Terra Luna Classic and Solana have made Avorak’s deep analytics list of cryptos with a bullish 2023 outlook. Using deep analytics, Avorak AI examines crucial metrics to provide investors and enthusiasts with a comprehensive overview of Terra Luna Classic and Solana and their potential for growth and adoption.

Avorak AI

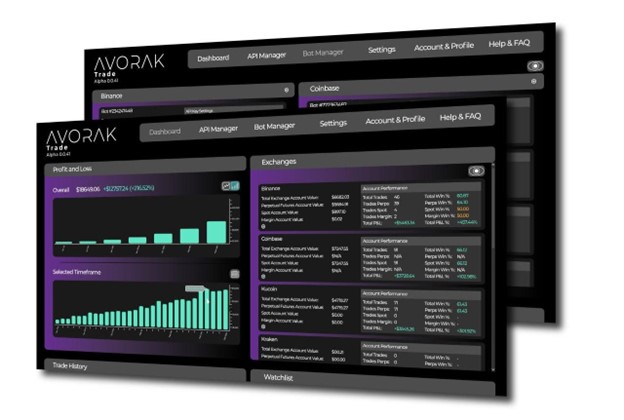

Avorak AI is a comprehensive AI crypto solution that addresses the with a rich portfolio of AI tools. Avorak provides simplified solutions to blockchains, NFT creators, and crypto traders. AI is revolutionizing various industries, including Healthcare, car manufacturing, aerospace, mining, etc. Avorak Trade is a trading bot that studies market behavior 24/7 while sieving voluminous data sets to produce accurate price movements.

Avorak ushered ICO phase six amid unprecedented success, with one AVRK token priced at $0.235 and experiencing a 291.67% rise. ICO investors benefit from bonuses, priority staking, and access to Beta. Many videos on YouTube showcase Avorak AI’s remarkable performance, describing it as a 100x project.

The Avorak token, AVRK, aims to launch at $1 and will list on popular cryptocurrency exchanges, including Azbit, Coinsbit, PancakeSwap, and LAToken. The platform completed two audits by Cyberscope and SolidProof, highlighting its commitment to providing secure and transparent services.

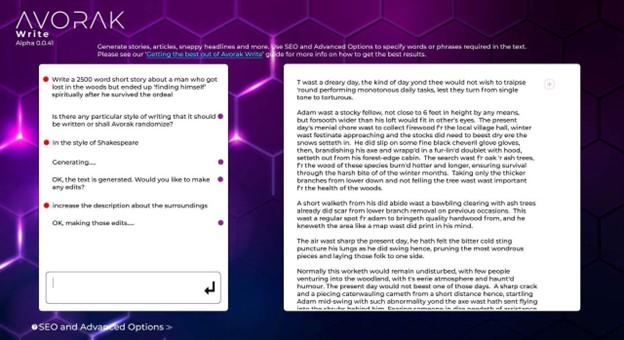

Avorak Write generates non-repetitive, plagiarism-free content in user desired style or format using a prewritten language bank to edit, proofread, and auto-correct content.

Is Solana a Good Investment?

Solana has been generating buzz in the cryptocurrency market this week as the SOL blockchain witnessed an influx of new users. SOL features and adoption rate are slowly making it a contender for the top blockchain networks. Since its launch in 2019, Solana has gained significant attention for its high scalability, fast transaction speeds, and low fees. It competes with established blockchains such as Ethereum, Binance Smart Chain, and Polkadot. Solana has attracted high-profile integrations and recently, Helium Network’s migration to SOL blockchain. Analysts believe these factors make Solana a good investment, considering its potential growth and the current market conditions. However, Avorak’s deep analysis prevails on investors to research and appraise the risks associated with this investment.

Will Luna Classic Reach $1

In 2022, the crypto market encountered difficulties due its stablecoin losing to the dollar. The original Terra LUNA coin was at the root of these issues. Following the Terra Luna crash, Terra 2.0 was established.

Initially, LUNC performed well after its launch in 2019, and by the end of 2021, it nearly reached $100. However, LUNC’s value decreased ,and it’s uncertain whether LUNC’s price will ever reach $1. The LUNC token-burning mechanism helps reduce supply. It will be interesting to see how the Terra ecosystem responds to these developments, as they will play a crucial role in determining whether LUNC can regain investor trust again. Most price predictions for LUNC suggest a meteoric rise to $1 is unlikely in 2023. Based on Avorak AI analysis, Terra Luna Classic may not attain $1. These predictions are subject to market conditions.

Find more on Avorak AI and ICO here:

Website: https://avorak.ai

Buy AVRK: https://invest.avorak.ai/register

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.