There is much talk about new forms of investment, but very little about addressing the issues haunting the investment ecosystem: the shrinking amount of liquidity on the exit, and the length of the illiquidity period. Mango Startups wants to change that, and it is turning to the blockchain as the answer to the liquidity problem.

Today, Mango Startups has announced the launch of the first initial coin offering (ICO) for a VC fund in Latin America.

Mango Startups will use blockchain to allow backers to make early-stage investments in promising tech companies. The fund will invest in a diversified portfolio of up to 24 tech startups from different countries in Latin America. The aim is to offer transparency and liquidity as well as a clear exit strategy for the investors.

‘Our core mission is to democratize venture investments and reshape the traditional Venture Capital industry for startups and investors. We add value to startups and investors through a proven track record of coaching and due diligence methodology. We provide liquidity, transparency, and inclusivity on the blockchain,’ comments Ami Lebendiker, Founding Partner of Mango Startups.

Our team coordinates the Latin America Accelerator Network (RETEI). With more than 8 accelerators and +1,000 startups, this network provides a huge pool of talented entrepreneurs and scalable projects to choose from. In order to minimize risk and maximize revenue, all startups in the portfolio must follow these prerequisites:

- Have graduated from a renown accelerator program,

- Maintain a positive cash flow for at least 6 months and

- Provide a service platform or product that is highly scalable. Only the best companies will receive funds to be part of the portfolio.

This initiative enables anyone to invest in early-stage tech companies while keeping the investment liquid from day one.

“While equity crowdsourcing brought startup investments to the public, we are hoping that Mango Startups, with its liquidity and inclusivity, will bring more and more people to invest in a growing region like Latin America, while avoiding the inherent risk of investing into a single startup or ICO,” said Fernando Arriola, CFO of Mango Startups.

The Ethereum-based token will be made available in cryptocurrency exchanges after the ICO is over.

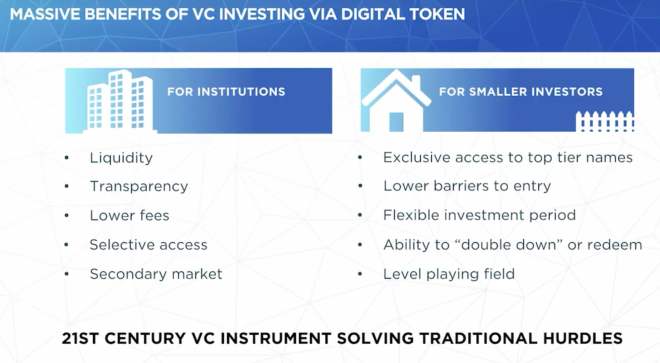

Massive Benefits of VC Investing vis Digital Token:

The Mango Startup Pre-ICO will launch on 1st of March, 2018 (Join to get 33% bonus). For more information or to participate in the crowdsale, visit www.mangostartups.com

I understand that if I am a Mango token holder I will benefit from incremental increases in startups valuations, is that correct?

That is correct,

The value of the token is pegged with the fund valuation.

Here is how it works: Mango Startups has created a bonus distribution mechanism as well as a token buyback process.

Here are 2 examples:

i. If Startup A in the portfolio generates outstanding profits and decides to distribute them, then Mango Startups consents to distribute this “bonus” to all token holders through a prorated coin airdrop. This will increase the amount of tokens for all holders, and immediately transfer the value to all investors.

ii. If Startups B in the portfolio experiences a liquidity event (i.e an exit or an M&A), then Mango Startups will spend the net profit, which it will receive directly from the InvertUP Fund, to purchase out Mango tokens from investors through the secondary exchange, in a token buyback process.

Its important to remember that as a token holder you can liquidate your investment at any point in time through cryptocurrency secondary exchanges

It seems to me as an Angel Investor that Mangostartups ICO is a game changer in the Venture Industry !!! Clear exit strategies, diversifying investments using a portfolio aproach , minimizing risk , credibilty and complaince through a strong due diligence process