Hi Everyone,

No doubt everyone wants to read about two major updates in the crypto market. Facebook has released some much-anticipated details about their new cryptocurrency and Ripple Labs has just bought a significant stake in MoneyGram. Well, you’ll need to wait just a little bit.

At the moment, the President of the European Central Bank (ECB) is on the television talking about adding even more stimulus to the European economy and possibly cutting interest rates, which are already in negative territory.

The ECB was widely expected to announce more ‘support’ for the markets but this type of language was much more dovish than expected.

If you’re looking for a main driver of the recent crypto bull rally, I’d say we have a prime suspect right here. I’m currently running a poll on twitter to see why people feel that crypto is rising so fast this year. Now you know my answer, will be glad to get your thoughts here.

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Highlights

- Dovish Central Banks

- Libra Coin Release

- MoneyGram Takeover

Please note: All data, figures & graphs are valid as of June 18th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

As stated above, the President of the ECB Mario Draghi delivered a shock to the financial markets this morning

Not only did he pave the way for more QE but also said that further rate cuts were a distinct possibility, even though rates are already negative across the block.

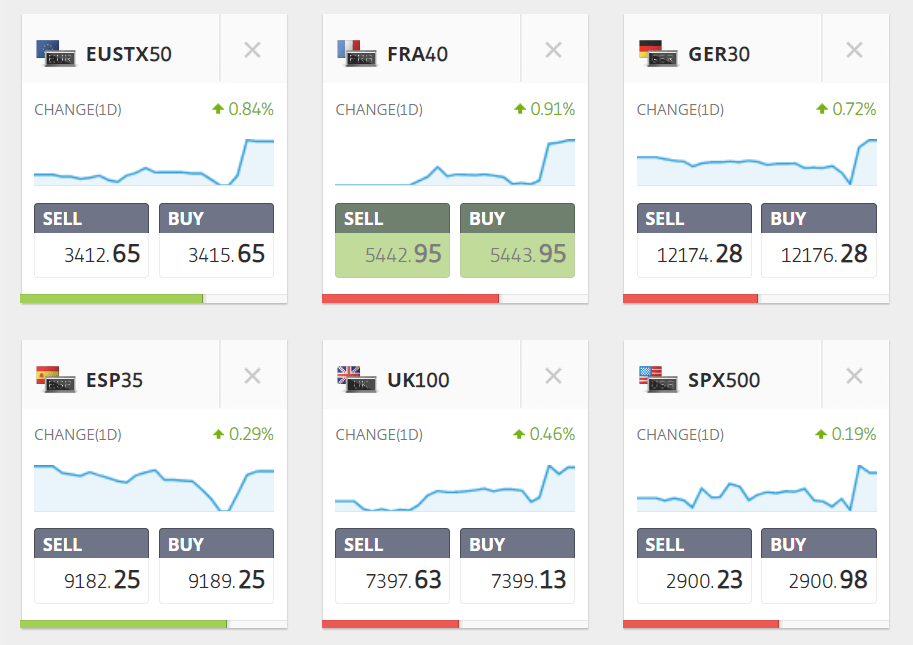

The market reaction was very clear on this announcement. Here we can see the drop in the Euro on the left and the seemingly forced rally in European stocks on the right.

As we’ve been discussing over the last few weeks, virtually all of the world’s central banks have taken a shockingly dovish tone lately. Their efforts have propped up financial markets quite considerably but at what cost?

Over time the effects of such stimulus measures seem to be ebbing slowly. European stock markets are up less than 1% on the announcement. Not exactly the type of face-melting rally we’re used to seeing from this type of stimulus.

The markets now await the US Federal Reserve which will announce its interest rate decision tomorrow. Markets are currently pricing in a 25% chance that they will cut the rates and if they don’t do it tomorrow, markets have priced in a 100% chance of a cut at the end of next month.

RippleGram

In a groundbreaking move yesterday, Ripple Labs has pledged to acquire a stake valued at up to $50 million in the global money processor MoneyGram.

As part of the deal, MoneyGram is set to begin using the XRP token to facilitate international transfers and settlements across the 200 countries that they operate in.

XRP coins saw a significant jump in price (purple circle) but did end up falling short of a breakout (yellow line). By this morning, the move had been completely retraced.

Speaking with Bloomberg about the deal, Ripple’s CEO Brad Garlinghouse stressed the importance of making MoneyGram’s system more efficient by reducing capital costs.

