Bitcoin dramatically recovered overnight on Friday as investors/speculators digested the prospects of central banks’ easing measures.

The benchmark cryptocurrency established a session high of $10,309.84 on San Francisco-based Coinbase exchange. The move upside brought its gains up by as much as $723.98, or 7.55 percent, as measured from yesterday’s session low of $9,585.86. Elsewhere in the cryptocurrency market, altcoins tailed bitcoin gains, with Ethereum surging the maximum by 4.55 percent against the US dollar. Other gainers included XRP, Bitcoin Cash, Litecoin, and Binance.

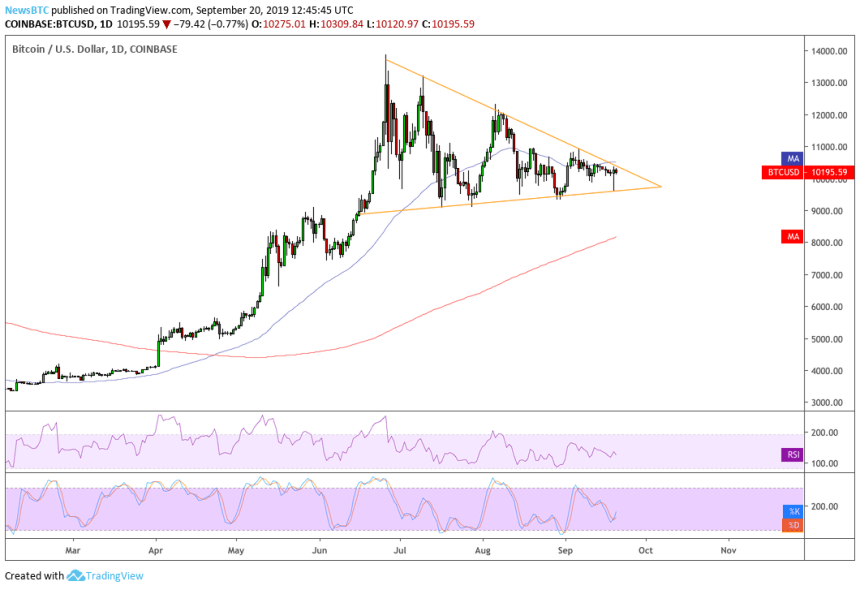

The latest rebound – technically – put bitcoin back on track to test the upper trendline of its symmetrical triangle range, as shown in the chart above. It is the sixth time the cryptocurrency rebounded from the lower trendline, confirming that traders are unwilling to extend their short positions anywhere below the said level. The lower volatility noted across this week also showed that traders are in a wait-and-watch approach as global market sentiments hint an absolute path.

According to Teddy Cleps, a prominent market analyst, traders are eyeing a so-called 21-weekly exponential moving average (EMA) as support, as shown in the chart below.

“Add the 21ema and look at longer timeframes (weekly) – as long as price continuously closes above, there is a clear bull bias. The moment we close below, you are technically allowed to freak out – till then, enjoy the ride.”

Bitcoin and Market Fundamentals

Meanwhile, there are fundamentals at play. The Federal Reserve mediated in the US money market third-day in a row to ease pressure on short-term lending. The New York Fed injected $75 billion in the market, with its auction oversubscribed as banks demanded $84 billion. That means the Fed could continue the cash injection even on Friday.

Another day, another $75 billion by the Fed to fix the lending market for the first time since the last financial crisis.

It took a decade for bitcoin to grow to $200 billion.

It took four days for the Fed to print $278 billion.

— Rhythm (@Rhythmtrader) September 20, 2019

Coupled with the Federal Open Market Committee’s “hawkish” decision to introduce a 25 bps rate cut, the events sent the US equities stalled. The S&P 500 index closed the day flat, additionally influenced by the dovish statements from the UK central bank.

“It’s been a scrum of central bank activity over the last 36 hours but without any real direction at the end of it,” Deutsche Bank strategist Jim Reid told FT.

Meanwhile, bitcoin’s traditional rival Gold – like itself – trended higher on Friday as investors’ appetite for safe-haven assets grew. The XAU/USD instrument surged 0.17 percent to $1,501.54. Bitcoin’s intraday correlation with Gold showed that speculators weighed macroeconomic factors while taking their upside calls on the cryptocurrency.

With Bakkt, the world’s first physically-settled bitcoin futures platform, launching on September 23, bitcoin could see further gains over the weekend. Meanwhile, a dip below 21-weekly EMA, as Cleps said, could be an indicator of an interim bearish bias.