Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The electronic payments sector is a huge industry that is growing at a rapid pace. The growth of population increased spending power combined with multiple payment options has been the greatest contributing factor for its growth over the years. The advent of cryptocurrencies opened up a whole new section of electronic payments waiting to be capitalized upon by the credit/debit card issuers, payment processors and technology startups.

The rapid growth in the bitcoin user base combined with the slow adoption of bitcoin payment options among the businesses has created a perfect opportunity for the card companies. Bitcoin debit cards are a result of this situation. Bitcoin debit cards fill a large gap in cryptocurrency payments by bridging it with conventional payment methods. Crypto debit cards are mostly connected to either the Visa or the Mastercard networks, similar to conventional cards. The only difference between cryptocards and conventional cards being the source of funds. While conventional cards are connected to a bank account, cryptocards are connected to a cryptocurrency wallet. These cards can be used on any POS terminal or online payment gateways connected to the respective card issuer network (Visa or Mastercard).

In order to spend bitcoin through a crypto card, one doesn’t need to have a wallet QR code or address. These cards can be used like just any other card and an equivalent amount in bitcoin will be deducted from the wallet to pay for the purchase. The merchant will not notice any difference. This makes paying with bitcoin possible, virtually anywhere. The payment processor and the gateway provider will also receive the applicable transaction and processing fees.

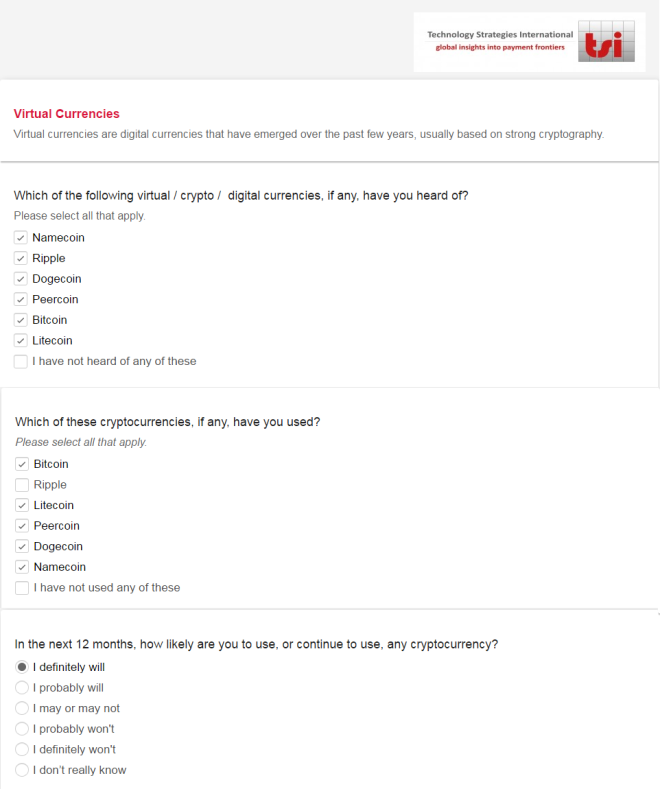

These cryptocards open up a whole new market segment for the industry players. In order to capitalize on it, companies are planning to offer cryptocard services, for which they are conducting surveys. Many online card surveys request information about the respondent’s understanding of cryptocurrency and its usage pattern.

A Redditor recently posted a screenshot of one such survey targeted towards Canadian customers. The survey included questions on whether the respondent uses cryptocurrencies and whether he/she will continue using it in the near future.

Cryptocards provide cryptocurrency users with a way to use bitcoin at virtually any place that accepts card payments. However, they do come with their own set of geographical restrictions. Many cards do not work in certain geographical locations either due to conflict with regional regulations, policies or technical feasibility. Even though bitcoin is a universal currency, bitcoin-powered debit cards may not be as universal as the digital currency.

Cryptocards are not available in all markets. Many countries do not support the cards issued by XAPO, Wirex and other bitcoin platforms. Similarly, there have been few issues reported where bitcoin-powered cards issued by few bitcoin companies were not accepted as a valid payment option on few mobile applications like Google Play Store, Uber, Lyft etc. as these cards were classified by the system as a prepaid card and not as a debit/credit card.

In countries like India, where two-factor authentication is mandatory, most of these cards are useless as they do not accommodate the 2FA technology. It is just a matter of time before these issues are ironed out and everyone across the world will have access to cryptocards, allowing them to make payments with bitcoin, no matter where they are.