OK then. Here goes. Our final look at the bitcoin price for the day, and the penultimate day of the week. It’s not been an overly exciting week by any stretch of the imagination, but we’ve had plenty of opportunities to get in and out of the markets and drawn a few –albeit small – profits from the action we’ve seen, so we can’t really complain. With any luck we’ll get a big close out, and finish the week on a high.

We’re not going to witter on about today’s action like we normally do here, as there’s not that much to talk about. Instead, let’s just get straight to the meat of our strategy and put together some key levels to go at this evening.

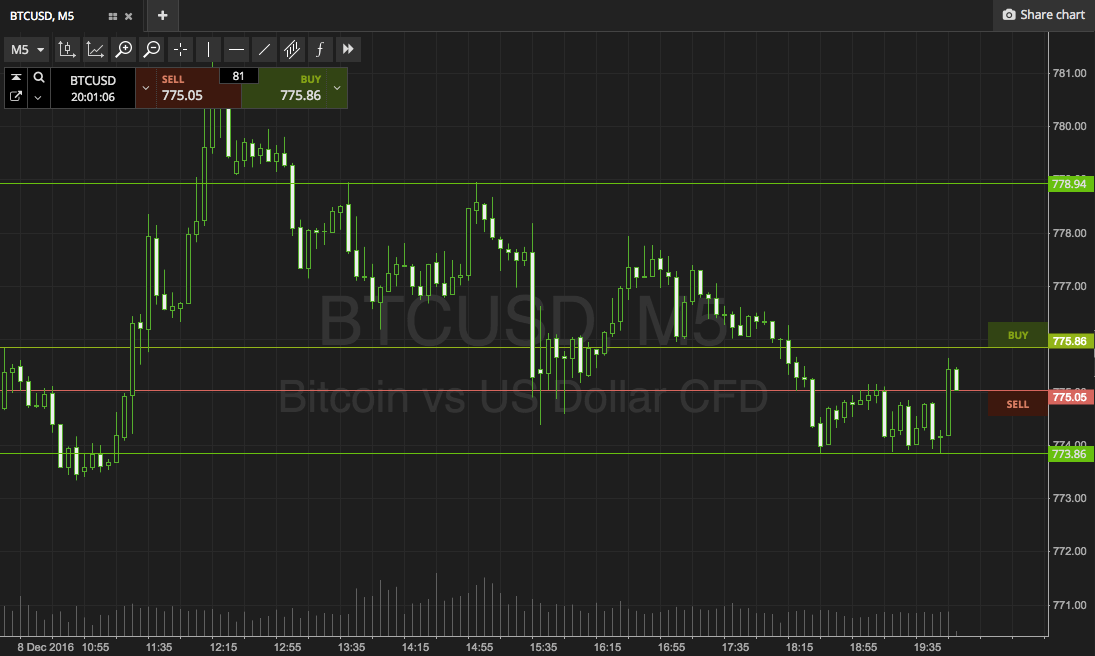

First up, and as ever, take a quick look at the chart below to get an idea of the levels we are watching, and where things stand from a just-passed perspective. The chart has a five-minute candlestick timeframe, and we’re looking at around twelve hours’ worth of action displayed. It’s got our key levels (and by proxy, our range) overlaid in green.

So, as illustrated, the range in focus this evening is defined by in term support to the downside at 773, and in term resistance at 779. There’s not really enough room to go at price with our intrarange strategy on this one, so we’ll be leaving that at the front door for now. If things alter, we’ll update.

With our breakout approach, we are going to look at getting in to a long position on a break and a close above in term resistance, with an initial upside target of 785. Conversely, if we see price break below support, we’ll look at getting in short towards 765. A stop just the other side of the entry on both trades defines risk nicely.

Now we wait…

Charts courtesy of SimpleFX