We have come to the end of the day in our bitcoin price trading efforts for Tuesday and – from a short-term perspective, at least – it has been a pretty good one. Chances are the long-term holders will disagree with us on this, but we are intraday traders, and it doesn’t really matter how price moves, or more specifically in what direction price moves, as long as it does.

As such, with the action, we have seen today and with price dipping to fresh weekly lows in and around 2300 flat, we have managed to draw a pretty decent profit from the volatility. Of course, we would love to see price return to its overarching upside momentum near term. Everybody wins when the price rises, whereas we only win from a hedge perspective when price declines. If it doesn’t, however, we aren’t going to complain. So long as we set up our entry points effectively, we will be in and out of the markets according to the rules of our intraday strategy as and when price signals entry and, if we stick to our risk management principles, we shouldn’t have too much trouble ending the week with a net profit.

So, with this note, let’s get some levels outlined for the session this evening.

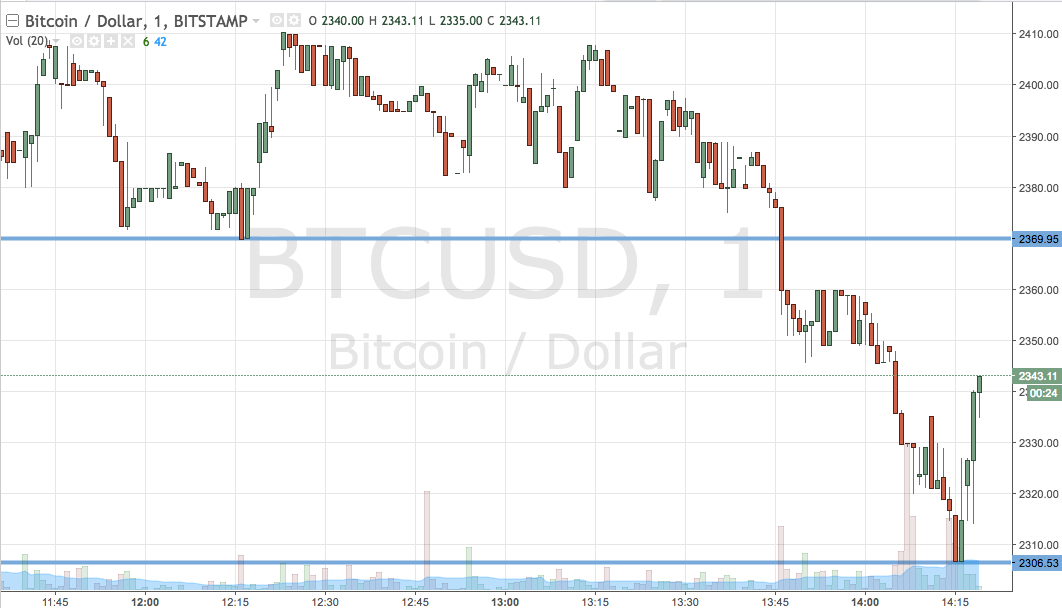

As ever, take a quick look at the chart below to get an idea of what is on and what we are looking at going forward.

As the chart shows, the range we have in our sights this evening is defined by support to the downside at 2306 and resistance to the upside at 2369. We are going to go at price with a breakout approach only right now. Specifically, if we see price break above resistance, we will be in long towards an immediate upside target of 2390. Conversely, a close below support will have us in towards 2275.

Chart courtesy of Trading View

SaveSave