Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A company called Tradewave, which provides a hosted platform for cryptocurrency trading bots, has announced the launch of the first ever natural language trading strategy editor. In simple language, that means anyone can now make their own trading bots without needing to be able to write code for it.

In a blog post published on 29th January, Tradewave founder James Potter describes how his firm’s new system could help to level the playing field between financial institutions and regular traders:

“There’s an ever-growing tools gap between retail and institutional traders. It’s estimated that more than 75% of stock trading on the main US exchanges now originates from automated systems. Practically none of that is coming from retail traders,” he writes.

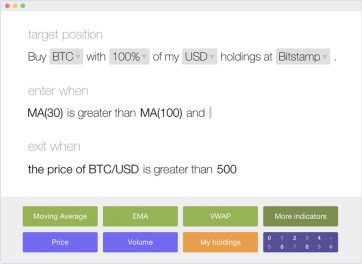

According to Potter, the reason for that is because ordinary traders don’t have the right combination of technical programming skills and access to real time data which is required for building trading bots. Tradewave’s new automated bitcoin trading strategy editor called ‘Scribe’ steps into this gap, allowing its users to construct their trading logic using precisely structured English language sentences built up using drop down boxes to select between pre-defined options. This trading logic is then ‘translated’ into python programming code to run a bot.

A back-testing feature allows users to test their strategies on historical data before putting them into action. Of course, more experienced traders and python programmers can also get stuck into the code to develop advanced strategies for their bots.

Tradewave customers can choose between packages. These go from a starter pack allowing them 1 bot and a $1000 (or equivalent) maximum trading pot, up to the Gekko plan which allows for 15 bots and no equity limits. All bots are hosted on the Tradewave platform and can use data and place trades at four of the world’s biggest Bitcoin exchanges: Kraken, Bitstamp, BTC-e, and Bitfinex.

Images from Tradewave.