Hi Everyone,

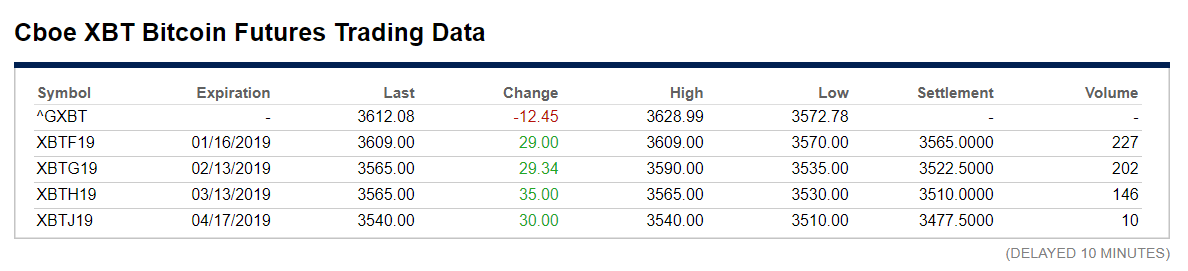

One of the joys of having a futures market is the ability to understand what investors are thinking about the future of the price. For bitcoin, it doesn’t seem so great at the moment.

As we can see, the contracts for the bitcoin futures on the CBOE are currently in backwardation, meaning that contracts with a later expiration are trading consecutively lower.

Of course, something like this might have made me nervous on a normal day, but then I remembered that oil futures were trading in contango (opposite of backwardation) before the prices collapsed back in October.

Also, the volumes here are kind of silly. I mean, 227 BTC (less than $1 million) trading on a contract that expires today. Sure, the title is catchy but what can we really learn from this?

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Highlights

- Shutdown: Day 26

- Day’s to Brexit: 72

- Constantinople Delayed

Please note: All data, figures & graphs are valid as of January 16th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

You may have noticed that we’re now including a countdown to Brexit in the highlights section, right next to the US government shutdown counter. I think they fit together neatly. Two governments descending into a state of turmoil over political wrangling.

Today, Theresa May’s government will see the ultimate test. If she loses the vote of no confidence, the UK heads to new elections… again.

Over in the East, China decided to inject the market with a record level of stimulus. Yesterday’s tax cuts may have been insufficient to maintain growth, so they’ve gone the route of free cash for the market.

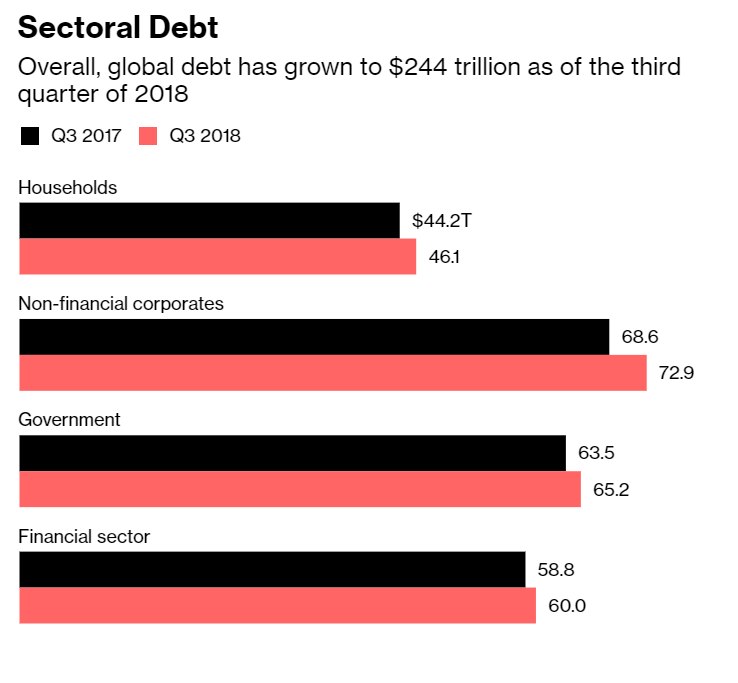

In addition, it seems the Institue of International Finance has made a rather shocking estimation. It seems our entire economic system, from our homes to places of work and our governments are increasingly reliant on debt.

Given all the above, it’s no wonder that the European Central Bank is now sounding a new alarm.

Don’t worry about any of this though. The stock markets are up today. Hope the earnings reports from the financial sector go well.

Ethereum Upgrade Delayed

After all the excitement, the crypto community was disappointed to hear last night that the long-awaited Constantinople upgrade has been delayed once again.

