Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin scalability debate has been going on for over a year now. The community has so far been unable to come to a consensus regarding the future roadmap of the cryptocurrency. These scalability delays have started to impact the usage of Bitcoin, due to increasing transaction times, flooded mempool and growing miner fee. There is a sense of urgency currently prevailing in the cryptocurrency community, a portion of which blames the Bitcoin Core development team for inaction.

Alternatives hard-fork options to improve the Bitcoin network has been proposed multiple times. While most of these proposals were shot down, Bitcoin Unlimited has started challenging the crypto-developer and user community. The Bitcoin Unlimited fork was introduced by Roger Ver better known as the Jesus of Bitcoin.

The Bitcoin Unlimited hard fork intends to increase the block size from existing 1 MB, and it has received significant support from the members of the community. Many cryptocurrency businesses, especially mining pools and data centers have already started adopting Bitcoin Unlimited. According to recent reports, some of the exchanges are considering the possibility of including Bitcoin Unlimited as an alternative asset.

On the other hand, some believe that the implementation of Bitcoin hard fork will further increase the chances of network centralization. They believe that the block size increase over a hard fork is not a good idea as it may benefit larger pools.

The top mining pools in the Bitcoin community are presently controlled by the Chinese and any changes to the Bitcoin network may result in the complete centralization of the cryptocurrency among these Chinese Pools. It has also given rise to few allegations which suggest that the government of China is actively pushing for the adoption of Bitcoin Unlimited.

The chances of Bitcoin Unlimited hard fork being implemented is very high at the moment. The hard fork will result in two cryptocurrencies, BTC and BTU (Bitcoin Unlimited), recreating a scenario similar to the one faced by Ethereum last year. The hard fork that followed the DAO fiasco resulted in the creation of Ethereum and Ethereum Classic. Based on the adoption patterns, Ethereum has continued to thrive, unlike Ethereum Classic.

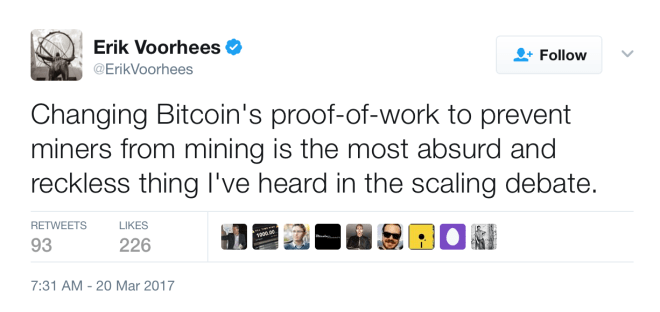

To prevent attacks following the hard fork, the community is contemplating a change in the PoW algorithm. It is still unclear as to how the whole scalability solution will work, but there will be a lot of challenges in-store that needs to be resolved over time to restore Bitcoin’s glory.

Ref: Twitter | Liberty Blitzkrieg | Image: NewsBTC