Some of the most beneficial investments are often only available to those with enough resources of status to open the right doors. Cryptocurrency has, in part, made it possible for retail investors to access opportunities they’ve historically never had access to.

Through the cryptocurrency space, retail investors were able to buy Ethereum in an initial coin offering that has led to incredible returns. That offering led to improved markets with similar barriers in the form of decentralized autonomous organizations (DAOs).

A DAO is an internet-native organization where decisions are made from the bottom-up, where often participants need a specific number of tokens to be eligible to participate in community governance. Whales benefit from these structures, allowing them to command retail investors while giving them a small amount of control.

KratosDAO opens up the DAO model further, allowing any stakeholder to have a say in the DAO’s future. The DAO is built on top of Optimistic on Ethereum and is a for-profit organization.

Understanding KratosDAO

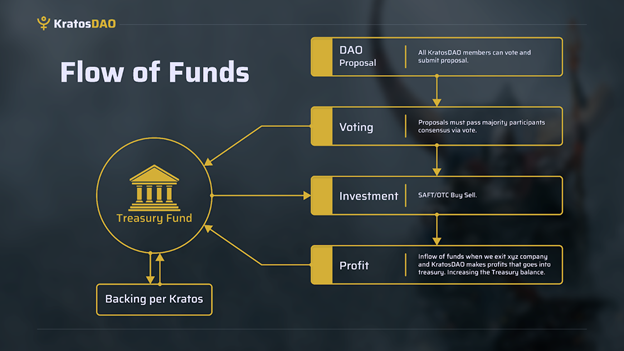

As mentioned above, KratosDAO is a for-profit DAO created by the community. Its purpose is to boost liquidity in the decentralized finance (DeFi) space while using a portion of its treasury to invest in early-stage decentralized applications, effectively democratizing early-stage investments.

Every decision within the KratosDAO is pitched, discussed, and voted on publicly until the community agrees on a path forward. The goal is to ensure the value of new projects isn’t just captured by large organizations or high-net-worth individuals, but instead by retail investors.

Transparency is at the heart of what KratosDAO is. The project did not fund itself through a presale or a private sale of its tokens and was instead created as a fork of the OlympusDAO. KratosDAO was launched on Optimism, a layer-two scaling solution for Ethereum with low fees.

Its smart contracts have been audited by Hacken and PeckShield, ensuring it can bring community leaders, brands, investors, and builders together in the DAO in a safe manner.

The KratosDAO App

KratosDAO works much in the same way OlympusDAO does, as an algorithmic currency protocol akin to a central bank using its reserves to manage the price of its token and its treasury.

KratosDAO, like its predecessor, creates a stablecoin asset that is backed by crypto and not USD and isn’t pegged to the price of fiat currencies. It uses staking and bonding to incentivize users to deposit or sell their crypto assets to the Kratos treasury in exchange for discounted tokens.

As a result, the KratosDAO app has an impressive annual percentage yield (APY) to offer users looking to earn a yield on their holdings. Returns can be estimated through the Kratos calculator, but it’s important to note that total supply increases on a daily basis and isn’t fixed.

The platform also has other improvements over Olympus, including the 4,4 bonds. These bonds are based on game theory and essentially represent a significant boost to the protocol and the price of its tokens, superior to OlympusDAO’s 3, 3 bonds. 4, 4 bonds allow the protocol to build reserves faster and offer more attractive APYs.

KratosDAO’s treasury is used to both ensure the value of the stablecoin at a set value – in theory, equal to one USD – and to invest in early-stage protocols and organizations. These investments, if successful, are then distributed through KratosDAO’s stakeholders.

Upcoming Launch of 4,4 Bonds

After consulting with its community on social media, KratosDAO is set to launch 4,4 bonds due to popular demand. Most users voted on the launch of these bonds, which can lead to higher rewards for users.

As mentioned above, KratosDAO’s 4,4 bonds are an improvement based on game theory and represent a significant boost to the protocol superior to OlympusDAO’s 3,3 bonds. The labels of these bonds – 4,4 and 3,3 – are simply given to certain actions associated with Game Theory.

Game Theory is the study of mathematical models that can be used to determine the advantage and disadvantages of specific user choices in specific scenarios. The first figure refers to a user’s actions while the second refers to the actions of others.

Staking is seen as having an outcome value of 3, meaning that if you stake and another user stakes their tokens as well, the total value is 6. Ideally, users stake and buy 4,4 bonds to help the KratosDAO’s reserves grow, and increase offered APYs.

It’s worth noting that 4,4 bonds offer users rewards paid in a token that allows for the rewards to compound as they are vested while having a single 4-day vesting period. These bonds are shorter in supply than 1,1 bonds – which have a smaller effect on the protocol – because they are generally more attractive.

4,4 bonds usually also have smaller discounts than 1,1 bonds, as people who buy these also benefit from compounding APY rewards applied to the tokens they are rewarded in, effectively making these more attractive over time.

You can learn more about KratosDAO and the coming launch of 4,4 bonds using the platform’s website, and by following it on Medium or Twitter.