Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As the spot Bitcoin exchange-traded fund (ETF) hype continues to take center stage in the crypto news scene, issuers have reportedly added 12.073 BTC to their holdings as institutional interest goes through the roof.

Meanwhile, Borroe Finance ($ROE) and Celestia (TIA) are poised for significant gains based on their real-world utilities.

Borroe Finance is a Rising AI Altcoin

As the artificial intelligence wave continues to rock the crypto sector, Borroe Finance is riding on it since its emerging as a promising AI altcoin that seeks to revamp the Web3 revenue financing process.

Therefore, Borroe Finance has shown its commitment to revolutionize the decentralized finance (DeFi) world by onboarding more players into the Web3 space.

With Borroe Finance materializing as one of the best DeFi projects, the network serves as a DEX (Decentralized Exchange) that links revenue buyers and sellers in the Web3 industry.

By providing Web3 players with the opportunity to mint their future earnings as non-fungible tokens (NFTs), Borroe Finance enables them to get instant cash by selling the NFTs on its peer-to-peer (P2P) marketplace.

AI comes in handy in this objective because it enables Borroe Finance to undertake enhanced risk assessment, given that scams and frauds are continuously wreaking havoc in the crypto sector.

Borroe Finance is powered by the Polygon blockchain and this ensures that transactions are fast, cheap, and efficient.

This real-life utility is enabling Borroe Finance to be one of the viral token launches, as evidenced by its governance token called $ROE.

For instance, more than 240 million $ROE tokens have been purchased at presale, with at least $2.9 million raised.

Therefore, this shows that Borroe Finance continues to be among the top in the decentralized cryptocurrency list.

Celestia Continues to Make Significant Strides

Given that Celestia avails significant room for growth, the fear of missing out is engulfing the crypto.

With TIA serving as a prominent modular blockchain network, it is emerging as one of the altcoins to watch because blockchains are deployed with minimal overhead.

Celestia is also eyeing robust growth since 21Shares recently announced the rolling out of the 21Shares Celestia Staking ETP, and this is a welcome move that intends to attract significant institutional investment.

21Shares is a prominent issuer of cryptocurrency exchange traded products (ETPs), and the strategic partnership with Celestia is meant to enhance the latter’s blockchain deployment and scaling capabilities.

Bitcoin ETFs Continue to Ignite the Fire

Following the approval of a spot Bitcoin ETF by the United States Securities and Exchange Commission (SEC) on January 11, a significant HODL culture has been engulfing the BTC network.

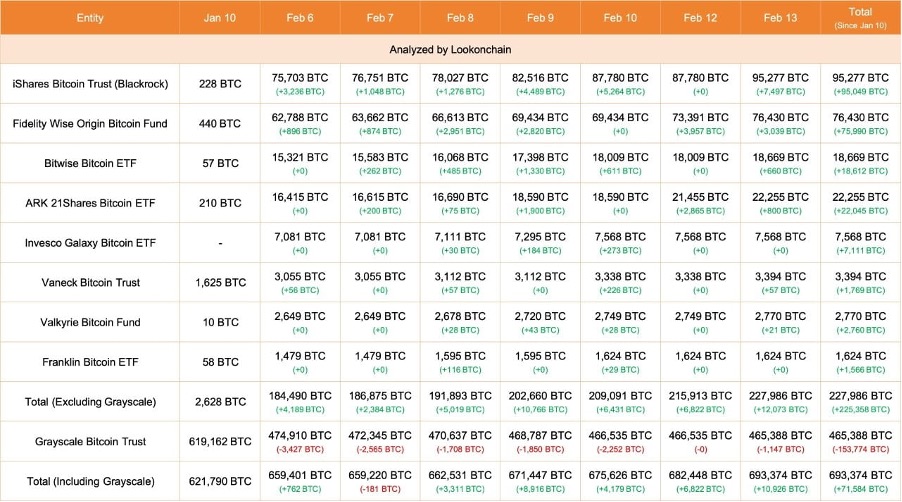

As a result, Bitcoin ETF issuers, such as Grayscale, BlackRock, and ARK Invest, have been increasing their holdings at an alarming rate.

Market Updates highlighted, “Bitcoin ETF Issuers now hold more than 1% of the BTC total supply. 12,073 BTC was added just and Grayscale only sold 1147 BTC.”

Source: Market Updates

Therefore, this trend shows heightened institutional interest and confidence in the Bitcoin market.

Bitcoin ETFs are playing an instrumental role in driving market momentum, given that inflows have exceeded $2.8 billion.

Consequently, Bitcoin has been the largest beneficiary as it continues to trade above the psychological price of $50,000.

BTC recently scaled heights and hit highs of $53,000 even though it had retraced to the $51,702 level at the time of writing, according to CoinGecko data.

Therefore, it goes without saying that Bitcoin ETFs have ignited a robust institutional investors’ appetite.

Learn more about Borroe Finance ($ROE) here:

Visit Borroe Finance Presale | Join The Telegram Group | Follow Borroe Finance on Twitter

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.