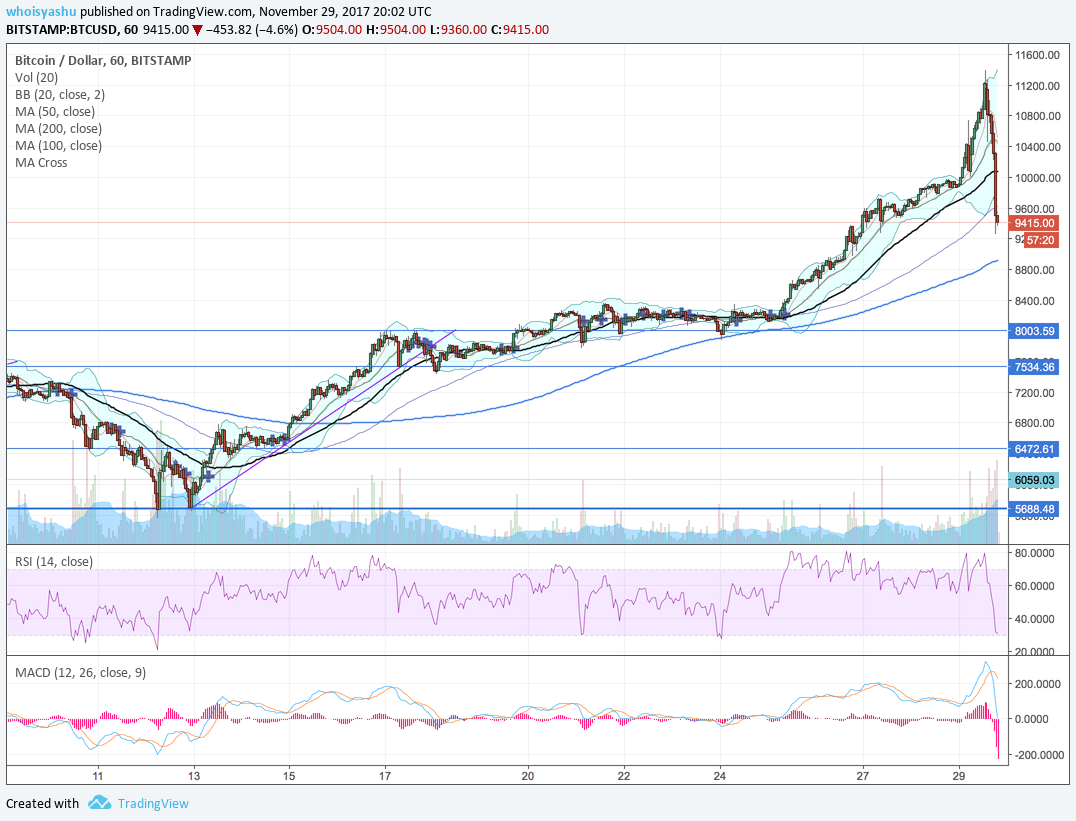

After establishing an all-time high near 11,300-fiat mark, Bitcoin price ditched the uptrend and fell towards lower 9000s on Wednesday night.

It is not a normal price action, to be honest. But going by the history of Bitcoin market, the aforementioned relapse doesn’t surprise. Bitcoin has always expressed exaggerated upside-downside price actions in the past, but the trend overall has remained bullish.

Only this year, the price of Bitcoin has jumped 858%. Many Wall Street professionals have refuted Bitcoin’s meteoric rise by calling it as a “bubble”. Other financial academics have also discouraged Bitcoin by comparing it to 1990s dot-com bubble, some even claiming that the BTC price will hit $0.

At the same time, there are also finance celebs like David Shrier (Distilled Analytics) and Iqbal Gandham (eToro) who favor Bitcoin for its underlying technology and think that the digital currency is here to stay.

“While the price volatility in Bitcoin leads some commentators to assume we’re in a Bitcoin bubble, the reality is that emerging technologies carrying radically new ideas will always see swings in their value before their potential is fully realized and the price stabilizes.” – Gandham told CNBC.

For now, the BTC/USD pair is eyeing 9500-fiat as an immediate support. Failing to sustain it will push the price action towards 9000-fiat. In the event of a bounce back, 10,000-fiat appears to be a natural upside target under more controlled circumstances.

Other cryptocurrencies, including Ethereum and Litecoin, have also fallen hard after setting their all-time highs above $500 and $100, respectively.