Hi Everyone,

Since landing in California last week, it’s become very clear to me how quickly the retail landscape is moving to the cloud.

My family and I have been doing a fair bit of shopping since we got here but friends and relatives are giving us some funny looks. Why would we go out to a shopping center and walk around for hours instead of just searching on the internet to find exactly what we need in minutes?

The birth of the internet is the death of the department store.

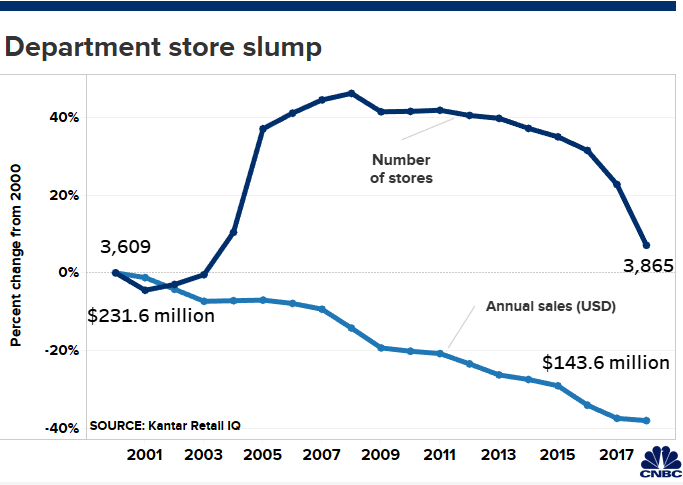

Seeing this graph posted on CNBC showing the retail shakeout yesterday really hit home for me.

Notice how quickly retailers were adding department stores from 2003 to 2005, only to shed most of them over the last three years, all the while watching their sales plummet. Talk about throwing money at a problem.

The thing is, the stores aren’t really empty either. Yesterday evening I had trouble finding a parking spot in a massive lot outside of JC Penny just one hour before the store’s closing time and the place didn’t seem like a ghost town.

However, what I’ve been informed is that people tend to do a lot of window shopping at these places and then later place their orders online. By now just about every store will price match what you find on the internet but this doesn’t seem to help much. I can’t help but think that there has to be a better model. Like, what if they put QR codes on all products so people could save the items to later compare and order?

Anyway, these stocks are falling pretty fast and if they don’t do something radical, brick and mortar may well go the way of the dinosaur.

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Highlights

- Snapback Rally

- Security of XRP

- Steady as a Bell

Please note: All data, figures & graphs are valid as of August 14th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Stocks bounced back fiercely yesterday after…

Many political pundits are saying that Donald Trump has blinked in the face of what may end up being a strong shopping season. Pushing up prices on Christmas gifts isn’t exactly a great way to get re-elected.

