Bitcoin (BTC) has had a crazy seven weeks. After feigning death for upwards of three months, with there being little price action and scant volumes to speak of, the cryptocurrency market returned. In fact, as of the time of writing this, the 24-hour volume figure on Bitwise’s BitcoinTradeVolume indicator reads at $917 million, much higher than the $500 million seen prior to all this price action. (Just last week, this read at a jaw-dropping $2.38 billion).

Related Reading: Analysts Believe Bitcoin is Likely to Surge Past $9,000 in Near Future as Upwards Momentum Builds

Derivative platforms have also seen similar spikes in volume, which analysts suggest is a clear sign of institutions joining the cryptocurrency fray yet again.

Bitcoin Derivatives See Massive Interest

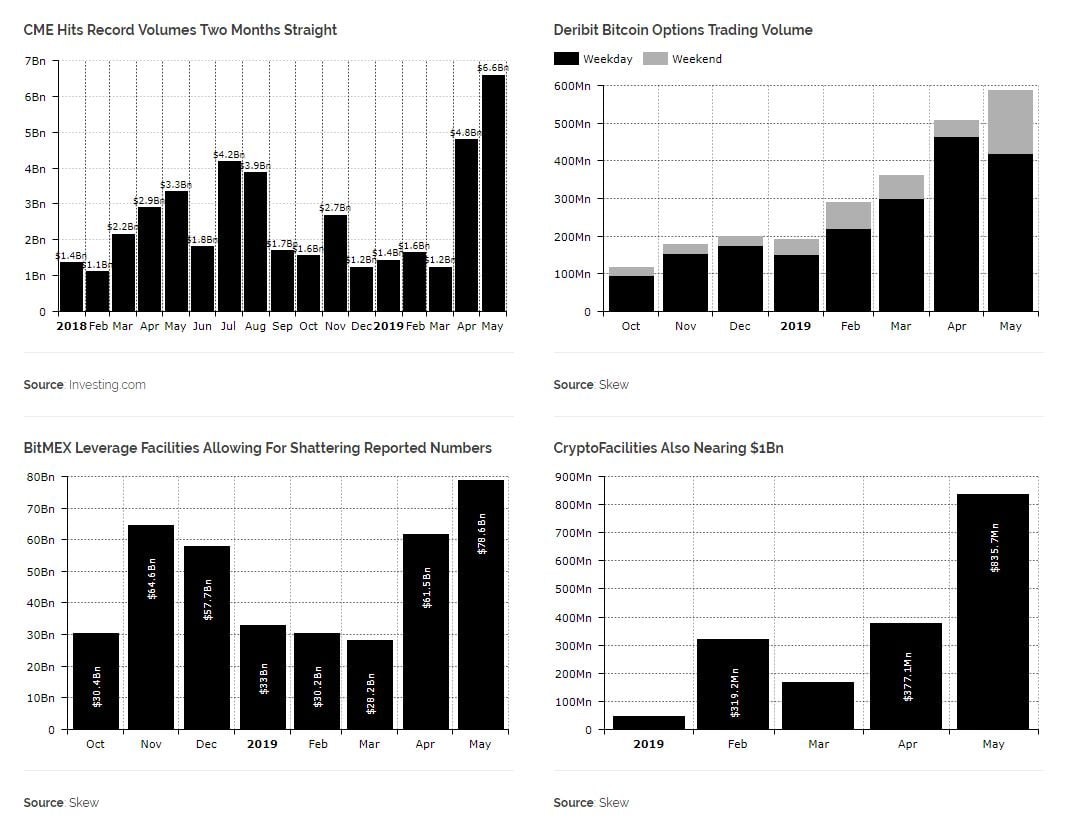

On Tuesday, cryptocurrency publication Diar released its latest newsletter. In the volume, it was revealed that Bitcoin derivatives volumes have grown alongside volumes seen on spot markets. Citing data from analytics startup Skew, Diar notes that on platforms like CME, Deribit, BitMEX, and the Kraken-owned CryptoFacilities, Bitcoin vehicle volumes are reaching multi-month, even all-time highs.

Indeed, according to a CME-stamped email from The Block, “May is shaping up to be the strongest month ever for CME Bitcoin Futures.” The Chicago-based market looked to the fact that on May 13th, $1.3 billion worth of paper BTC changed hands, and the number of accounts trading the product has grown well above 2,500. The exchange explains this statistic:

“The number of unique accounts continues to grow showing that the marketplace is increasingly using BTC futures to hedge bitcoin risk and/or access exposure.”

It’s a similar sight on the more cryptocurrency-specific platforms. In May (so far), BitMEX has seen $78.6 billion worth of volume, around half of Bitcoin’s market capitalization, while Deribit has seen nearly $600 million worth of volume for its array of options contracts.

According to a recent tweet from Paradigma Capital, a cryptocurrency-friendly analysis unit and fund, this interest in futures and its ilk confirms that Bitcoin’s rally from $4,200 to $8,000 (or some of it anyway) was a result of derivatives traders playing with the market.

The data, namely futures funding rates, long-to-short ratios, and the times of large market moves, would suggest that this is the case, according to Alex Krüger. And as renowned crypto-centric researcher Willy Woo points out, blockchain data shows that there weren’t enough capital movements to warrant the idea that spot markets caused the Bitcoin boom. Instead, Woo exclaims that the recent move to $8,000 was an “orchestrated short squeeze to milk profits”, a move purportedly “done by pros”.

This last exponential rise & crash was NOT organic. We have a blockchain to show capital movements. There weren’t any. It was an orchestrated short squeeze to milk profits. That requires immense capital to buy up all the shorts. It’s done by pros. https://t.co/58cpr00Iyh

— Willy Woo (@woonomic) May 17, 2019

ETF Needed For Further Institutional Interest

Although all this data is pointing towards the idea that the cryptocurrency market is being bombarded by institutional players, we have yet to reach a point where every big name investor and their mother are clamoring for Bitcoin and its brethren.

Alex Krüger, however, speculates that a fully-regulated, U.S.-based Bitcoin exchange-traded fund (ETF) will be the spark that catalyzes widespread institutional adoption. In a tweet, he postulated that the Securities and Exchange Commission (SEC) “approving a Bitcoin ETF would be a very big deal and go long ways into legitimizing crypto in the eyes of institutional investors with deep pockets.”

The SEC approving a bitcoin ETF would be a very big deal and go long ways into legitimizing crypto in the eyes of institutional investors with deep pockets.

— Alex Krüger (@krugermacro) May 21, 2019

The issue is though, the agency has just pushed back its verdict on a Bitcoin fund application from ETF, and doesn’t look poised to accept such an offering any time soon. There is hope though. As reported by Decrypt Media, SEC Commissioner Hester Peirce told conference-goers at Consensus, New York that now, or even one year ago, is the right time for an ETF. The fact that the cryptocurrency ecosystem has an “inside woman” does bode well for ETFs, just give it some time.

Featured Image from Shutterstock