Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

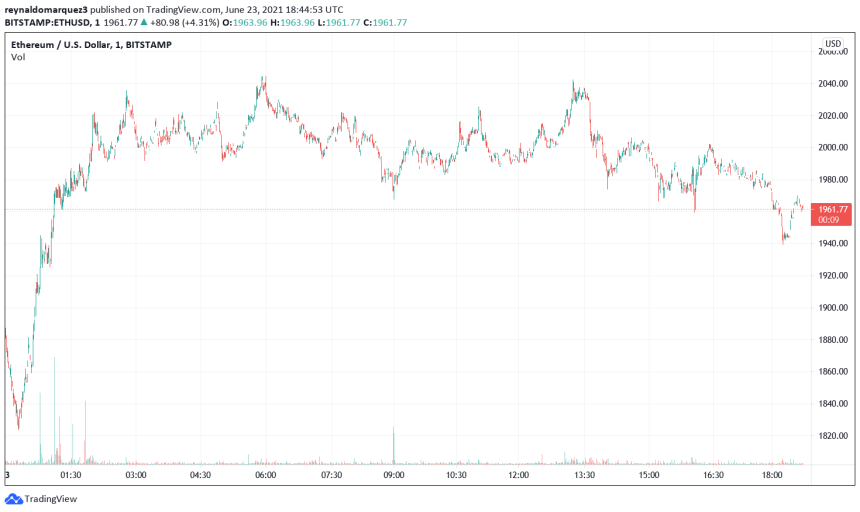

Ethereum crashed to $1,770 in one of the worst days for the first cryptocurrency by market cap in 2021. At the time of writing, it has reclaimed the high area around these levels and trades at $1,991 with a 4.6% profit in the daily chart.

A recent report by Glassnode Insights, written by Luke Posey, investigates the implications of these price action in the Ethereum ecosystem. The analyst believes both the cryptocurrency and DeFi token prices are showing weakness with EIP-1559 not having the expected catalyzer effect.

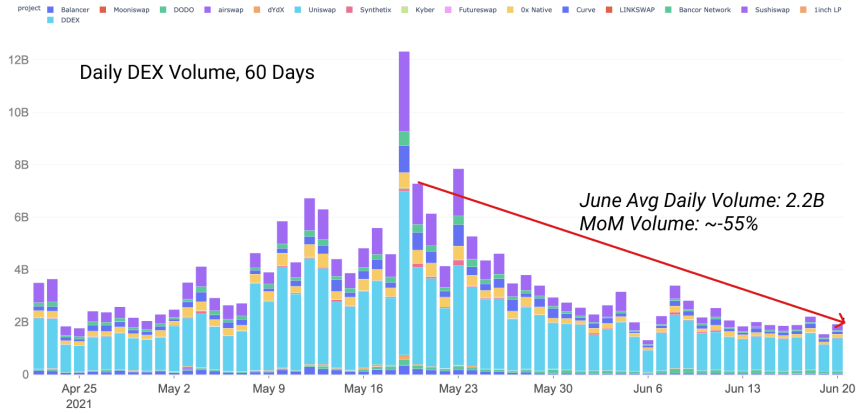

Ethereum’s network has seen low activity and its transaction fees have declined to levels last seen in summer 2020. Most of the activity has been taken by decentralized exchanges with Uniswap still number dominating this metric.

The DEX sector has experienced the highest growth in the ecosystem with a 5,600% increase year over year in terms of volume. This metric has been consolidating around $2 billion daily with an increase in periods of high volatility.

DeFi participants, said Posey, are yield farming stablecoin pairs with high yield to accumulate governance tokens. The analyst said:

Activity has stalled from previously exponential growth as participants sit mostly idle during sideways moves. We can see brief bursts of activity during price volatility, however it quickly slows down as prices stabilize.

On the other hand, long-term ETH holders have more conviction with their accumulation. Governance token holders might have seen more downside as the bears deepen their attack on these assets.

