Hi Everyone,

Once again the deteriorating relationship between the United States and Turkey is leading the news. The Lira is sliding again and it does seem to be bringing some of the other emerging market currencies with it.

As we’ve been saying throughout the week, it’s very possible that the declines in the crypto market earlier this week are due to a stronger US Dollar more than anything else.

As I’ve said before, in order to understand what’s happening in crypto, we must look at what’s happening in the rest of the economy as well. In this case, the US Dollar strength isn’t coming from Turkey, that’s just the catalyst.

The Greenback has been gaining ground since early April on the promise of higher interest rates in a strong economy. So far today, it doesn’t seem that the Lira’s slide is affecting the other major currencies though, nor has it touched crypto for the time being.

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Highlights

- Currency Contagion

- Looking at Metals

- ETC Backwards

Please note: All data, figures & graphs are valid as of August 17th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Now that we’ve established the underlying theme and why the Dollar’s been surging, it seems that the situation has largely been contained. At the beginning of the week, the strong Dollar was taking out everything in its path. Today, the declines seem to be limited to the emerging markets.

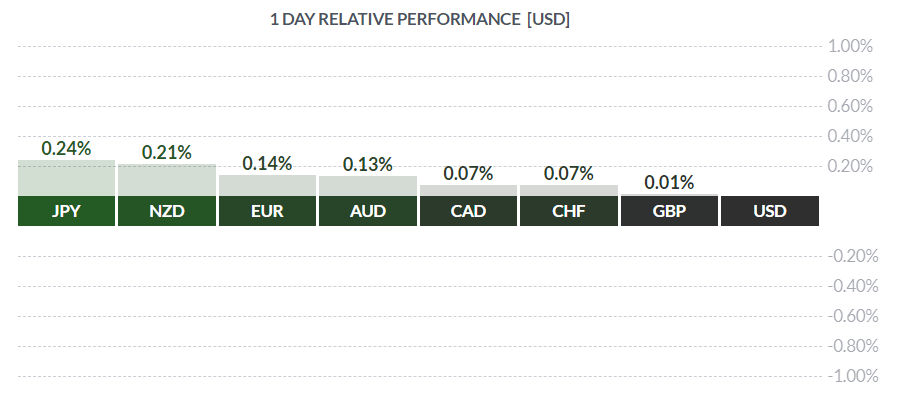

In fact, of the major currencies, the USD is the worst performer today.

