Bitcoin price continues to move sideways in an increasingly tightening trading range to the dismay of cryptocurrency investors. The bearish sentiment across the space is among the most prominent in years — potentially more bearish than the 2018 bear market.

Here is why the recent correction has felt far more painful than even Black Thursday, despite BTCUSD trading at roughly the same price as one year ago.

Bearish Bitcoin Sentiment Could Be Blind To Bull Market

You might not know it by the current price action, sentiment, or even economic backdrop, but there is a strong chance that Bitcoin is still in a bull market.

The ongoing sideways consolidation phase could ultimately result in another, unexpected thrust upward, according to Bitcoin market structure mimicking an Elliott Wave Theory motive wave.

Related Reading | Bitcoin Bear Market Comparison Says It Is Almost Time For Bull Season

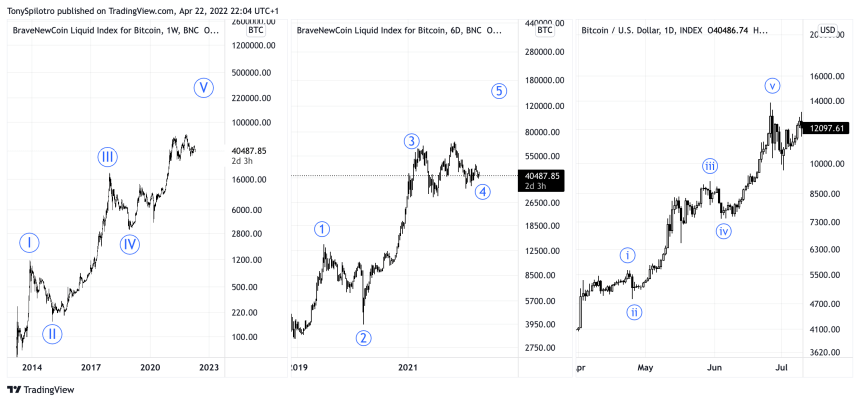

A motive wave is five waves in total, with three of those waves moving in the direction of the primary trend. Two waves move in the opposite direction of the primary trend — the same direction as the bear market.

Up and down waves alternate, and the characteristics of each wave also alternate between sharp and sideways. Up-waves are called impulses and also move in the same five-wave pattern. Corrective phases are typically in an ABC pattern.

The final wave of wave V of wave 5 | Source: BTCUSD on TradingView.com

Bitcoin price very clearly follows this structure on a variety of scales. And all of these structures indicate that there could be a grand finale still left to complete a motive wave with a powerful wave five.

Why Ongoing Sideways Is More Painful Than Black Thursday

If this is what could still be ahead, then why exactly is sentiment so bearish? For one, bearish sentiment is often the driver of a wave five. At this point in the trend, fundamentals are no longer improving at the same pace that pulled in market participants. Profit taking is increasing.

Wave fives are FOMO-driven. And how does that FOMO develop? By having a market on the wrong side of the trade, due to overly bearish sentiment. Such a situation leads to participants chasing entries as prices soar higher.

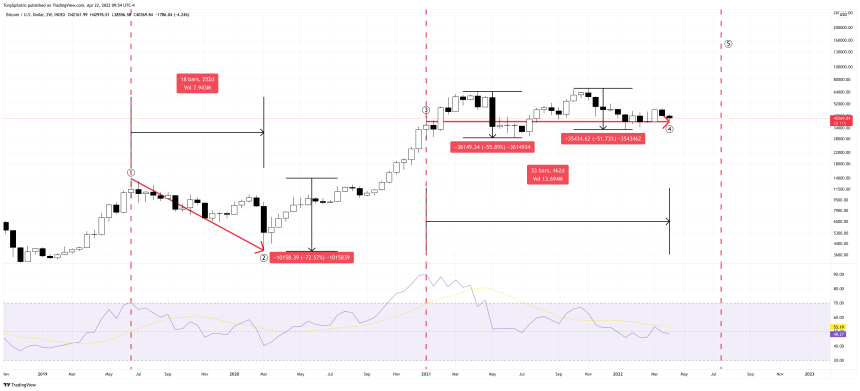

Bearish sentiment is a result of positioning. Bears have either sold, are short, or expect more downside. Sentiment is so bearish not because Bitcoin has seen horrific new lows like Black Thursday. Sentiment is so bearish because it has taken almost twice as long to go exactly nowhere.

Sideways stabs more painfully than a sharp correction | Source: BTCUSD on TradingView.com

If Black Thursday, put in the “sharp” wave two bottom, then the market could be painfully moving “sideways” in wave four per Elliott Wave’s law of alternation. Although the March 2020 correction took BTCUSD down more than 70% from wave one high to wave two low, it only took around 250 days. The intra-cycle peaks on the RSI as the wave three top puts in a potential wave four bottom at roughly the same exact price as it was 14 months ago.

Even though investors haven’t lost anything in value since then, there is the cost of their time. This correction has gone sideways but taken more than 460 days to mostly go nowhere. Even the bear market itself took only 370 days to reach a capitulation bottom. In a world where instant gratification is commonplace, Bitcoin was expected to already be more than $100K, a war is waging, an economic crisis is looming, and more — no wonder why the masses are so bearish on Bitcoin.

Related Reading | Now Or Never: Bitcoin Builds Base At Decade-Long Parabolic Curve

But what if they’re wrong, and wave five remains? This theory is shared by contrarian David Hunter, who reminds us that a “bull market climbs a wall of worry.” Hunter has made chilling calls in the past, and is expecting a “once-in-a-generation melt up” to ensue any day now, based on little more then the bearish sentiment.

The idea is that after all this time of sideways, the market has overpriced in any downside, and instead the market corrects to the upside in a dramatic bang. When wave five completes, the market will be blinded by greed and the bearish price movement causing all this negative sentiment will catch everyone off guard.

“Bear markets slide down a slope of hope.”

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com