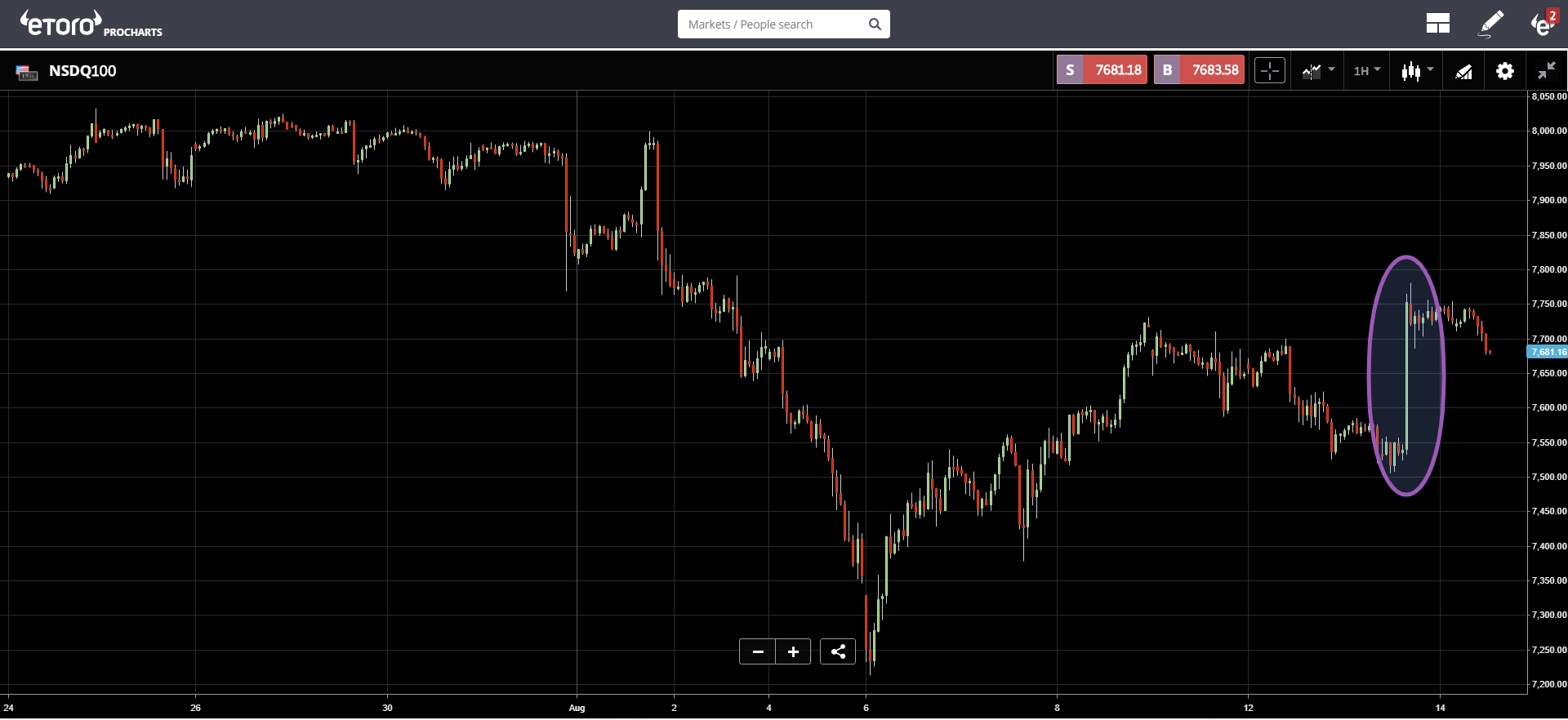

The timing of the news is seen here for the Nasdaq in the purple circle.

Stocks are firmly in the red today though as it seems the news was enough to spark a spike but not necessarily a sustained rally. Just enough to shake out a few short sellers… but I’m not bitter though.

Security of XRP

The ongoing legal proceedings against Ripple in the United States seems to have taken a turn for the worse recently.

Relying heavily on new guidance from the SEC, it seems that some XRP investors have revamped their efforts to sue Ripple for selling them an unregistered security.

In my view, XRP has always been a utility token due to its unique role within Ripple’s payments network. However, the Securities and Exchange Commission has a strong tendency to see most digital assets as securities. As XRP is the biggest such instance, it does seem odd that they haven’t really commented on this particular case and it looks like this will end up being resolved by the courts.

What’s interesting here is that for the first time Ripple Labs will be compelled to give a formal response, the deadline for which is September 19th.

Even though it was one of the strongest gainers of the 2017 crypto bull run, it seems that XRP has completely sat out the 2019 rally and is now testing heavy support at exactly one quarter per coin.

Crypto Shakeout

Once again bitcoin is searching for support and having trouble finding it. Volumes are back to normal today throughout the market but the price seems to be gradually falling.

Many analysts have been doing their best to tie in the latest moves in the crypto market to the uncertainty in geopolitics but it’s difficult to say exactly how much connection there really is.

In an attempt to answer this, I’ve done an interview for you this morning with Block TV’s Ron Friedman. Make sure to check it out here: https://blocktv.com/watch/2019-08-14/5d53de5c1ba0f-greenspan-the-perfect-storm-is-brewing-for-bitcoin

Have an excellent day!

About the Author: Mati Greenspan is a Senior Market Analyst at eToro Connect with Mati on…. eToro: http://etoro.tw/Mati Twitter: https://twitter.com/matigreenspan LinkedIn: https://www.linkedin.com/in/matisyahu/ Telegram: https://t.me/MatiGreenspan Office Phone: +44-203-1500308 (ext:311)

Disclaimer: The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. NewsBTC is neither responsible nor liable for the accuracy of any of the information supplied in Sponsored Stories/Press Releases such as this one.