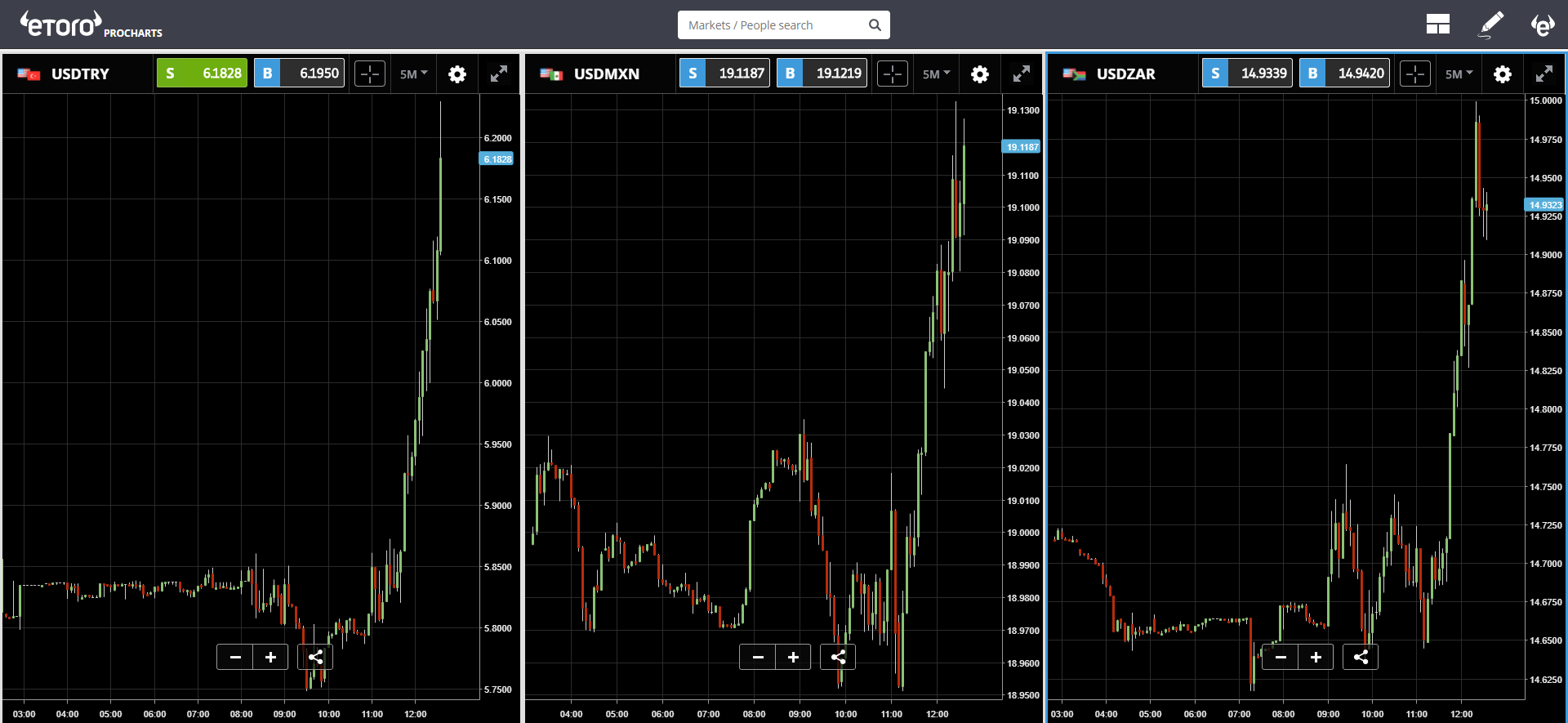

So even though the Dollar is rising against the Lira, Peso, and Rand…

… it doesn’t seem to be spilling over into other markets today.

