We’re off on another week’s worth of trading in the bitcoin price and we’re having to shuffle our key levels around before we get started. Things have been pretty volatile over the weekend and this gives us a couple of options. We can widen out our range and limit our entries to the breaks, or we can narrow things up and try to jump in and out on the choppy action. The latter is a little more aggressive but it probably makes a little more sense to go at things with a bit more conservatism today; at least, that is, while the market finds its post-weekend groove.

If things become a little steadier during the day, we might narrow things in a little. As things stand, however, we’re going to maintain a risk-off sentiment and keep things nice and wide.

So, with all this noted, here’s a look at what we’re watching during the session open and where we’re going to try and get in and out of the markets according to the rules of our intraday strategy.

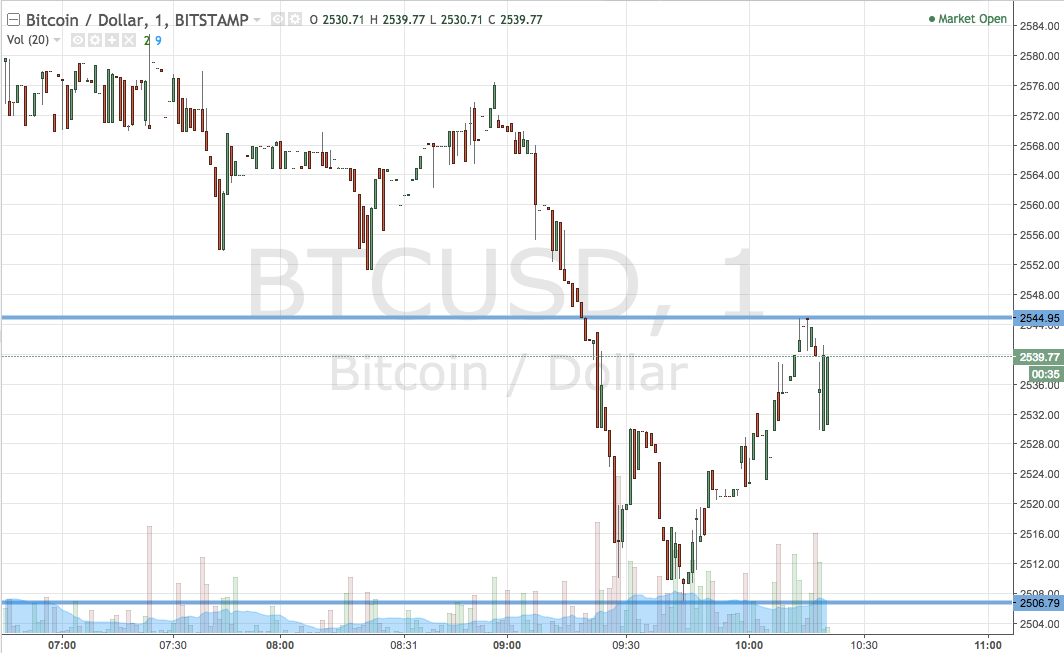

As ever, take a quick look at the chart below before we get started for the day. It’s a one-minute candlestick chart and it’s got our key range overlaid in blue.

As the chart shows, the range we are going at today comes in at support to the downside at 2506 and resistance to the upside at 2544. As we said, it’s pretty wide, but we’re only on the lookout for breaks right now – intrarange is temporarily shelved.

If we see price break through resistance to the upside, we’re going to try and get in long towards an immediate upside target of 2570. Looking the other way, a close below support will have us in short towards a downside target of 2470.

Happy trading!

Charts courtesy of Trading View