microsoft or Gazprom, which allows them to form the stock market. It is enough to buy a share of one of these companies, and you already own a small part of it and receive dividends from this. In the event of an increase in the value of shares, they can be sold and a good profit recorded.

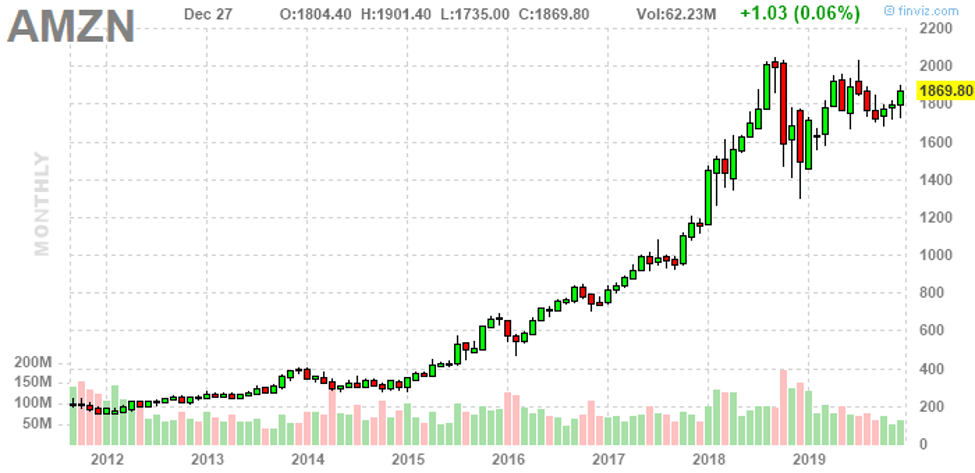

Everyone can invest in profitable stocks. The algorithm of actions is simple (no more complicated than buying toothpaste in a store), and after a dozen operations, anyone will be easily orienting in transactions at the stock market. As an example, consider Amazon stocks:

Over the past year, securities have added almost 100% in price, and such dynamics is not a first year. If this seems to you to be an isolated case, then take a look at Tesla, Google and other well-known companies.

Over the past year, securities have added almost 100% in price, and such dynamics is not a first year. If this seems to you to be an isolated case, then take a look at Tesla, Google and other well-known companies.

- Venture funds

Investing in venture projects is both extremely profitable, but also very risky. To begin with, we will note that a venture fund is an investment project aimed at introducing innovations into start-ups or existing enterprises.

The scheme of work of venture funds: individuals can be participants and investors, as well as companies and banking structures; investments are made not only in money, but also as commitments (an obligation to invest a sum of money when it will be needed); part of the funds is contributed also by founders of a venture fund; then the fund distributes money to the companies included in portfolio and develops them over the stated period, usually 5-10 years.

- Real estate

Perhaps the most traditional way to generate income is to buy real estate. It is extremely difficult to single out something new in this area. Nevertheless, we will note the main points, for example, real estate income can be of two types: rental payments; resale of real estate object at a higher cost. The most common is the first option. Many people buy apartments and rent out them in order to receive stable payments.

One can purchase not only residential, but also commercial facilities. The latter are an order of magnitude more expensive than apartments and require special approach to selection, since they are intended for business. Most often, such option is suitable for people who do not want to greatly increase their capital, but rather just save it, since apartment for 40 thousand dollars (outside of capital) can bring 200 dollars a month, while at the stock market the same amount could bring 10 times more, and with trust managment at a foreign exchange market, it could even pay off in a year.

The main problem for investing in real estate is the starting capital, it should be quite large. For example, for commercial real estate in Moscow, the average cost of 1 square. m. is 407,700 rubles (according to the Domofond.ru research project). Given that the standard object will have an area of about 100 square meters. m., you will need an amount of 1 million USD. Potential income from investments in real estate: From rent – for commercial facilities will be about 10-15% per year, and for residential it will be about 5-8%.

Resale – when buying a new building, it may reach 30-40%, in general, for all objects, the annual increase is about 5-10%.

- Start-ups

Start-up companies have long been in a centre of attention for investments. This direction can bring quite a large profit over time, as evidenced by stories about Facebook, Microsoft and others. Their investors, after a dozen years, made a profit of thousands of percent.

If you think that an IPO of a startup on the exchange is a good opportunity to invest a small amount of money, then you may be wrong.

Firstly, an IPO already means a very high cash flow at a company, which means that you need to invest in startups before an IPO, at the very early stages.

Secondly, an IPO does not guarantee stock growth, on the contrary, in the first year after an IPO, in most companies, stocks fall in price.

The amount that can be earned at startups is in hundreds, and sometimes thousands, of percentages. On the other hand, investing in young companies is risky, as they may not be successful at the end and cause loss.

Investing in startups is best on themed exchanges:

https://www.crowdcube.com

https://www.indiegogo.com/

https://circleup.com/

- Cryptocurrencies

Investing in cryptocurrencies is the most powerful trend in the world over the past 50 years. Today, many people compare this asset to gold (gold rush), and according to a survey, more than 50% of investors would prefer to invest in Bitcoin instead of gold. More than 76% of cryptocurrency holders are confident in the whale forecasts, that the cost of bitcoin in the next few years will reach $ 250,000 per 1 BTC.

The creators of cryptocurrencies themselves and many billionaire investors call them a bubble, however, no one can stop it’s growth. Even states have to adapt to the avalanche trend and develop their own currencies based on the blockchain decentralization system.

It is difficult to talk about future, but at the moment even grandmothers know about Bitcoin, and price of the new money continues to rise. If you do not want to acquire electronic wallets, to delve into the essence of new technologies, if it is difficult for you, you can just invest in different cryptocurrencies via exchange brokers, because it is very affordable and does not require large expenses. In addition, brokers offer leverage, which will increase your profit.

In addition to brokers, in 2019 fully automated platforms based on neural networks began to appear. That is, the analysis of coin rates, charts, ICO / IEO is not done by brokers, but by artificial intelligence.

Firstly, unlike people, the chance of a neural network error tends to zero.

Secondly, a blockchain-based neural network, unlike a trader, will not be able to fool you.

Case study: https://bitsmax.ltd

The platform is a brainchild of the English billionaire – David Harding.

You might not understand cryptocurrencies completely, just make a deposit and get from 2 to 5% per day in this passive mode! Agree, that bank deposits against the background of such incomes seem ridiculous.

The platform did not appeared long ago, however, more than 300,000$ has already been invested in the platform and the amount is multiplying every day. It is not surprising, because everyone wants to receive passive income with such interest, investing in the most promising direction.

The platform is developing and every day the number of accepted cryptocurrencies and payment systems is growing. The company also effectively uses network marketing to attract investors, that is, you can make money on the platform even without investing money, but only by inviting friends. The advantage of the platform is that the investment limit is limited to only $ 50,000, although contracts can be opened as many as you want, as well as any inhabitant of the planet earth can invest in the platform. Also, unlike other platforms, you do not receive money at the end of the investment period, but receive accruals every day for a year and you can immediately withdraw money or reinvest again.

Conclusion

Every year, there are more and more directions for investment.

Each investor, if he wants to make a profit and become a professional, must to follow a number of simple rules – diversification, risk calculation and others. With all this, do not neglect the recommendations and advices from successful investors who have already proven their skills in practice.

Image by Steve Buissinne from Pixabay