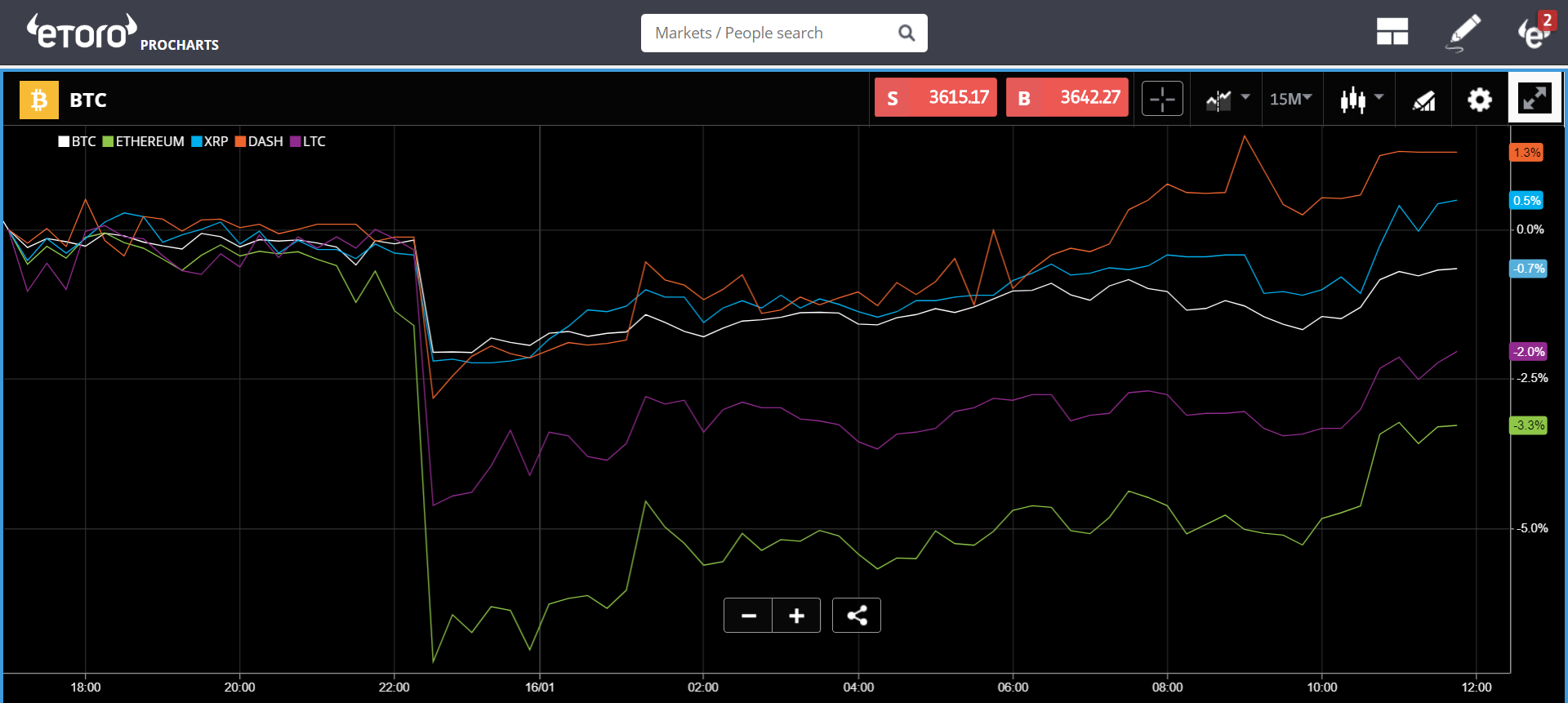

It seems a critical bug was found at the last minute and the lead developers pulled the plug. Here we can see the crypto market, led by Ethereum, dropping moments after the announcement was made

We’re seeing a bit of a recovery this morning but that was really scary. I mean, it’s good that they caught the bug before going live but the fact that it came within 30 hours of the upgrade is a bit nervewracking.

These things do happen, virtually all major platforms including Windows, Android, and Apple Operating systems, have seen critical bugs before. Though it would be possible to release a patch, fork the network again, and return to normal, that kind of process could in itself have done irreparable damage.

We hope that Constantinople whenever it is ready, goes through without any additional hitches.

This content is provided for information and educational purposes only and should not be considered to be investment advice or recommendation.

Past performance is not an indication of future results. All trading involves risk; only risk capital you are prepared to lose.

The outlook presented is a personal opinion of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

About the Author: Mati Greenspan is a Senior Market Analyst at eToro Connect with Mati on…. eToro: http://etoro.tw/Mati Twitter: https://twitter.com/matigreenspan LinkedIn: https://www.linkedin.com/in/matisyahu/ Telegram: https://t.me/MatiGreenspan Office Phone: +44-203-1500308 (ext:311)

Disclaimer: The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. NewsBTC is neither responsible nor liable for the accuracy of any of the information supplied in Sponsored Stories/Press Releases such as this one.