If you have at least a little experience in binary options trading, you know that sometimes you encounter situations when you have already opened positions, but the chart changes its trend suddenly and there is a danger of finishing “out-of-the-money”. In such situations, experienced trades often use a strategy called “Hedging”.

Hedging occurs when you open two trades in one asset with the same time of expire but different directions. For example, if the first position is CALL, so second one will be PUT.

The aim of hedging is to decrease the risk of losing and to increase the profits. To use this strategy you need to make a investment twice – both on the price of the asset going up and down. By doing so you will create a situation where both of your bets can win and one of them will definitely win.

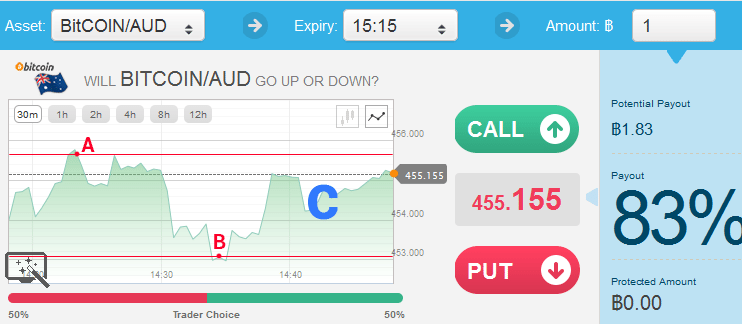

Look at the picture below:

In this example to use the hedging strategy, you would have to open a position in point A that the price will go down (PUT) and open a position in point B that the rate will rise (CALL).

If, after your chosen period of time, the price will be in the hedged area C, you will win both options. If the price will be outside the hedged area, then you will win either the trade A or trade B.

The worst possible scenario would happen if you predicted that the rate would go down (PUT) in point A, but it keeps going up (CALL), because then you lose all of the money you invested.

If you had invested 1 BTC with each of the trades, then in the case C your net profit would have amounted to 1.66 BTC, in cases A and B you would have lost 0.34 BTC and in the worst possible scenario, you would have lost 2 BTC.

This strategy is effective because, as you can see in the chart above, the price is volatile, so it’s easy to forecast the high points and make the right investments at the right time.

Advantages of the strategy:

- Very profitable if used correctly

- Can be used in a small period of time (15 minutes)

- Easy to comprehend and use. Suitable for novices

- Provides risk management to a great extent, especially with SELL/ROLLOVER features

Disadvantages of the strategy:

- If the rate goes against your forecast, you lose all your investment

Keys to remember:

- Play with minimal investment amount (0.05 btc) at the beginning

- Hold on to strategy – turn off your emotions, don’t get greedy.