In a groundbreaking move, YieldNest announced the merger of PrimeStaked’s Liquid Restaking Token (LRT), primeETH, into YieldNest’s much anticipated ynLSD product. This collaboration marks a significant step forward in the DeFi landscape by providing primeStaked users with YieldNest’s advanced technology to offer unparalleled benefits. This aligns with YieldNest’s vision of becoming the premier liquid management and programmatic yield layer of restaked DeFi assets.

To celebrate, YieldNest is providing exclusive benefits to primeETH users and additional access to YieldNest’s community incentives, which are anticipated to be over 60%.

PrimeStaked: A Journey of Innovation & Commitment

PrimeStaked, an initiative by Origin Protocol, is always striving to stay at the forefront of the evolving DeFi industry. From its inception, PrimeStaked has been dedicated to providing users with benefits, constantly innovating to enhance the user experience. This merger with YieldNest ensures that PrimeStaked users remain on top of the industry, benefiting from enhanced opportunities.

YieldNest: Shaping the Future of Restaking

YieldNest is renowned for its innovative approach and cutting-edge technology, setting new standards in the industry with the backing of notable angels including the founders of Curve (Michael Egorov), Convex (Winthorpe & C2TP), Frax (Sam Kazemian), Kyber (Loi Luu), Algorand (Steve Kokinos), Yearn (Wavey), Moralis (Ivan on Tech) and others.

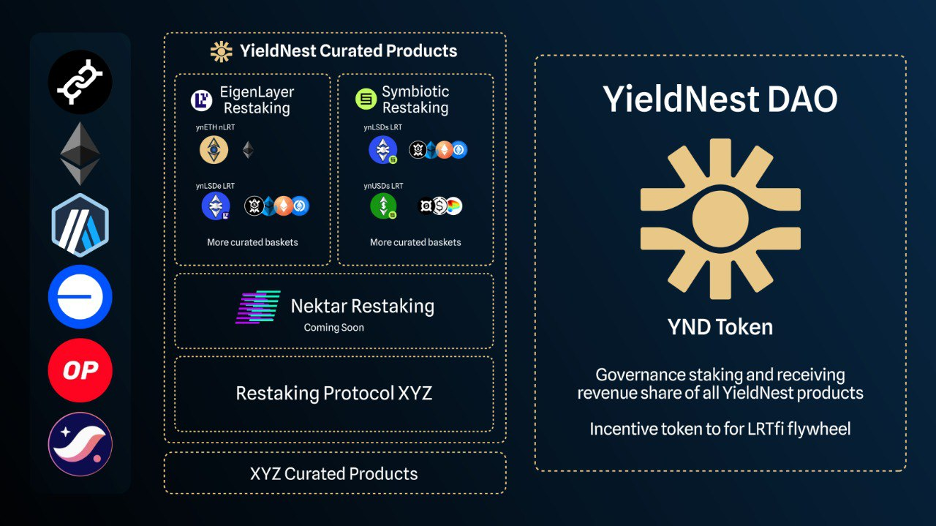

Committed to building a sustainable product designed for long-term success, YieldNest offers unique solutions such as controlled AVS Exposure with YieldNest/External curated LRTs and isolated LRTs that wrap around multiple restaking protocols. YieldNest’s products focus on providing real, secure, and maximum risk-adjusted returns.

YieldNest is pioneering with ynLSD (ynLSDe, ynLSDs) & ynUSDs

In line with the primeETH merger, YieldNest will be launching its new products:

ynLSD is YieldNest’s innovative Liquid Restaking Derivative (LSD) designed to optimize user yields by leveraging other DeFi tokens, like OETH. LSDs allow users to stake their assets while retaining liquidity, meaning they can still use their staked assets in other DeFi activities. YieldNest’s first ynLSD offering will be:

- ynLSDe – the liquid restaking solution on EigenLayer, designed to unlock the next generation of ETH yields and EigenLayer rewards. Leveraging EigenLayer’s infrastructure to provide users with superior yield opportunities through custom-tailored restaking strategies.

- ynLSDs – an innovative approach to restaking within the Symbiotic ecosystem. The ynLSDs token utilizes Symbiotic’s infrastructure to provide users with access to outstanding yield and Symbiotic rewards opportunities.

ynUSDs – is designed to deliver competitive yields and Symbiotic rewards on USD-denominated assets with risk-adjusted returns through innovative strategies tailored to the unique characteristics of stablecoins.

YieldNest aims to fully transition to a DAO and sub-DAO structure for community decision-making. The goal is to create a self-sustaining, decentralized protocol that can operate independently of the core team. The governance structure features chambers, each managed by elected leaders based on staked YND tokens, with each chamber voting on specific categories of issues. This transition emphasizes the importance of community-aligned token distribution, gradually transferring power to the community, making YieldNest a fully decentralized liquid restaking protocol that can operate, maintain, and grow itself from within.

YieldNest’s vision is expansive, aiming to shape the future of restaking by delivering comprehensive insights into all associated risks. With its independent risk team and audits for top-tier auditors, providing more security and stability for its users. This merger will introduce primeETH users to a new network of opportunities, enhancing their ecosystem and offering additional yield and rewards through protocols like EigenLayer and future partners like Symbiotic.

Combining Strengths for a Promising Future

This merger is more than a strategic alliance; it is a logical next step in the journey of both YieldNest and PrimeStaked.

PrimeStaked users will now have access to YieldNest’s superior technology and innovative products, ensuring they remain at the cutting edge of the DeFi industry. This collaboration is set to create a more robust, secure, and rewarding environment for all users, paving the way for a brighter future.

To celebrate and reward all loyal primeETH adopters who migrate to YieldNest, primeETH users receive exclusive benefits, which are only available for a limited time:

- PrimeStaked YieldNest Airdrop

- YieldNest Seeds Bonus (+5% bonus for primeETH users)

- Receive Pioneer NFT + 15% Permanent Boost (Migrated 5 OETH or more)

- Receive AVS/Network Yields & Airdrops

- And many others…

For all the migrated primeETH users and YieldNest’s native users, YieldNest anticipates that the total airdrop allocation will be no less than 15% of the total supply of YND and aims to increase the amount allocated to airdrops contingent upon TVL increasing over time with a target of being one of the most generous airdrops to hit the market in the restaking vertical with community incentives anticipated to be over 60%.

Want to join YieldNest’s anticipated airdrop? Make sure you start restaking via YieldNest’s platform now!

About YieldNest:

Led by industry veterans, YieldNest aims to be the top liquid restaking solution, unlocking next-gen strategies and establishing itself as the leading protocol for liquid restaked assets.

About PrimeStaked, an initiative by Origin:

Prime Staked ETH (primeETH) is a liquid restaked token (LRT) by Origin, that provides liquidity for assets that have been deposited into EigenLayer.

For press inquiries concerning YieldNest, please contact media@yieldnest.finance.

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.