Indeed, MoneyGram’s current business model sees lots of money sitting on the side just waiting for someone to move it. By utilizing the XRP token, they’ll be able to free up that capital and utilize it in more productive ways.

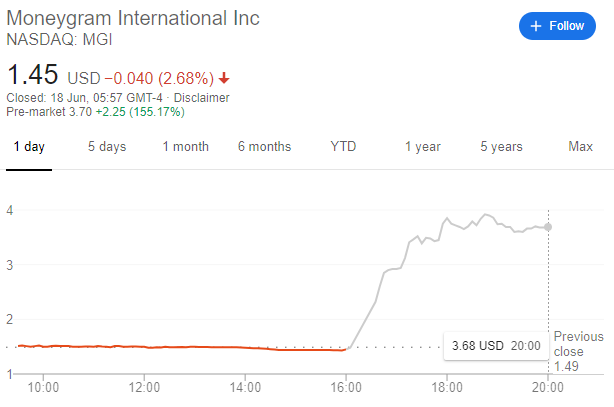

As far as this partnership goes, the devil is in the details. Ripple’s $50 million bid will likely end up bagging them about 6% to 10% of the company. The price they’re paying of $4.10 a share represents a considerable markup from the $1.45 a share they were trading at when the market closed yesterday.

In after-hours trading, the shares did see a significant pop and are expected to open around $3.68.

So Ripple is paying quite a hefty premium in order to convince MoneyGram to use their service. An investment that, in my humble opinion, was well thought out and well placed. This massive payment network could potentially be the new backbone of Ripple’s blockchain and drastically increase the size, scope, and scale of the Ripple network, like an adrenaline shot to the world of international remittances. Let’s hope it pays off.

Libra Coin

The excitement around Facebook’s new crypto project has been building up across the financial world for the past few months and it all came to a head this morning with an incredibly satisfactory release.

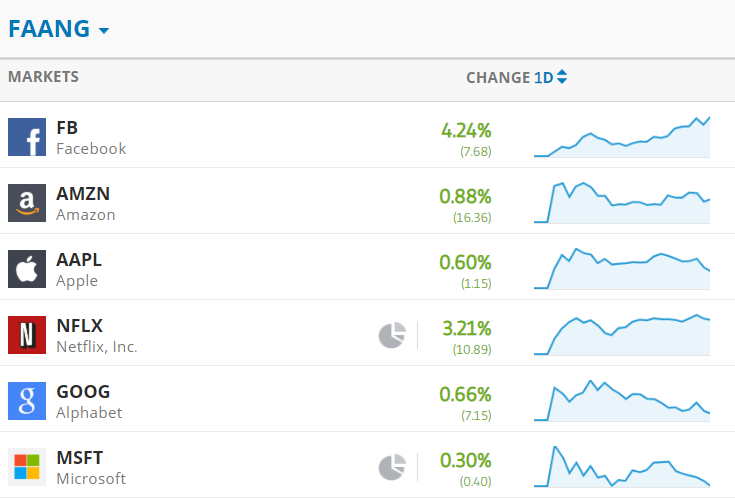

Rumors of the release not only influenced prices in the crypto market but yesterday the FAANG stocks all saw remarkable gains, led of course by Facebook.

It seems like mainstream investors are finally beginning to grasp the power of the internet of value and the future that technology and finance are headed towards.

Tencent has been running their own payments network environment in Asia for years now and if Facebook is successful here, there’s no reason why other tech giants won’t soon follow suit.

To me, the big curveball in the mountain of documents released by Facebook this morning was the implementation of smart contracts on the Libra blockchain introducing a brand new programming language called Move.

If you’ll recall, Facebook Messanger came out with their own script that allowed developers to program bots for the messaging app. I still use a few of them but it seems that the concept never really took off in a big way. Perhaps the missing ingredient to that is actually value.

By having a service that is easily accessible they’re essentially pushing the dream that is decentralized applications and programmable money to a much wider audience.

Let’s have a fantastic day ahead!

About the Author: Mati Greenspan is a Senior Market Analyst at eToro Connect with Mati on…. eToro: http://etoro.tw/Mati Twitter: https://twitter.com/matigreenspan LinkedIn: https://www.linkedin.com/in/matisyahu/ Telegram: https://t.me/MatiGreenspan Office Phone: +44-203-1500308 (ext:311)

Disclaimer: The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. NewsBTC is neither responsible nor liable for the accuracy of any of the information supplied in Sponsored Stories/Press Releases such as this one. Image by Gerd Altmann from Pixabay