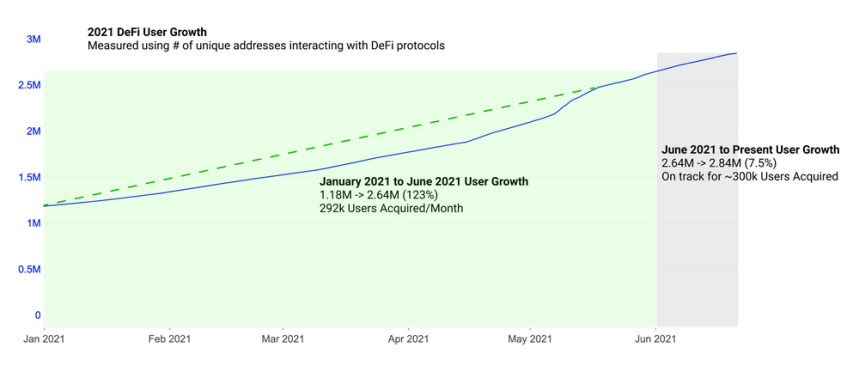

The number of new users on Ethereum has been steady, the analyst added. During April and May, one of the worst months for ETH’s price, this metric stood at 18% and 25%, respectively.

High user growth can be a bullish metric for holders as it is a key metric for adoption, but also a key metric for identifying if there are marginal token buyers. While growth by total user numbers remains strong, growth as a percentage is flattening the curve.

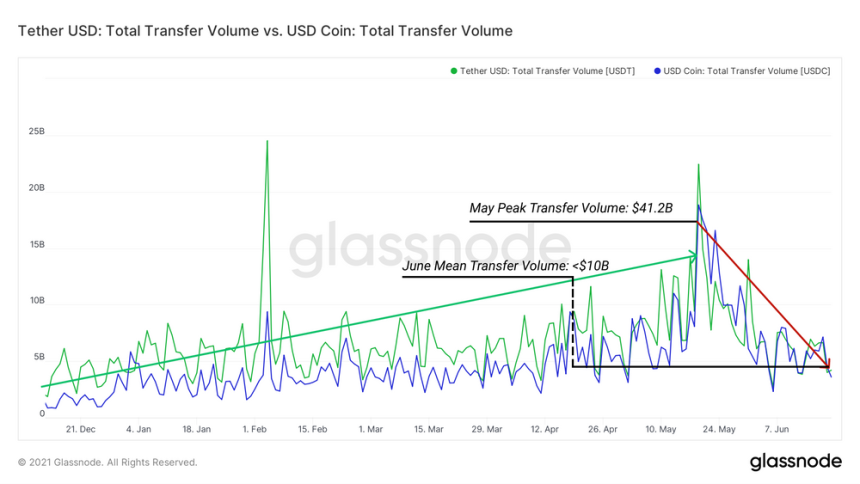

Demand For USDT On Ethereum Reduced During Market Crash

The reduction of demand for USDT on Ethereum it’s an important metric to understand the current price action. A rise in stablecoin supply usually leads to two scenarios: an increase in transaction fees and high volatility in the market with potential for bullish momentum.

If the opposite were to happen, a return of high demand and on-chain activity, ETH’s price could react to the upside. In the meantime, short-term ETH holders have seen their gains turn into losses with the aggregated loss for these investors standing at 25% of the market cap.

This creates a scenario where many short-term holders decided to liquidate their investment for the loss if the ETH price continues to decline. On the contrary, they could be more persuaded to hold, if the price moves to the upside with more conviction. The analyst said:

(…) we can conclude that significant volumes of ETH were purchased on the run up from around $2.2k to the ATH, all of which are now underwater. The risk is that these investors could liquidate as prices rally into their cost basis (STH-NUPL = 0). Conversely, if conviction remains high, they may well hold throughout whatever volatility comes next.