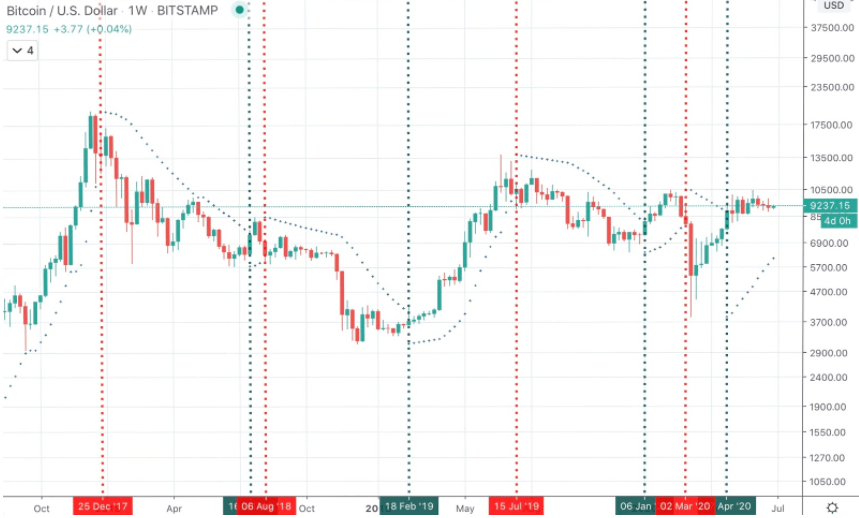

Trend reversals can unwind extremely slowly, or happen sharply as a strong rejection. Traders must be ready for anything.

Some technical analysis indicators can tip traders off to when assets reach oversold or overbought conditions. This is often a sign that a trend may soon be turning.

Certain chart patterns and candlesticks also can signal a reversal is near. When watching for reversals, however, paying attention to a surge in volume is critical to confirmation.

In the example below, bearish and bullish crossovers on the MACD are used to spot trend reversals.

The next example instead uses a touch of the Parabolic SAR indicator, hence its name “stop and reverse.”

Next, extreme readings on the RSI can signal a reversal.