Looking at Metals

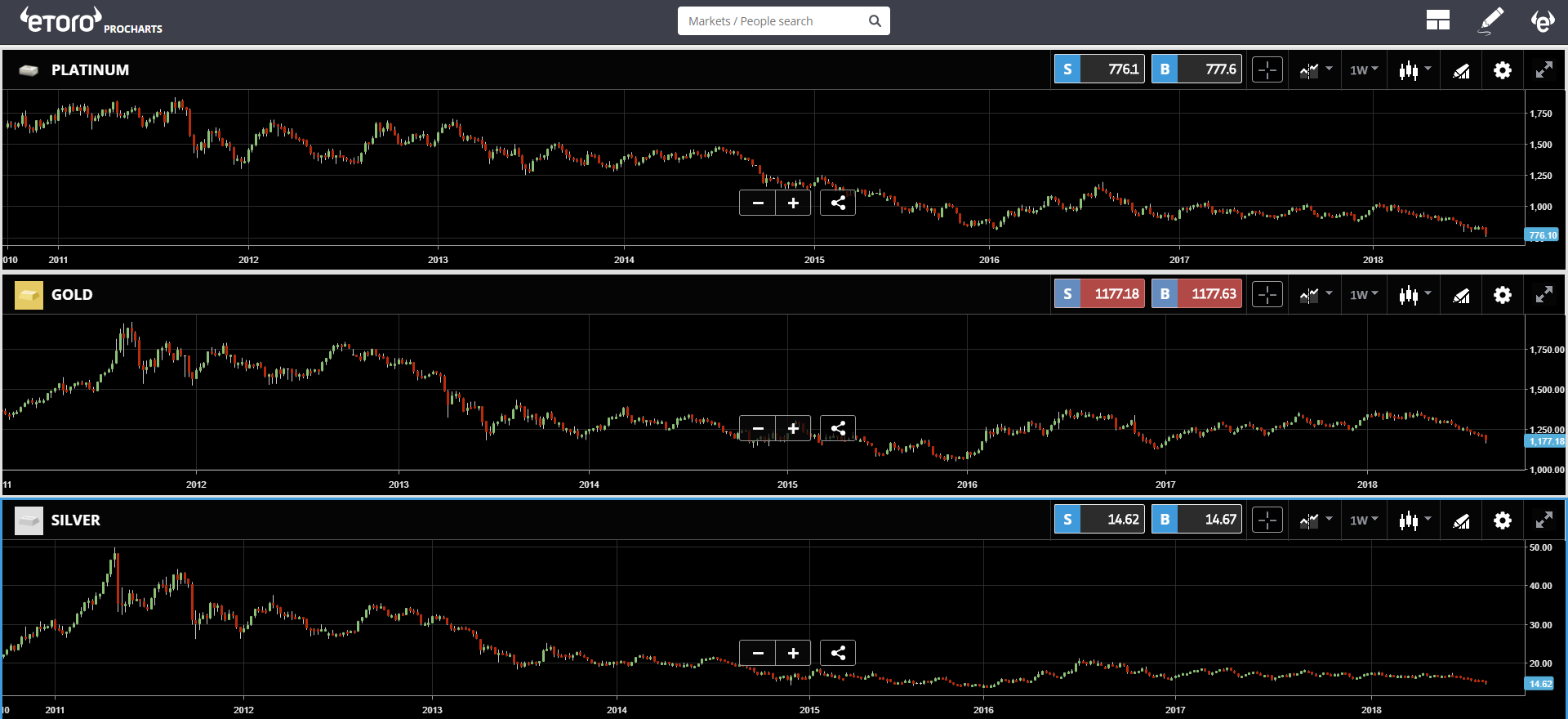

Now that we’ve seen one of the biggest declines in the metals markets in recent history, it’s time to examine the long-term charts again.

Frankly, the weakness in metals still doesn’t make much sense to me. As we saw the Dollar strength earlier in the week, it did decline further but the declines seem disproportionate to the gains of the Buck.

Actually, what we’re seeing since 2011 is a precious metals market that’s been trending down.

The question is, has that dynamic come to a head?

The fun thing about the way down is that eventually, you run into a lower barrier at the production cost. Meaning, if the price to mine a metal is higher than the price to sell it, miners will stop mining, which generally tends to drive up the price.

A quick look at the mining costs of all three of the above does seem to indicate that those prices are quite close or even already passed.

A Crypto of its own

It’s good to see the rebound taking hold in the crypto markets despite the emerging currencies continuing to sell-off today. This is a positive indication that crypto is less sensitive to the moves of the Dollar but under extreme circumstances still is susceptible.

One thing that seems to be sticking out like a sore thumb is Ethereum Classic. In this graph, we can see that ETC (white line) has been acting out since mid-June and simply hasn’t been following the rest of the market.

This type of go-it-alone price action is typical when prices are moving up, but we almost never see it when prices are declining.

One of the reasons might be due to the listing of ETC on Coinbase. A new door to this crypto could mean new money flowing in. This could be worth keeping an eye on in the next few days. I’m eager to see how long it will take to fall back in line with the other cryptos or if it increases in market share following the listing.

Wishing you a fantastic weekend!

This content is provided for information and educational purposes only and should not be considered to be investment advice or recommendation.

The outlook presented is a personal opinion of the analyst and does not represent an official position of eToro.

Past performance is not an indication of future results. All trading involves risk; only risk capital you are prepared to lose.

Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

About the Author: Mati Greenspan is a Senior Market Analyst at eToro

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: +44-203-1500308 (ext:311)

Disclaimer: The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. NewsBTC is neither responsible nor liable for the accuracy of any of the information supplied in Sponsored Stories/Press Releases such as this one.