Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

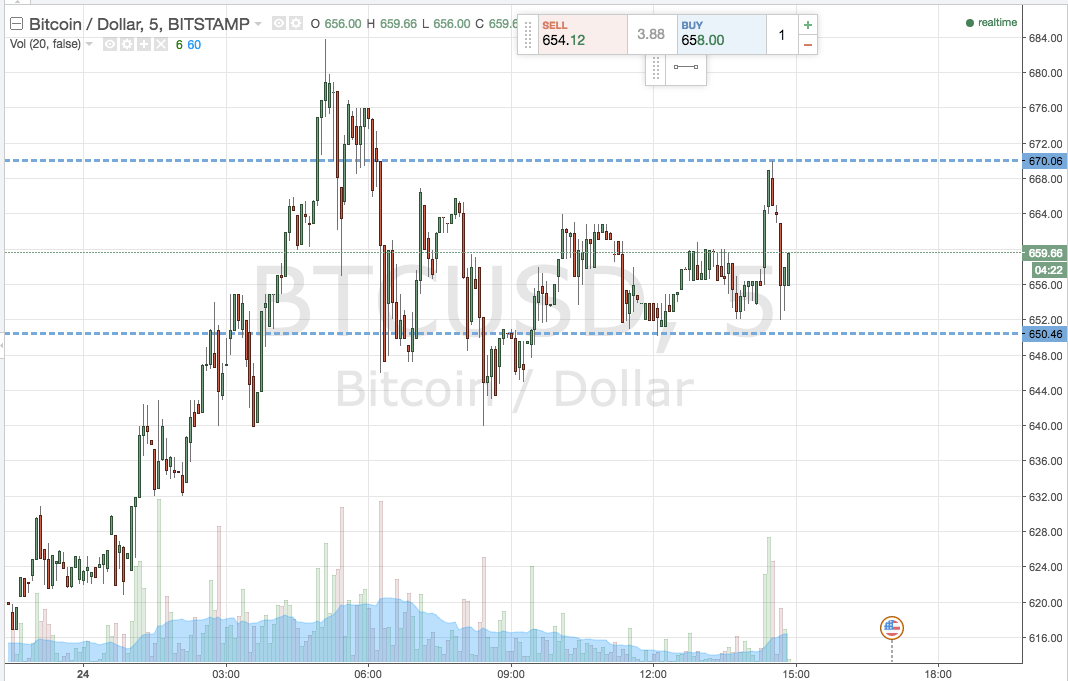

The dominating topic for the day has been the British referendum, and the ensuing decoupling of the UK from its European Union counterparts. Chances are that this topic will dominate global economic news (and in turn, equities and other financial asset market sentiment) for the next few days, making it difficult to predict what’s going to happen in the price of (what are essentially speculative, when it comes to this sort of underlying fundamental) assets such as bitcoin. Having said this, even though we don’t really know which direction is set to command the overarching trend in the bitcoin price, it’s more than possible to pick out a profit from the market purely by setting up against both sides of any potential volatility. With this in mind, and armed with our intraday strategies, here’s what we are looking at. First up, take a quick look at the chart below to get an idea of the key levels we are bringing to the table.

The first thing you will notice is that they are pretty much where we placed them this morning, albeit with a slightly tighter focus. Specifically, we have shifted in term support to 650 flat (up ten dollars on this morning’s downside parameter) while resistance falls to 670. Intrarange is still on, despite the tightening of the range, so we’re looking to enter long on a bounce from 650 with a target of 670, and vice versa on a correction from resistance.

From a breakout point of view, if price closes below support we will get in short towards a downside target of 635 flat. A stop loss at 655 defines risk. If price breaks resistance and we see some upside momentum, we will get in long towards an immediate upside target of 685. A stop on this one at 664 flat keeps our downside potential to a minimum.

Charts courtesy of Trading View